Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

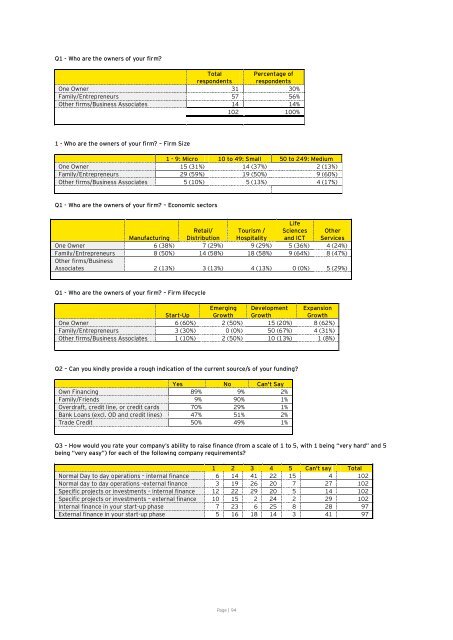

Q1 - Who are the owners <strong>of</strong> your firm?<br />

Total<br />

Percentage <strong>of</strong><br />

resp<strong>on</strong>dents resp<strong>on</strong>dents<br />

One Owner 31 30%<br />

Family/Entrepreneurs 57 56%<br />

Other firms/Business Associates 14 14%<br />

102 100%<br />

1 - Who are the owners <strong>of</strong> your firm? – Firm Size<br />

1 - 9: Micro 10 <strong>to</strong> 49: Small 50 <strong>to</strong> 249: Medium<br />

One Owner 15 (31%) 14 (37%) 2 (13%)<br />

Family/Entrepreneurs 29 (59%) 19 (50%) 9 (60%)<br />

Other firms/Business Associates 5 (10%) 5 (13%) 4 (17%)<br />

Q1 - Who are the owners <strong>of</strong> your firm? – Ec<strong>on</strong>omic sec<strong>to</strong>rs<br />

Retail/ Tourism /<br />

Life<br />

Sciences Other<br />

Manufacturing Distributi<strong>on</strong> Hospitality and ICT Services<br />

One Owner 6 (38%) 7 (29%) 9 (29%) 5 (36%) 4 (24%)<br />

Family/Entrepreneurs<br />

Other firms/Business<br />

8 (50%) 14 (58%) 18 (58%) 9 (64%) 8 (47%)<br />

Associates 2 (13%) 3 (13%) 4 (13%) 0 (0%) 5 (29%)<br />

Q1 - Who are the owners <strong>of</strong> your firm? – Firm lifecycle<br />

Emerging Development Expansi<strong>on</strong><br />

Start-Up Growth Growth<br />

Growth<br />

One Owner 6 (60%) 2 (50%) 15 (20%) 8 (62%)<br />

Family/Entrepreneurs 3 (30%) 0 (0%) 50 (67%) 4 (31%)<br />

Other firms/Business Associates 1 (10%) 2 (50%) 10 (13%) 1 (8%)<br />

Q2 – Can you kindly provide a rough indicati<strong>on</strong> <strong>of</strong> the current source/s <strong>of</strong> your funding?<br />

Yes No Can't Say<br />

Own Financing 89% 9% 2%<br />

Family/Friends 9% 90% 1%<br />

Overdraft, credit line, or credit cards 70% 29% 1%<br />

<strong>Bank</strong> Loans (excl. OD and credit lines) 47% 51% 2%<br />

Trade Credit 50% 49% 1%<br />

Q3 – How would you rate your company’s ability <strong>to</strong> raise finance (from a scale <strong>of</strong> 1 <strong>to</strong> 5, with 1 being “very hard” and 5<br />

being “very easy”) for each <strong>of</strong> the following company requirements?<br />

1 2 3 4 5 Can't say Total<br />

Normal Day <strong>to</strong> day operati<strong>on</strong>s – internal finance 6 14 41 22 15 4 102<br />

Normal day <strong>to</strong> day operati<strong>on</strong>s -external finance 3 19 26 20 7 27 102<br />

Specific projects or investments – internal finance 12 22 29 20 5 14 102<br />

Specific projects or investments – external finance 10 15 2 24 2 29 102<br />

Internal finance in your start-up phase 7 23 6 25 8 28 97<br />

External finance in your start-up phase 5 16 18 14 3 41 97<br />

Page | 94