Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Malta Business Bureau – <str<strong>on</strong>g>Market</str<strong>on</strong>g> gaps in access <strong>to</strong> finance<br />

April 2013<br />

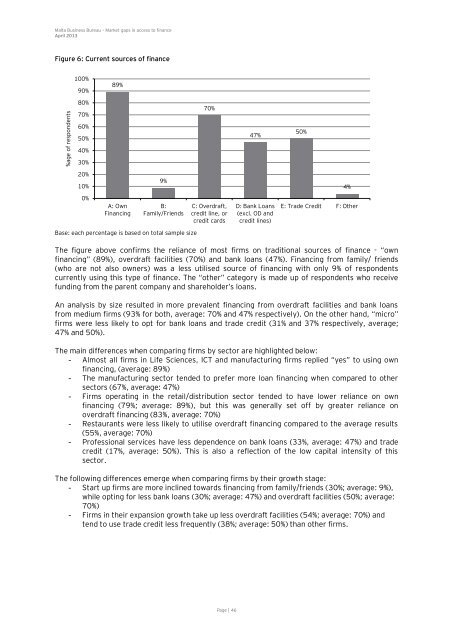

Figure 6: Current sources <strong>of</strong> finance<br />

%age <strong>of</strong> resp<strong>on</strong>dents<br />

100%<br />

90%<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

89%<br />

A: Own<br />

Financing<br />

9%<br />

B:<br />

Family/Friends<br />

Base: each percentage is based <strong>on</strong> <strong>to</strong>tal sample size<br />

70%<br />

C: Overdraft,<br />

credit line, or<br />

credit cards<br />

The figure above c<strong>on</strong>firms the reliance <strong>of</strong> most firms <strong>on</strong> traditi<strong>on</strong>al sources <strong>of</strong> finance - “own<br />

financing” (89%), overdraft facilities (70%) and bank loans (47%). Financing from family/ friends<br />

(who are not also owners) was a less utilised source <strong>of</strong> financing with <strong>on</strong>ly 9% <strong>of</strong> resp<strong>on</strong>dents<br />

currently using this type <strong>of</strong> finance. The “other” category is made up <strong>of</strong> resp<strong>on</strong>dents who receive<br />

funding from the parent company and shareholder’s loans.<br />

An analysis by size resulted in more prevalent financing from overdraft facilities and bank loans<br />

from medium firms (93% for both, average: 70% and 47% respectively). On the other hand, “micro”<br />

firms were less likely <strong>to</strong> opt for bank loans and trade credit (31% and 37% respectively, average;<br />

47% and 50%).<br />

The main differences when comparing firms by sec<strong>to</strong>r are highlighted below:<br />

- Almost all firms in Life Sciences, ICT and manufacturing firms replied “yes” <strong>to</strong> using own<br />

financing, (average: 89%)<br />

- The manufacturing sec<strong>to</strong>r tended <strong>to</strong> prefer more loan financing when compared <strong>to</strong> other<br />

sec<strong>to</strong>rs (67%, average: 47%)<br />

- Firms operating in the retail/distributi<strong>on</strong> sec<strong>to</strong>r tended <strong>to</strong> have lower reliance <strong>on</strong> own<br />

financing (79%; average: 89%), but this was generally set <strong>of</strong>f by greater reliance <strong>on</strong><br />

overdraft financing (83%, average: 70%)<br />

- Restaurants were less likely <strong>to</strong> utilise overdraft financing compared <strong>to</strong> the average results<br />

(55%, average: 70%)<br />

- Pr<strong>of</strong>essi<strong>on</strong>al services have less dependence <strong>on</strong> bank loans (33%, average: 47%) and trade<br />

credit (17%, average: 50%). This is also a reflecti<strong>on</strong> <strong>of</strong> the low capital intensity <strong>of</strong> this<br />

sec<strong>to</strong>r.<br />

The following differences emerge when comparing firms by their growth stage:<br />

- Start up firms are more inclined <strong>to</strong>wards financing from family/friends (30%; average: 9%),<br />

while opting for less bank loans (30%; average: 47%) and overdraft facilities (50%; average:<br />

70%)<br />

- Firms in their expansi<strong>on</strong> growth take up less overdraft facilities (54%; average: 70%) and<br />

tend <strong>to</strong> use trade credit less frequently (38%; average: 50%) than other firms.<br />

Page | 46<br />

47%<br />

D: <strong>Bank</strong> Loans<br />

(excl. OD and<br />

credit lines)<br />

50%<br />

4%<br />

E: Trade Credit F: Other