Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Malta Business Bureau – <str<strong>on</strong>g>Market</str<strong>on</strong>g> gaps in access <strong>to</strong> finance<br />

April 2013<br />

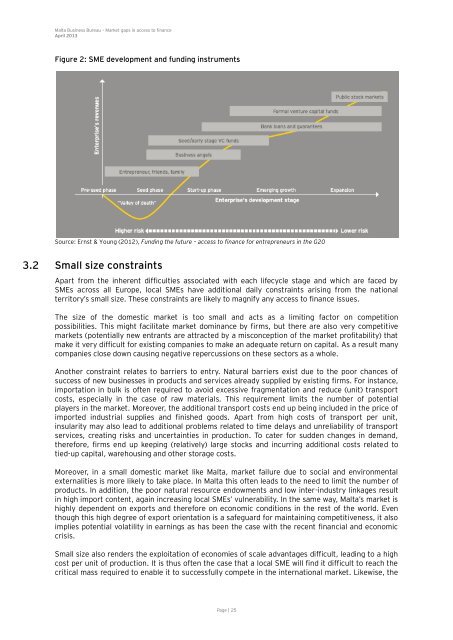

Figure 2: SME development and funding instruments<br />

Source: Ernst & Young (2012), Funding the future – access <strong>to</strong> finance for entrepreneurs in the G20<br />

3.2 Small size c<strong>on</strong>straints<br />

Apart from the inherent difficulties associated with each lifecycle stage and which are faced by<br />

SMEs across all Europe, local SMEs have additi<strong>on</strong>al daily c<strong>on</strong>straints arising from the nati<strong>on</strong>al<br />

terri<strong>to</strong>ry’s small size. These c<strong>on</strong>straints are likely <strong>to</strong> magnify any access <strong>to</strong> finance issues.<br />

The size <strong>of</strong> the domestic market is <strong>to</strong>o small and acts as a limiting fac<strong>to</strong>r <strong>on</strong> competiti<strong>on</strong><br />

possibilities. This might facilitate market dominance by firms, but there are also very competitive<br />

markets (potentially new entrants are attracted by a misc<strong>on</strong>cepti<strong>on</strong> <strong>of</strong> the market pr<strong>of</strong>itability) that<br />

make it very difficult for existing companies <strong>to</strong> make an adequate return <strong>on</strong> capital. As a result many<br />

companies close down causing negative repercussi<strong>on</strong>s <strong>on</strong> these sec<strong>to</strong>rs as a whole.<br />

Another c<strong>on</strong>straint relates <strong>to</strong> barriers <strong>to</strong> entry. Natural barriers exist due <strong>to</strong> the poor chances <strong>of</strong><br />

success <strong>of</strong> new businesses in products and services already supplied by existing firms. For instance,<br />

importati<strong>on</strong> in bulk is <strong>of</strong>ten required <strong>to</strong> avoid excessive fragmentati<strong>on</strong> and reduce (unit) transport<br />

costs, especially in the case <strong>of</strong> raw materials. This requirement limits the number <strong>of</strong> potential<br />

players in the market. Moreover, the additi<strong>on</strong>al transport costs end up being included in the price <strong>of</strong><br />

imported industrial supplies and finished goods. Apart from high costs <strong>of</strong> transport per unit,<br />

insularity may also lead <strong>to</strong> additi<strong>on</strong>al problems related <strong>to</strong> time delays and unreliability <strong>of</strong> transport<br />

services, creating risks and uncertainties in producti<strong>on</strong>. To cater for sudden changes in demand,<br />

therefore, firms end up keeping (relatively) large s<strong>to</strong>cks and incurring additi<strong>on</strong>al costs related <strong>to</strong><br />

tied-up capital, warehousing and other s<strong>to</strong>rage costs.<br />

Moreover, in a small domestic market like Malta, market failure due <strong>to</strong> social and envir<strong>on</strong>mental<br />

externalities is more likely <strong>to</strong> take place. In Malta this <strong>of</strong>ten leads <strong>to</strong> the need <strong>to</strong> limit the number <strong>of</strong><br />

products. In additi<strong>on</strong>, the poor natural resource endowments and low inter-industry linkages result<br />

in high import c<strong>on</strong>tent, again increasing local SMEs’ vulnerability. In the same way, Malta’s market is<br />

highly dependent <strong>on</strong> exports and therefore <strong>on</strong> ec<strong>on</strong>omic c<strong>on</strong>diti<strong>on</strong>s in the rest <strong>of</strong> the world. Even<br />

though this high degree <strong>of</strong> export orientati<strong>on</strong> is a safeguard for maintaining competitiveness, it also<br />

implies potential volatility in earnings as has been the case with the recent financial and ec<strong>on</strong>omic<br />

crisis.<br />

Small size also renders the exploitati<strong>on</strong> <strong>of</strong> ec<strong>on</strong>omies <strong>of</strong> scale advantages difficult, leading <strong>to</strong> a high<br />

cost per unit <strong>of</strong> producti<strong>on</strong>. It is thus <strong>of</strong>ten the case that a local SME will find it difficult <strong>to</strong> reach the<br />

critical mass required <strong>to</strong> enable it <strong>to</strong> successfully compete in the internati<strong>on</strong>al market. Likewise, the<br />

Page | 25