Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

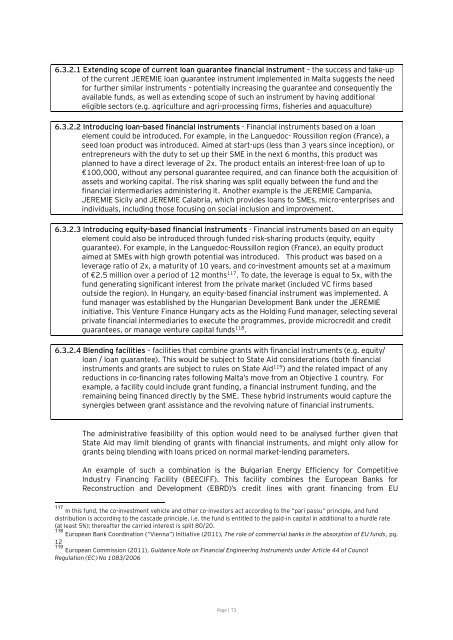

6.3.2.1 Extending scope <strong>of</strong> current loan guarantee financial instrument – the success and take-up<br />

<strong>of</strong> the current JEREMIE loan guarantee instrument implemented in Malta suggests the need<br />

for further similar instruments – potentially increasing the guarantee and c<strong>on</strong>sequently the<br />

available funds, as well as extending scope <strong>of</strong> such an instrument by having additi<strong>on</strong>al<br />

eligible sec<strong>to</strong>rs (e.g. agriculture and agri-processing firms, fisheries and aquaculture)<br />

6.3.2.2 Introducing loan-based financial instruments - Financial instruments based <strong>on</strong> a loan<br />

element could be introduced. For example, in the Languedoc- Roussill<strong>on</strong> regi<strong>on</strong> (France), a<br />

seed loan product was introduced. Aimed at start-ups (less than 3 years since incepti<strong>on</strong>), or<br />

entrepreneurs with the duty <strong>to</strong> set up their SME in the next 6 m<strong>on</strong>ths, this product was<br />

planned <strong>to</strong> have a direct leverage <strong>of</strong> 2x. The product entails an interest-free loan <strong>of</strong> up <strong>to</strong><br />

€100,000, without any pers<strong>on</strong>al guarantee required, and can finance both the acquisiti<strong>on</strong> <strong>of</strong><br />

assets and working capital. The risk sharing was split equally between the fund and the<br />

financial intermediaries administering it. Another example is the JEREMIE Campania,<br />

JEREMIE Sicily and JEREMIE Calabria, which provides loans <strong>to</strong> SMEs, micro-enterprises and<br />

individuals, including those focusing <strong>on</strong> social inclusi<strong>on</strong> and improvement.<br />

6.3.2.3 Introducing equity-based financial instruments - Financial instruments based <strong>on</strong> an equity<br />

element could also be introduced through funded risk-sharing products (equity, equity<br />

guarantee). For example, in the Languedoc-Roussill<strong>on</strong> regi<strong>on</strong> (France), an equity product<br />

aimed at SMEs with high growth potential was introduced. This product was based <strong>on</strong> a<br />

leverage ratio <strong>of</strong> 2x, a maturity <strong>of</strong> 10 years, and co-investment amounts set at a maximum<br />

<strong>of</strong> €2.5 milli<strong>on</strong> over a period <strong>of</strong> 12 m<strong>on</strong>ths 117 . To date, the leverage is equal <strong>to</strong> 5x, with the<br />

fund generating significant interest from the private market (included VC firms based<br />

outside the regi<strong>on</strong>). In Hungary, an equity-based financial instrument was implemented. A<br />

fund manager was established by the Hungarian Development <strong>Bank</strong> under the JEREMIE<br />

initiative. This Venture <strong>Finance</strong> Hungary acts as the Holding Fund manager, selecting several<br />

private financial intermediaries <strong>to</strong> execute the programmes, provide microcredit and credit<br />

guarantees, or manage venture capital funds 118 .<br />

6.3.2.4 Blending facilities – facilities that combine grants with financial instruments (e.g. equity/<br />

loan / loan guarantee). This would be subject <strong>to</strong> State Aid c<strong>on</strong>siderati<strong>on</strong>s (both financial<br />

instruments and grants are subject <strong>to</strong> rules <strong>on</strong> State Aid 119 ) and the related impact <strong>of</strong> any<br />

reducti<strong>on</strong>s in co-financing rates following Malta’s move from an Objective 1 country. For<br />

example, a facility could include grant funding, a financial instrument funding, and the<br />

remaining being financed directly by the SME. These hybrid instruments would capture the<br />

synergies between grant assistance and the revolving nature <strong>of</strong> financial instruments.<br />

The administrative feasibility <strong>of</strong> this opti<strong>on</strong> would need <strong>to</strong> be analysed further given that<br />

State Aid may limit blending <strong>of</strong> grants with financial instruments, and might <strong>on</strong>ly allow for<br />

grants being blending with loans priced <strong>on</strong> normal market-lending parameters.<br />

An example <strong>of</strong> such a combinati<strong>on</strong> is the Bulgarian Energy Efficiency for Competitive<br />

Industry Financing Facility (BEECIFF). This facility combines the European <strong>Bank</strong>s for<br />

Rec<strong>on</strong>structi<strong>on</strong> and Development (EBRD)’s credit lines with grant financing from EU<br />

117<br />

In this fund, the co-investment vehicle and other co-inves<strong>to</strong>rs act according <strong>to</strong> the “pari passu” principle, and fund<br />

distributi<strong>on</strong> is according <strong>to</strong> the cascade principle, i.e. the fund is entitled <strong>to</strong> the paid-in capital in additi<strong>on</strong>al <strong>to</strong> a hurdle rate<br />

(at least 5%); thereafter the carried interest is split 80/20.<br />

118<br />

European <strong>Bank</strong> Coordinati<strong>on</strong> (“Vienna”) Initiative (2011), The role <strong>of</strong> commercial banks in the absorpti<strong>on</strong> <strong>of</strong> EU funds, pg.<br />

12<br />

119<br />

European Commissi<strong>on</strong> (2011), Guidance Note <strong>on</strong> Financial Engineering Instruments under Article 44 <strong>of</strong> Council<br />

Regulati<strong>on</strong> (EC) No 1083/2006<br />

Page | 73