Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

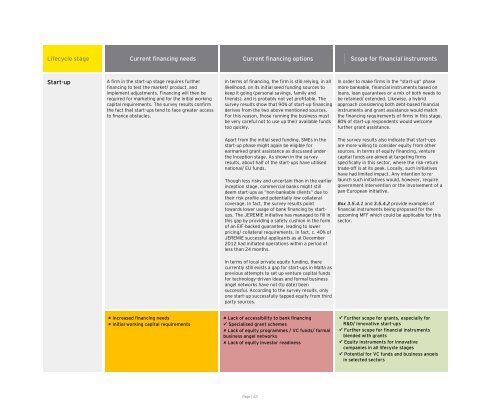

Lifecycle stage Current financing needs Current financing opti<strong>on</strong>s Scope for financial instruments<br />

Start-up<br />

A firm in the start-up stage requires further<br />

financing <strong>to</strong> test the market/ product, and<br />

implement adjustments. Financing will then be<br />

required for marketing and for the initial working<br />

capital requirements. The survey results c<strong>on</strong>firm<br />

the fact that start-ups tend <strong>to</strong> face greater access<br />

<strong>to</strong> finance obstacles.<br />

Increased financing needs<br />

Initial working capital requirements<br />

In terms <strong>of</strong> financing, the firm is still relying, in all<br />

likelihood, <strong>on</strong> its initial seed funding sources <strong>to</strong><br />

keep it going (pers<strong>on</strong>al savings, family and<br />

friends), and is probably not yet pr<strong>of</strong>itable. The<br />

survey results show that 90% <strong>of</strong> start-up financing<br />

derives from the two above-menti<strong>on</strong>ed sources.<br />

For this reas<strong>on</strong>, those running the business must<br />

be very careful not <strong>to</strong> use up their available funds<br />

<strong>to</strong>o quickly.<br />

Apart from the initial seed funding, SMEs in the<br />

start-up phase might again be eligible for<br />

earmarked grant assistance as discussed under<br />

the Incepti<strong>on</strong> stage. As shown in the survey<br />

results, about half <strong>of</strong> the start-ups have utilised<br />

nati<strong>on</strong>al/ EU funds.<br />

Though less risky and uncertain than in the earlier<br />

incepti<strong>on</strong> stage, commercial banks might still<br />

deem start-ups as “n<strong>on</strong>-bankable clients” due <strong>to</strong><br />

their risk pr<strong>of</strong>ile and potentially low collateral<br />

coverage. In fact, the survey results point<br />

<strong>to</strong>wards lower usage <strong>of</strong> bank financing by startups.<br />

The JEREMIE initiative has managed <strong>to</strong> fill in<br />

this gap by providing a safety cushi<strong>on</strong> in the form<br />

<strong>of</strong> an EIF-backed guarantee, leading <strong>to</strong> lower<br />

pricing/ collateral requirements. In fact, c. 40% <strong>of</strong><br />

JEREMIE successful applicants as at December<br />

2012 had initiated operati<strong>on</strong>s within a period <strong>of</strong><br />

less than 24 m<strong>on</strong>ths.<br />

In terms <strong>of</strong> local private equity funding, there<br />

currently still exists a gap for start-ups in Malta as<br />

previous attempts <strong>to</strong> set up venture capital funds<br />

for technology-driven ideas and formal business<br />

angel networks have not (<strong>to</strong> date) been<br />

successful. According <strong>to</strong> the survey results, <strong>on</strong>ly<br />

<strong>on</strong>e start-up successfully tapped equity from third<br />

party sources.<br />

Lack <strong>of</strong> accessibility <strong>to</strong> bank financing<br />

Specialised grant schemes<br />

Lack <strong>of</strong> equity programmes / VC funds/ formal<br />

business angel networks<br />

Lack <strong>of</strong> equity inves<strong>to</strong>r readiness<br />

Page | 63<br />

In order <strong>to</strong> make firms in the “start-up” phase<br />

more bankable, financial instruments based <strong>on</strong><br />

loans, loan guarantees or a mix <strong>of</strong> both needs <strong>to</strong><br />

be retained/ extended. Likewise, a hybrid<br />

approach c<strong>on</strong>sidering both debt-based financial<br />

instruments and grant assistance would match<br />

the financing requirements <strong>of</strong> firms in this stage.<br />

80% <strong>of</strong> start-up resp<strong>on</strong>dents would welcome<br />

further grant assistance.<br />

The survey results also indicate that start-ups<br />

are more willing <strong>to</strong> c<strong>on</strong>sider equity from other<br />

sources. In terms <strong>of</strong> equity financing, venture<br />

capital funds are aimed at targeting firms<br />

specifically in this sec<strong>to</strong>r, where the risk-return<br />

trade-<strong>of</strong>f is at its peak. Locally, such initiatives<br />

have had limited impact. Any intenti<strong>on</strong> <strong>to</strong> relaunch<br />

such initiatives would, however, require<br />

government interventi<strong>on</strong> or the involvement <strong>of</strong> a<br />

pan-European initiative.<br />

Box 3.5.4.1 and 3.5.4.2 provide examples <strong>of</strong><br />

financial instruments being proposed for the<br />

upcoming MFF which could be applicable for this<br />

sec<strong>to</strong>r.<br />

Further scope for grants, especially for<br />

R&D/ innovative start-ups<br />

Further scope for financial instruments<br />

blended with grants<br />

Equity instruments for innovative<br />

companies in all lifecycle stages<br />

Potential for VC funds and business angels<br />

in selected sec<strong>to</strong>rs