Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Malta Business Bureau – <str<strong>on</strong>g>Market</str<strong>on</strong>g> gaps in access <strong>to</strong> finance<br />

April 2013<br />

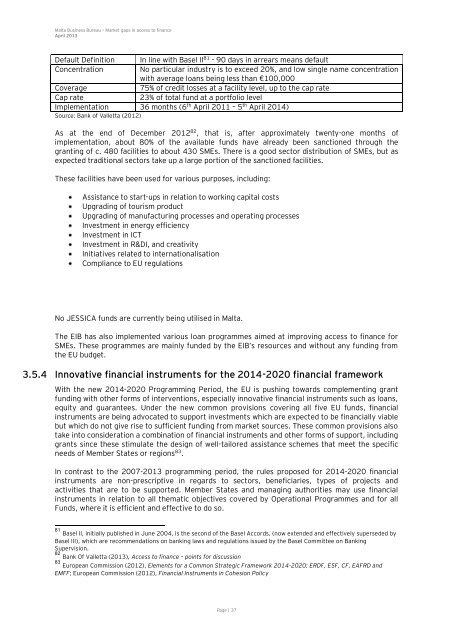

Default Definiti<strong>on</strong> In line with Basel II 81 - 90 days in arrears means default<br />

C<strong>on</strong>centrati<strong>on</strong> No particular industry is <strong>to</strong> exceed 20%, and low single name c<strong>on</strong>centrati<strong>on</strong><br />

with average loans being less than €100,000<br />

Coverage 75% <strong>of</strong> credit losses at a facility level, up <strong>to</strong> the cap rate<br />

Cap rate 23% <strong>of</strong> <strong>to</strong>tal fund at a portfolio level<br />

Implementati<strong>on</strong> 36 m<strong>on</strong>ths (6 th April 2011 – 5 th April 2014)<br />

Source: <strong>Bank</strong> <strong>of</strong> <strong>Valletta</strong> (2012)<br />

As at the end <strong>of</strong> December 2012 82 , that is, after approximately twenty-<strong>on</strong>e m<strong>on</strong>ths <strong>of</strong><br />

implementati<strong>on</strong>, about 80% <strong>of</strong> the available funds have already been sancti<strong>on</strong>ed through the<br />

granting <strong>of</strong> c. 480 facilities <strong>to</strong> about 430 SMEs. There is a good sec<strong>to</strong>r distributi<strong>on</strong> <strong>of</strong> SMEs, but as<br />

expected traditi<strong>on</strong>al sec<strong>to</strong>rs take up a large porti<strong>on</strong> <strong>of</strong> the sancti<strong>on</strong>ed facilities.<br />

These facilities have been used for various purposes, including:<br />

Assistance <strong>to</strong> start-ups in relati<strong>on</strong> <strong>to</strong> working capital costs<br />

Upgrading <strong>of</strong> <strong>to</strong>urism product<br />

Upgrading <strong>of</strong> manufacturing processes and operating processes<br />

Investment in energy efficiency<br />

Investment in ICT<br />

Investment in R&DI, and creativity<br />

Initiatives related <strong>to</strong> internati<strong>on</strong>alisati<strong>on</strong><br />

Compliance <strong>to</strong> EU regulati<strong>on</strong>s<br />

No JESSICA funds are currently being utilised in Malta.<br />

The EIB has also implemented various loan programmes aimed at improving access <strong>to</strong> finance for<br />

SMEs. These programmes are mainly funded by the EIB’s resources and without any funding from<br />

the EU budget.<br />

3.5.4 Innovative financial instruments for the 2014-2020 financial framework<br />

With the new 2014-2020 Programming Period, the EU is pushing <strong>to</strong>wards complementing grant<br />

funding with other forms <strong>of</strong> interventi<strong>on</strong>s, especially innovative financial instruments such as loans,<br />

equity and guarantees. Under the new comm<strong>on</strong> provisi<strong>on</strong>s covering all five EU funds, financial<br />

instruments are being advocated <strong>to</strong> support investments which are expected <strong>to</strong> be financially viable<br />

but which do not give rise <strong>to</strong> sufficient funding from market sources. These comm<strong>on</strong> provisi<strong>on</strong>s also<br />

take in<strong>to</strong> c<strong>on</strong>siderati<strong>on</strong> a combinati<strong>on</strong> <strong>of</strong> financial instruments and other forms <strong>of</strong> support, including<br />

grants since these stimulate the design <strong>of</strong> well-tailored assistance schemes that meet the specific<br />

needs <strong>of</strong> Member States or regi<strong>on</strong>s 83 .<br />

In c<strong>on</strong>trast <strong>to</strong> the 2007-2013 programming period, the rules proposed for 2014-2020 financial<br />

instruments are n<strong>on</strong>-prescriptive in regards <strong>to</strong> sec<strong>to</strong>rs, beneficiaries, types <strong>of</strong> projects and<br />

activities that are <strong>to</strong> be supported. Member States and managing authorities may use financial<br />

instruments in relati<strong>on</strong> <strong>to</strong> all thematic objectives covered by Operati<strong>on</strong>al Programmes and for all<br />

Funds, where it is efficient and effective <strong>to</strong> do so.<br />

81 Basel II, initially published in June 2004, is the sec<strong>on</strong>d <strong>of</strong> the Basel Accords, (now extended and effectively superseded by<br />

Basel III), which are recommendati<strong>on</strong>s <strong>on</strong> banking laws and regulati<strong>on</strong>s issued by the Basel Committee <strong>on</strong> <strong>Bank</strong>ing<br />

Supervisi<strong>on</strong>.<br />

82 <strong>Bank</strong> Of <strong>Valletta</strong> (2013), <strong>Access</strong> <strong>to</strong> finance – points for discussi<strong>on</strong><br />

83 European Commissi<strong>on</strong> (2012), Elements for a Comm<strong>on</strong> Strategic Framework 2014-2020: ERDF, ESF, CF, EAFRD and<br />

EMFF; European Commissi<strong>on</strong> (2012), Financial Instruments in Cohesi<strong>on</strong> Policy<br />

Page | 37