Tamil Nadu Urban Infrastructure Financial Services ... - Municipal

Tamil Nadu Urban Infrastructure Financial Services ... - Municipal

Tamil Nadu Urban Infrastructure Financial Services ... - Municipal

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

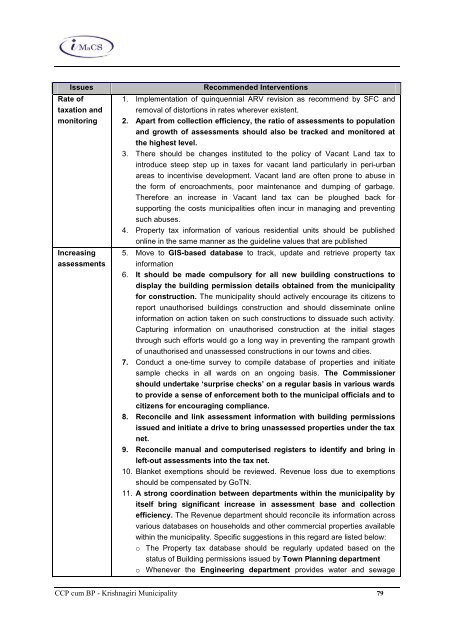

Issues Recommended Interventions<br />

Rate of<br />

taxation and<br />

monitoring<br />

Increasing<br />

assessments<br />

1. Implementation of quinquennial ARV revision as recommend by SFC and<br />

removal of distortions in rates wherever existent.<br />

2. Apart from collection efficiency, the ratio of assessments to population<br />

and growth of assessments should also be tracked and monitored at<br />

the highest level.<br />

3. There should be changes instituted to the policy of Vacant Land tax to<br />

introduce steep step up in taxes for vacant land particularly in peri-urban<br />

areas to incentivise development. Vacant land are often prone to abuse in<br />

the form of encroachments, poor maintenance and dumping of garbage.<br />

Therefore an increase in Vacant land tax can be ploughed back for<br />

supporting the costs municipalities often incur in managing and preventing<br />

such abuses.<br />

4. Property tax information of various residential units should be published<br />

online in the same manner as the guideline values that are published<br />

5. Move to GIS-based database to track, update and retrieve property tax<br />

information<br />

6. It should be made compulsory for all new building constructions to<br />

display the building permission details obtained from the municipality<br />

for construction. The municipality should actively encourage its citizens to<br />

report unauthorised buildings construction and should disseminate online<br />

information on action taken on such constructions to dissuade such activity.<br />

Capturing information on unauthorised construction at the initial stages<br />

through such efforts would go a long way in preventing the rampant growth<br />

of unauthorised and unassessed constructions in our towns and cities.<br />

7. Conduct a one-time survey to compile database of properties and initiate<br />

sample checks in all wards on an ongoing basis. The Commissioner<br />

should undertake ‘surprise checks’ on a regular basis in various wards<br />

to provide a sense of enforcement both to the municipal officials and to<br />

citizens for encouraging compliance.<br />

8. Reconcile and link assessment information with building permissions<br />

issued and initiate a drive to bring unassessed properties under the tax<br />

net.<br />

9. Reconcile manual and computerised registers to identify and bring in<br />

left-out assessments into the tax net.<br />

10. Blanket exemptions should be reviewed. Revenue loss due to exemptions<br />

should be compensated by GoTN.<br />

11. A strong coordination between departments within the municipality by<br />

itself bring significant increase in assessment base and collection<br />

efficiency. The Revenue department should reconcile its information across<br />

various databases on households and other commercial properties available<br />

within the municipality. Specific suggestions in this regard are listed below:<br />

o The Property tax database should be regularly updated based on the<br />

status of Building permissions issued by Town Planning department<br />

o Whenever the Engineering department provides water and sewage<br />

CCP cum BP - Krishnagiri <strong>Municipal</strong>ity 79