Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Malta Business Bureau – <str<strong>on</strong>g>Market</str<strong>on</strong>g> gaps in access <strong>to</strong> finance<br />

April 2013<br />

One <strong>of</strong> the main shortcomings observed in the previous programming period were related <strong>to</strong> gap<br />

assessments 84 . Financial instruments are a special category <strong>of</strong> spending and their successful design<br />

and implementati<strong>on</strong> hinges <strong>on</strong> a correct assessment <strong>of</strong> market gaps and needs. The amended<br />

regulati<strong>on</strong>s stipulate that financial instruments should be designed <strong>on</strong> the basis <strong>of</strong> an ex ante<br />

assessment that has identified market failures or sub-optimal investment situati<strong>on</strong>s, respective<br />

investment needs, possible private sec<strong>to</strong>r participati<strong>on</strong> and resulting added value <strong>of</strong> the financial<br />

instrument in questi<strong>on</strong>. Such an ex ante assessment should also avoid overlaps and inc<strong>on</strong>sistencies<br />

between funding instruments implemented by different ac<strong>to</strong>rs at different levels.<br />

The EC has already outlined a number <strong>of</strong> proposals for the inclusi<strong>on</strong> <strong>of</strong> innovative financial<br />

instruments in the next MFF <strong>to</strong> be implemented through a set <strong>of</strong> comm<strong>on</strong> rules and guidance for<br />

equity and debt instruments (referred <strong>to</strong> as the “EU equity and debt platforms”) 85 . These include 86 :<br />

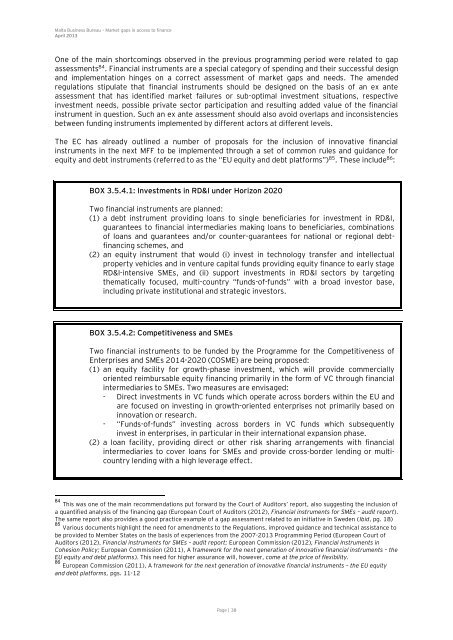

BOX 3.5.4.1: Investments in RD&I under Horiz<strong>on</strong> 2020<br />

Two financial instruments are planned:<br />

(1) a debt instrument providing loans <strong>to</strong> single beneficiaries for investment in RD&I,<br />

guarantees <strong>to</strong> financial intermediaries making loans <strong>to</strong> beneficiaries, combinati<strong>on</strong>s<br />

<strong>of</strong> loans and guarantees and/or counter-guarantees for nati<strong>on</strong>al or regi<strong>on</strong>al debtfinancing<br />

schemes, and<br />

(2) an equity instrument that would (i) invest in technology transfer and intellectual<br />

property vehicles and in venture capital funds providing equity finance <strong>to</strong> early stage<br />

RD&I-intensive SMEs, and (ii) support investments in RD&I sec<strong>to</strong>rs by targeting<br />

thematically focused, multi-country “funds-<strong>of</strong>-funds” with a broad inves<strong>to</strong>r base,<br />

including private instituti<strong>on</strong>al and strategic inves<strong>to</strong>rs.<br />

BOX 3.5.4.2: Competitiveness and SMEs<br />

Two financial instruments <strong>to</strong> be funded by the Programme for the Competitiveness <strong>of</strong><br />

Enterprises and SMEs 2014-2020 (COSME) are being proposed:<br />

(1) an equity facility for growth-phase investment, which will provide commercially<br />

oriented reimbursable equity financing primarily in the form <strong>of</strong> VC through financial<br />

intermediaries <strong>to</strong> SMEs. Two measures are envisaged:<br />

- Direct investments in VC funds which operate across borders within the EU and<br />

are focused <strong>on</strong> investing in growth-oriented enterprises not primarily based <strong>on</strong><br />

innovati<strong>on</strong> or research.<br />

- “Funds-<strong>of</strong>-funds” investing across borders in VC funds which subsequently<br />

invest in enterprises, in particular in their internati<strong>on</strong>al expansi<strong>on</strong> phase.<br />

(2) a loan facility, providing direct or other risk sharing arrangements with financial<br />

intermediaries <strong>to</strong> cover loans for SMEs and provide cross-border lending or multicountry<br />

lending with a high leverage effect.<br />

84 This was <strong>on</strong>e <strong>of</strong> the main recommendati<strong>on</strong>s put forward by the Court <strong>of</strong> Audi<strong>to</strong>rs’ report, also suggesting the inclusi<strong>on</strong> <strong>of</strong><br />

a quantified analysis <strong>of</strong> the financing gap (European Court <strong>of</strong> Audi<strong>to</strong>rs (2012), Financial instruments for SMEs – audit report).<br />

The same report also provides a good practice example <strong>of</strong> a gap assessment related <strong>to</strong> an initiative in Sweden (Ibid, pg. 18)<br />

85 Various documents highlight the need for amendments <strong>to</strong> the Regulati<strong>on</strong>s, improved guidance and technical assistance <strong>to</strong><br />

be provided <strong>to</strong> Member States <strong>on</strong> the basis <strong>of</strong> experiences from the 2007-2013 Programming Period (European Court <strong>of</strong><br />

Audi<strong>to</strong>rs (2012), Financial instruments for SMEs – audit report; European Commissi<strong>on</strong> (2012), Financial Instruments in<br />

Cohesi<strong>on</strong> Policy; European Commissi<strong>on</strong> (2011), A framework for the next generati<strong>on</strong> <strong>of</strong> innovative financial instruments – the<br />

EU equity and debt platforms). This need for higher assurance will, however, come at the price <strong>of</strong> flexibility.<br />

86 European Commissi<strong>on</strong> (2011), A framework for the next generati<strong>on</strong> <strong>of</strong> innovative financial instruments – the EU equity<br />

and debt platforms, pgs. 11-12<br />

Page | 38