Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Malta Business Bureau – <str<strong>on</strong>g>Market</str<strong>on</strong>g> gaps in access <strong>to</strong> finance<br />

April 2013<br />

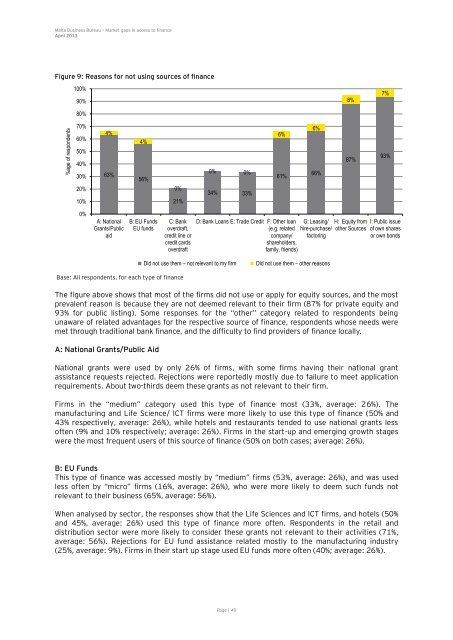

Figure 9: Reas<strong>on</strong>s for not using sources <strong>of</strong> finance<br />

%age <strong>of</strong> resp<strong>on</strong>dents<br />

100%<br />

90%<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

4%<br />

63%<br />

A: Nati<strong>on</strong>al<br />

Grants/Public<br />

aid<br />

4%<br />

56%<br />

B: EU Funds<br />

EU funds<br />

Base: All resp<strong>on</strong>dents, for each type <strong>of</strong> finance<br />

The figure above shows that most <strong>of</strong> the firms did not use or apply for equity sources, and the most<br />

prevalent reas<strong>on</strong> is because they are not deemed relevant <strong>to</strong> their firm (87% for private equity and<br />

93% for public listing). Some resp<strong>on</strong>ses for the “other” category related <strong>to</strong> resp<strong>on</strong>dents being<br />

unaware <strong>of</strong> related advantages for the respective source <strong>of</strong> finance, resp<strong>on</strong>dents whose needs were<br />

met through traditi<strong>on</strong>al bank finance, and the difficulty <strong>to</strong> find providers <strong>of</strong> finance locally.<br />

A: Nati<strong>on</strong>al Grants/Public Aid<br />

0%<br />

21%<br />

C: <strong>Bank</strong><br />

overdraft,<br />

credit line or<br />

credit cards<br />

overdraft<br />

0% 0%<br />

34% 33%<br />

Nati<strong>on</strong>al grants were used by <strong>on</strong>ly 26% <strong>of</strong> firms, with some firms having their nati<strong>on</strong>al grant<br />

assistance requests rejected. Rejecti<strong>on</strong>s were reportedly mostly due <strong>to</strong> failure <strong>to</strong> meet applicati<strong>on</strong><br />

requirements. About two-thirds deem these grants as not relevant <strong>to</strong> their firm.<br />

Firms in the “medium” category used this type <strong>of</strong> finance most (33%, average: 26%). The<br />

manufacturing and Life Science/ ICT firms were more likely <strong>to</strong> use this type <strong>of</strong> finance (50% and<br />

43% respectively, average: 26%), while hotels and restaurants tended <strong>to</strong> use nati<strong>on</strong>al grants less<br />

<strong>of</strong>ten (9% and 10% respectively; average: 26%). Firms in the start-up and emerging growth stages<br />

were the most frequent users <strong>of</strong> this source <strong>of</strong> finance (50% <strong>on</strong> both cases; average: 26%).<br />

B: EU Funds<br />

This type <strong>of</strong> finance was accessed mostly by “medium” firms (53%, average: 26%), and was used<br />

less <strong>of</strong>ten by “micro” firms (16%, average: 26%), who were more likely <strong>to</strong> deem such funds not<br />

relevant <strong>to</strong> their business (65%, average: 56%).<br />

When analysed by sec<strong>to</strong>r, the resp<strong>on</strong>ses show that the Life Sciences and ICT firms, and hotels (50%<br />

and 45%, average: 26%) used this type <strong>of</strong> finance more <strong>of</strong>ten. Resp<strong>on</strong>dents in the retail and<br />

distributi<strong>on</strong> sec<strong>to</strong>r were more likely <strong>to</strong> c<strong>on</strong>sider these grants not relevant <strong>to</strong> their activities (71%,<br />

average: 56%). Rejecti<strong>on</strong>s for EU fund assistance related mostly <strong>to</strong> the manufacturing industry<br />

(25%, average: 9%). Firms in their start up stage used EU funds more <strong>of</strong>ten (40%; average: 26%).<br />

Page | 49<br />

6%<br />

61%<br />

D: <strong>Bank</strong> Loans E: Trade Credit F: Other loan<br />

(e.g. related<br />

company/<br />

shareholders,<br />

family, friends)<br />

6%<br />

66%<br />

Did not use them – not relevant <strong>to</strong> my firm Did not use them – other reas<strong>on</strong>s<br />

8%<br />

87%<br />

G: Leasing/ H: Equity from<br />

hire-purchase/ other Sources<br />

fac<strong>to</strong>ring<br />

7%<br />

93%<br />

I: Public issue<br />

<strong>of</strong> own shares<br />

or own b<strong>on</strong>ds