Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Malta Business Bureau – <str<strong>on</strong>g>Market</str<strong>on</strong>g> gaps in access <strong>to</strong> finance<br />

April 2013<br />

c<strong>on</strong>siderati<strong>on</strong> further recycling <strong>of</strong> funds). This guarantee thus enables loans <strong>to</strong> be <strong>of</strong>fered at<br />

favourable interest rates and lower collateral requirements.<br />

The main JEREMIE benefits for Malta and its SMEs relate <strong>to</strong> 79 :<br />

Sustainability <strong>of</strong> funding: SMEs are supplied with sustainable funding <strong>on</strong> market-friendly<br />

terms<br />

Recycling <strong>of</strong> funds: The Holding fund is <strong>of</strong> a revolving nature, receiving payments for<br />

further investments in the SME sec<strong>to</strong>r. This ensures sustainability <strong>of</strong> SME support by rolling<br />

over recycled funds over the l<strong>on</strong>ger term.<br />

Leverage: JEREMIE has a potential ability <strong>to</strong> engage the financial sec<strong>to</strong>r either at the<br />

Holding Fund level with additi<strong>on</strong>al capital from financial instituti<strong>on</strong>s, or at the level <strong>of</strong><br />

financial instruments through co-financing. In the case <strong>of</strong> Malta, a guarantee <strong>of</strong> €8.8 milli<strong>on</strong><br />

generated a loans portfolio <strong>of</strong> €51 milli<strong>on</strong>, which is a sizeable pot for the local market.<br />

Benefits <strong>of</strong> a portfolio approach: The umbrella fund approach will allow a diversificati<strong>on</strong> <strong>of</strong><br />

risks and expected returns due <strong>to</strong> the pooling <strong>of</strong> different default rates, as well as active<br />

cash flow management <strong>to</strong> allow for a swift resp<strong>on</strong>se <strong>to</strong> changing market requirements.<br />

Expertise: Apart from external funding, SMEs very <strong>of</strong>ten also require additi<strong>on</strong>al pr<strong>of</strong>essi<strong>on</strong>al<br />

assistance <strong>to</strong> be able <strong>to</strong> utilise funding in the most efficient and effective way. The<br />

involvement <strong>of</strong> a financial instituti<strong>on</strong> allows for the leverage <strong>of</strong> the bank’s expertise – the<br />

bank has an incentive <strong>to</strong> get involved in understanding the business because it retains the<br />

sole direct client credit relati<strong>on</strong>ship. In the case <strong>of</strong> BOV (and other commercial banks in<br />

Malta), a large part <strong>of</strong> its existing cus<strong>to</strong>mers would already be SMEs – in this regard, banks<br />

have a competitive advantage for projects involving SMEs 80 .<br />

Requirements: JEREMIE also allows for lower collateral requirements and favourable<br />

interest rates for SMEs, making bank financing more affordable.<br />

Instituti<strong>on</strong> building: since there is no guarantee society in Malta, a European counterguarantee<br />

scheme is thus important <strong>to</strong> provide the possibility for local financial instituti<strong>on</strong>s<br />

<strong>to</strong> boost their volumes in the early stage, and facilitate the creati<strong>on</strong> <strong>of</strong> such schemes.<br />

Cash flow: this scheme provides finance <strong>to</strong> final recipients before actual project<br />

expenditure. This is an added benefit compared <strong>to</strong> the reimbursement process applicable in<br />

most grant schemes<br />

The Holding Fund is also able <strong>to</strong> re-allocate the resources <strong>to</strong> <strong>on</strong>e or more financial products in a<br />

flexible way, depending <strong>on</strong> the actual demand over time. This benefit is however not applicable <strong>to</strong><br />

the initial local JEREMIE initiative as it is based <strong>on</strong> <strong>on</strong>e financial product <strong>on</strong>ly.<br />

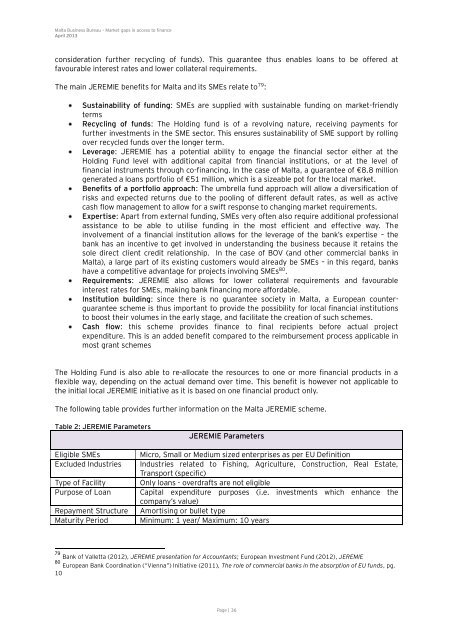

The following table provides further informati<strong>on</strong> <strong>on</strong> the Malta JEREMIE scheme.<br />

Table 2: JEREMIE Parameters<br />

JEREMIE Parameters<br />

Eligible SMEs Micro, Small or Medium sized enterprises as per EU Definiti<strong>on</strong><br />

Excluded Industries Industries related <strong>to</strong> Fishing, Agriculture, C<strong>on</strong>structi<strong>on</strong>, Real Estate,<br />

Transport (specific)<br />

Type <strong>of</strong> Facility Only loans - overdrafts are not eligible<br />

Purpose <strong>of</strong> Loan Capital expenditure purposes (i.e. investments which enhance the<br />

company’s value)<br />

Repayment Structure Amortising or bullet type<br />

Maturity Period Minimum: 1 year/ Maximum: 10 years<br />

79 <strong>Bank</strong> <strong>of</strong> <strong>Valletta</strong> (2012), JEREMIE presentati<strong>on</strong> for Accountants; European Investment Fund (2012), JEREMIE<br />

80 European <strong>Bank</strong> Coordinati<strong>on</strong> (“Vienna”) Initiative (2011), The role <strong>of</strong> commercial banks in the absorpti<strong>on</strong> <strong>of</strong> EU funds, pg.<br />

10<br />

Page | 36