Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

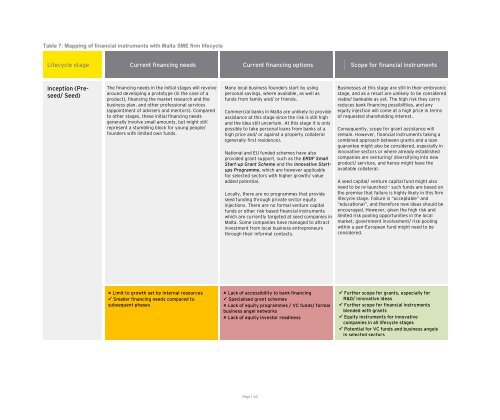

Table 7: Mapping <strong>of</strong> financial instruments with Malta SME firm lifecycle<br />

Lifecycle stage Current financing needs Current financing opti<strong>on</strong>s Scope for financial instruments<br />

Incepti<strong>on</strong> (Preseed/<br />

Seed)<br />

The financing needs in the initial stages will revolve<br />

around developing a pro<strong>to</strong>type (in the case <strong>of</strong> a<br />

product), financing the market research and the<br />

business plan, and other pr<strong>of</strong>essi<strong>on</strong>al services<br />

(appointment <strong>of</strong> advisers and men<strong>to</strong>rs). Compared<br />

<strong>to</strong> other stages, these initial financing needs<br />

generally involve small amounts, but might still<br />

represent a stumbling block for young people/<br />

founders with limited own funds.<br />

Limit <strong>to</strong> growth set by internal resources<br />

Smaller financing needs compared <strong>to</strong><br />

subsequent phases<br />

Many local business founders start by using<br />

pers<strong>on</strong>al savings, where available, as well as<br />

funds from family and/ or friends.<br />

Commercial banks in Malta are unlikely <strong>to</strong> provide<br />

assistance at this stage since the risk is still high<br />

and the idea still uncertain. At this stage it is <strong>on</strong>ly<br />

possible <strong>to</strong> take pers<strong>on</strong>al loans from banks at a<br />

high price and/ or against a property collateral<br />

(generally first residence).<br />

Nati<strong>on</strong>al and EU funded schemes have also<br />

provided grant support, such as the ERDF Small<br />

Start-up Grant Scheme and the Innovative Startups<br />

Programme, which are however applicable<br />

for selected sec<strong>to</strong>rs with higher growth/ value<br />

added potential.<br />

Locally, there are no programmes that provide<br />

seed funding through private sec<strong>to</strong>r equity<br />

injecti<strong>on</strong>s. There are no formal venture capital<br />

funds or other risk-based financial instruments<br />

which are currently targeted at seed companies in<br />

Malta. Some companies have managed <strong>to</strong> attract<br />

investment from local business entrepreneurs<br />

through their informal c<strong>on</strong>tacts.<br />

Lack <strong>of</strong> accessibility <strong>to</strong> bank financing<br />

Specialised grant schemes<br />

Lack <strong>of</strong> equity programmes / VC funds/ formal<br />

business angel networks<br />

Lack <strong>of</strong> equity inves<strong>to</strong>r readiness<br />

Page | 62<br />

Businesses at this stage are still in their embry<strong>on</strong>ic<br />

stage, and as a result are unlikely <strong>to</strong> be c<strong>on</strong>sidered<br />

viable/ bankable as yet. The high risk they carry<br />

reduces bank financing possibilities, and any<br />

equity injecti<strong>on</strong> will come at a high price in terms<br />

<strong>of</strong> requested shareholding interest.<br />

C<strong>on</strong>sequently, scope for grant assistance will<br />

remain. However, financial instruments taking a<br />

combined approach between grants and a loan<br />

guarantee might also be c<strong>on</strong>sidered, especially in<br />

innovative sec<strong>to</strong>rs or where already established<br />

companies are venturing/ diversifying in<strong>to</strong> new<br />

product/ services, and hence might have the<br />

available collateral.<br />

A seed capital/ venture capital fund might also<br />

need <strong>to</strong> be re-launched – such funds are based <strong>on</strong><br />

the premise that failure is highly likely in this firm<br />

lifecycle stage. Failure is “acceptable” and<br />

“educati<strong>on</strong>al”, and therefore new ideas should be<br />

encouraged. However, given the high risk and<br />

limited risk pooling opportunities in the local<br />

market, government involvement/ risk-pooling<br />

within a pan-European fund might need <strong>to</strong> be<br />

c<strong>on</strong>sidered.<br />

Further scope for grants, especially for<br />

R&D/ innovative ideas<br />

Further scope for financial instruments<br />

blended with grants<br />

Equity instruments for innovative<br />

companies in all lifecycle stages<br />

Potential for VC funds and business angels<br />

in selected sec<strong>to</strong>rs