Communications Regulatory Authority

Communications Regulatory Authority

Communications Regulatory Authority

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

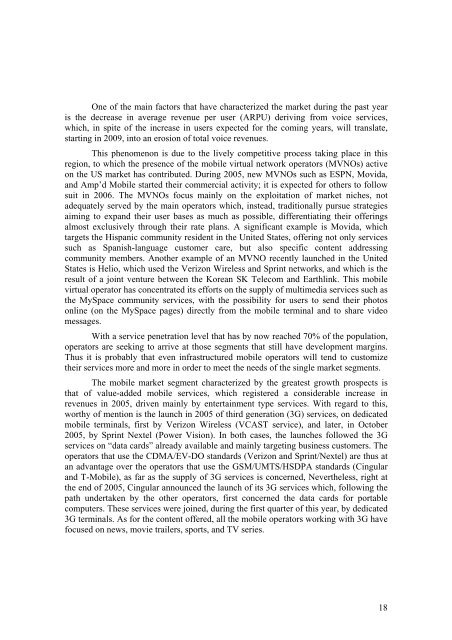

One of the main factors that have characterized the market during the past year<br />

is the decrease in average revenue per user (ARPU) deriving from voice services,<br />

which, in spite of the increase in users expected for the coming years, will translate,<br />

starting in 2009, into an erosion of total voice revenues.<br />

This phenomenon is due to the lively competitive process taking place in this<br />

region, to which the presence of the mobile virtual network operators (MVNOs) active<br />

on the US market has contributed. During 2005, new MVNOs such as ESPN, Movida,<br />

and Amp’d Mobile started their commercial activity; it is expected for others to follow<br />

suit in 2006. The MVNOs focus mainly on the exploitation of market niches, not<br />

adequately served by the main operators which, instead, traditionally pursue strategies<br />

aiming to expand their user bases as much as possible, differentiating their offerings<br />

almost exclusively through their rate plans. A significant example is Movida, which<br />

targets the Hispanic community resident in the United States, offering not only services<br />

such as Spanish-language customer care, but also specific content addressing<br />

community members. Another example of an MVNO recently launched in the United<br />

States is Helio, which used the Verizon Wireless and Sprint networks, and which is the<br />

result of a joint venture between the Korean SK Telecom and Earthlink. This mobile<br />

virtual operator has concentrated its efforts on the supply of multimedia services such as<br />

the MySpace community services, with the possibility for users to send their photos<br />

online (on the MySpace pages) directly from the mobile terminal and to share video<br />

messages.<br />

With a service penetration level that has by now reached 70% of the population,<br />

operators are seeking to arrive at those segments that still have development margins.<br />

Thus it is probably that even infrastructured mobile operators will tend to customize<br />

their services more and more in order to meet the needs of the single market segments.<br />

The mobile market segment characterized by the greatest growth prospects is<br />

that of value-added mobile services, which registered a considerable increase in<br />

revenues in 2005, driven mainly by entertainment type services. With regard to this,<br />

worthy of mention is the launch in 2005 of third generation (3G) services, on dedicated<br />

mobile terminals, first by Verizon Wireless (VCAST service), and later, in October<br />

2005, by Sprint Nextel (Power Vision). In both cases, the launches followed the 3G<br />

services on “data cards” already available and mainly targeting business customers. The<br />

operators that use the CDMA/EV-DO standards (Verizon and Sprint/Nextel) are thus at<br />

an advantage over the operators that use the GSM/UMTS/HSDPA standards (Cingular<br />

and T-Mobile), as far as the supply of 3G services is concerned, Nevertheless, right at<br />

the end of 2005, Cingular announced the launch of its 3G services which, following the<br />

path undertaken by the other operators, first concerned the data cards for portable<br />

computers. These services were joined, during the first quarter of this year, by dedicated<br />

3G terminals. As for the content offered, all the mobile operators working with 3G have<br />

focused on news, movie trailers, sports, and TV series.<br />

18