Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Malta Business Bureau – <str<strong>on</strong>g>Market</str<strong>on</strong>g> gaps in access <strong>to</strong> finance<br />

April 2013<br />

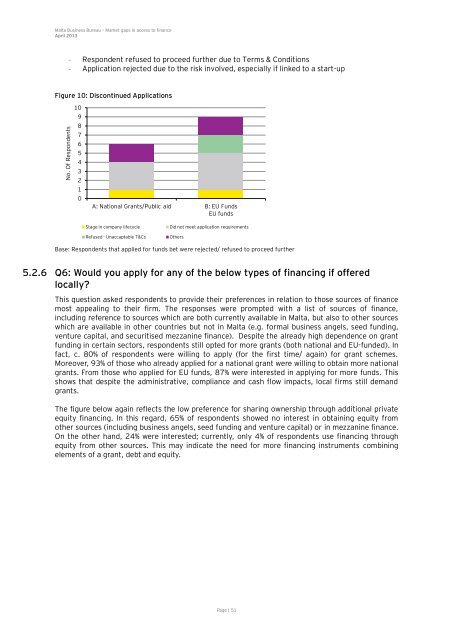

– Resp<strong>on</strong>dent refused <strong>to</strong> proceed further due <strong>to</strong> Terms & C<strong>on</strong>diti<strong>on</strong>s<br />

– Applicati<strong>on</strong> rejected due <strong>to</strong> the risk involved, especially if linked <strong>to</strong> a start-up<br />

Figure 10: Disc<strong>on</strong>tinued Applicati<strong>on</strong>s<br />

No. Of Resp<strong>on</strong>dents<br />

10<br />

9<br />

8<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

A: Nati<strong>on</strong>al Grants/Public aid B: EU Funds<br />

EU funds<br />

Stage in company lifecycle Did not meet applicati<strong>on</strong> requirements<br />

Refused - Unaccaptable T&Cs Others<br />

Base: Resp<strong>on</strong>dents that applied for funds bet were rejected/ refused <strong>to</strong> proceed further<br />

5.2.6 Q6: Would you apply for any <strong>of</strong> the below types <strong>of</strong> financing if <strong>of</strong>fered<br />

locally?<br />

This questi<strong>on</strong> asked resp<strong>on</strong>dents <strong>to</strong> provide their preferences in relati<strong>on</strong> <strong>to</strong> those sources <strong>of</strong> finance<br />

most appealing <strong>to</strong> their firm. The resp<strong>on</strong>ses were prompted with a list <strong>of</strong> sources <strong>of</strong> finance,<br />

including reference <strong>to</strong> sources which are both currently available in Malta, but also <strong>to</strong> other sources<br />

which are available in other countries but not in Malta (e.g. formal business angels, seed funding,<br />

venture capital, and securitised mezzanine finance). Despite the already high dependence <strong>on</strong> grant<br />

funding in certain sec<strong>to</strong>rs, resp<strong>on</strong>dents still opted for more grants (both nati<strong>on</strong>al and EU-funded). In<br />

fact, c. 80% <strong>of</strong> resp<strong>on</strong>dents were willing <strong>to</strong> apply (for the first time/ again) for grant schemes.<br />

Moreover, 93% <strong>of</strong> those who already applied for a nati<strong>on</strong>al grant were willing <strong>to</strong> obtain more nati<strong>on</strong>al<br />

grants. From those who applied for EU funds, 87% were interested in applying for more funds. This<br />

shows that despite the administrative, compliance and cash flow impacts, local firms still demand<br />

grants.<br />

The figure below again reflects the low preference for sharing ownership through additi<strong>on</strong>al private<br />

equity financing. In this regard, 65% <strong>of</strong> resp<strong>on</strong>dents showed no interest in obtaining equity from<br />

other sources (including business angels, seed funding and venture capital) or in mezzanine finance.<br />

On the other hand, 24% were interested; currently, <strong>on</strong>ly 4% <strong>of</strong> resp<strong>on</strong>dents use financing through<br />

equity from other sources. This may indicate the need for more financing instruments combining<br />

elements <strong>of</strong> a grant, debt and equity.<br />

Page | 51