Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

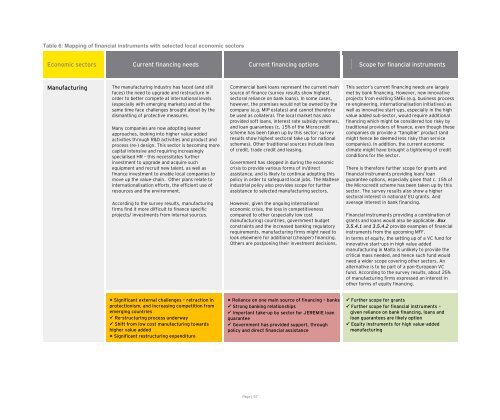

Table 6: Mapping <strong>of</strong> financial instruments with selected local ec<strong>on</strong>omic sec<strong>to</strong>rs<br />

Ec<strong>on</strong>omic sec<strong>to</strong>rs Current financing needs Current financing opti<strong>on</strong>s Scope for financial instruments<br />

Manufacturing<br />

The manufacturing industry has faced (and still<br />

faces) the need <strong>to</strong> upgrade and restructure in<br />

order <strong>to</strong> better compete at internati<strong>on</strong>al levels<br />

(especially with emerging markets) and at the<br />

same time face challenges brought about by the<br />

dismantling <strong>of</strong> protective measures.<br />

Many companies are now adopting leaner<br />

approaches, looking in<strong>to</strong> higher value-added<br />

activities through R&D activities and product and<br />

process (re-) design. This sec<strong>to</strong>r is becoming more<br />

capital intensive and requiring increasingly<br />

specialised HR – this necessitates further<br />

investment <strong>to</strong> upgrade and acquire such<br />

equipment and recruit new talent, as well as<br />

finance investment <strong>to</strong> enable local companies <strong>to</strong><br />

move up the value-chain. Other plans relate <strong>to</strong><br />

internati<strong>on</strong>alisati<strong>on</strong> efforts, the efficient use <strong>of</strong><br />

resources and the envir<strong>on</strong>ment.<br />

According <strong>to</strong> the survey results, manufacturing<br />

firms find it more difficult <strong>to</strong> finance specific<br />

projects/ investments from internal sources.<br />

Significant external challenges – retracti<strong>on</strong> in<br />

protecti<strong>on</strong>ism, and increasing competiti<strong>on</strong> from<br />

emerging countries<br />

Re-structuring process underway<br />

Shift from low cost manufacturing <strong>to</strong>wards<br />

higher value added<br />

Significant restructuring expenditure<br />

Commercial bank loans represent the current main<br />

source <strong>of</strong> finance (survey results show highest<br />

sec<strong>to</strong>ral reliance <strong>on</strong> bank loans). In some cases,<br />

however, the premises would not be owned by the<br />

company (e.g. MIP estates) and cannot therefore<br />

be used as collateral. The local market has also<br />

provided s<strong>of</strong>t loans, interest rate subsidy schemes,<br />

and loan guarantees (c. 15% <strong>of</strong> the Microcredit<br />

scheme has been taken up by this sec<strong>to</strong>r; survey<br />

results show highest sec<strong>to</strong>ral take up for nati<strong>on</strong>al<br />

schemes). Other traditi<strong>on</strong>al sources include lines<br />

<strong>of</strong> credit, trade credit and leasing.<br />

Government has stepped in during the ec<strong>on</strong>omic<br />

crisis <strong>to</strong> provide various forms <strong>of</strong> in/direct<br />

assistance, and is likely <strong>to</strong> c<strong>on</strong>tinue adopting this<br />

policy in order <strong>to</strong> safeguard local jobs. The Maltese<br />

industrial policy also provides scope for further<br />

assistance <strong>to</strong> selected manufacturing sec<strong>to</strong>rs.<br />

However, given the <strong>on</strong>going internati<strong>on</strong>al<br />

ec<strong>on</strong>omic crisis, the loss in competitiveness<br />

compared <strong>to</strong> other (especially low cost<br />

manufacturing) countries, government budget<br />

c<strong>on</strong>straints and the increased banking regula<strong>to</strong>ry<br />

requirements, manufacturing firms might need <strong>to</strong><br />

look elsewhere for additi<strong>on</strong>al (cheaper) financing.<br />

Others are postp<strong>on</strong>ing their investment decisi<strong>on</strong>s.<br />

Reliance <strong>on</strong> <strong>on</strong>e main source <strong>of</strong> financing – banks<br />

Str<strong>on</strong>g banking relati<strong>on</strong>ships<br />

Important take-up by sec<strong>to</strong>r for JEREMIE loan<br />

guarantee<br />

Government has provided support, through<br />

policy and direct financial assistance<br />

Page | 57<br />

This sec<strong>to</strong>r’s current financing needs are largely<br />

met by bank financing. However, new innovative<br />

projects from existing SMEs (e.g. business process<br />

re-engineering, internati<strong>on</strong>alisati<strong>on</strong> initiatives) as<br />

well as innovative start-ups, especially in the high<br />

value added sub-sec<strong>to</strong>r, would require additi<strong>on</strong>al<br />

financing which might be c<strong>on</strong>sidered <strong>to</strong>o risky by<br />

traditi<strong>on</strong>al providers <strong>of</strong> finance, even though these<br />

companies do provide a “tangible” product (and<br />

might hence be deemed less risky than service<br />

companies). In additi<strong>on</strong>, the current ec<strong>on</strong>omic<br />

climate might have brought a tightening <strong>of</strong> credit<br />

c<strong>on</strong>diti<strong>on</strong>s for the sec<strong>to</strong>r.<br />

There is therefore further scope for grants and<br />

financial instruments providing loan/ loan<br />

guarantee opti<strong>on</strong>s, especially given that c. 15% <strong>of</strong><br />

the Microcredit scheme has been taken up by this<br />

sec<strong>to</strong>r. The survey results also show a higher<br />

sec<strong>to</strong>ral interest in nati<strong>on</strong>al/ EU grants. And<br />

average interest in bank financing.<br />

Financial instruments providing a combinati<strong>on</strong> <strong>of</strong><br />

grants and loans would also be applicable. Box<br />

3.5.4.1 and 3.5.4.2 provide examples <strong>of</strong> financial<br />

instruments from the upcoming MFF.<br />

In terms <strong>of</strong> equity, the setting up <strong>of</strong> a VC fund for<br />

innovative start-ups in high value added<br />

manufacturing in Malta is unlikely <strong>to</strong> provide the<br />

critical mass needed, and hence such fund would<br />

need a wider scope covering other sec<strong>to</strong>rs. An<br />

alternative is <strong>to</strong> be part <strong>of</strong> a pan-European VC<br />

fund. According <strong>to</strong> the survey results, about 25%<br />

<strong>of</strong> manufacturing firms expressed an interest in<br />

other forms <strong>of</strong> equity financing.<br />

Further scope for grants<br />

Further scope for financial instruments –<br />

given reliance <strong>on</strong> bank financing, loans and<br />

loan guarantees are likely opti<strong>on</strong><br />

Equity instruments for high value-added<br />

manufacturing