COUNTRY BACKGROUND - Gross National Happiness Commission

COUNTRY BACKGROUND - Gross National Happiness Commission

COUNTRY BACKGROUND - Gross National Happiness Commission

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Economic Outlook<br />

8<br />

(b) major investments which are themselves net revenue generators to the government (notably hydel schemes<br />

and the proposed Dungsum Cement Project during 7FYP).<br />

7.17 The second category have traditionally been considered as "non-plan" projects, to proceed if funding can be<br />

secured. This approach makes sense for several reasons:<br />

- the projects are so large that their inclusion within a single capital expenditure target would distort<br />

the entire programme;<br />

- as long as they are genuinely self-liquidating (i.e. they can earn a commercial rate of return on<br />

investment), the recurrent budget constraint which limits the capital expenditure which RGOB<br />

should undertake does not apply to them;<br />

- because of their commercial potential, such projects should be able to tap funding sources which<br />

are not accessible to mainstream capital projects: competition for funding between Plan and non-<br />

Plan projects is therefore limited.<br />

7.18 Accordingly, the expenditure projections for 7FYP focus mainly on the target for recurrent plus Planproject<br />

expenditure. Anticipated expenditures on non-Plan projects (and the funding that they require) are<br />

identified separately. However, this does not imply that these projects are less important. The overall target for<br />

(Plan Project) capital expenditure is Nu. 6980m for the 7FYP, ( in nominal prices) with a ratio of capital to<br />

recurrent expenditure being 45:55 compared with 50:50 in the 6FYP. The distribution between capital and<br />

recurrent funds is shown in Figure 7.3. Non-Plan projects amount to Nu.9,632m and include power projects and<br />

the Dungsum Cement Plant. As already noted, this figure is separate from the main Plan targets, in the sense that<br />

an increase/decrease in estimates for non-Plan projects need not affect the targets for Plan projects or for recurrent<br />

expenditure, although it does affect the total external financing requirement.<br />

Sectoral AllocationsSectoral Allocations<br />

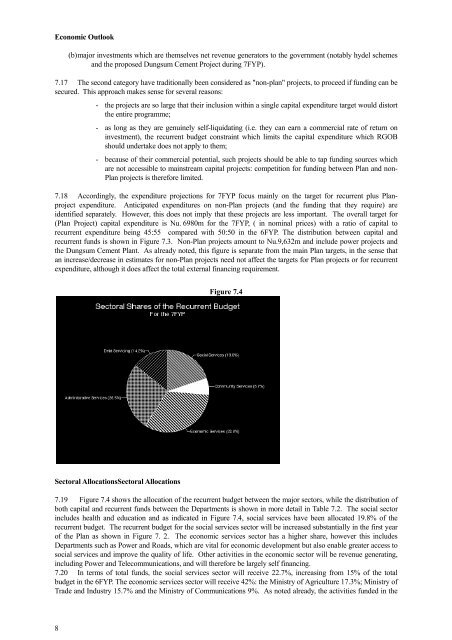

Figure 7.4<br />

7.19 Figure 7.4 shows the allocation of the recurrent budget between the major sectors, while the distribution of<br />

both capital and recurrent funds between the Departments is shown in more detail in Table 7.2. The social sector<br />

includes health and education and as indicated in Figure 7.4, social services have been allocated 19.8% of the<br />

recurrent budget. The recurrent budget for the social services sector will be increased substantially in the first year<br />

of the Plan as shown in Figure 7. 2. The economic services sector has a higher share, however this includes<br />

Departments such as Power and Roads, which are vital for economic development but also enable greater access to<br />

social services and improve the quality of life. Other activities in the economic sector will be revenue generating,<br />

including Power and Telecommunications, and will therefore be largely self financing.<br />

7.20 In terms of total funds, the social services sector will receive 22.7%, increasing from 15% of the total<br />

budget in the 6FYP. The economic services sector will receive 42%: the Ministry of Agriculture 17.3%; Ministry of<br />

Trade and Industry 15.7% and the Ministry of Communications 9%. As noted already, the activities funded in the