Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Malta Business Bureau – <str<strong>on</strong>g>Market</str<strong>on</strong>g> gaps in access <strong>to</strong> finance<br />

April 2013<br />

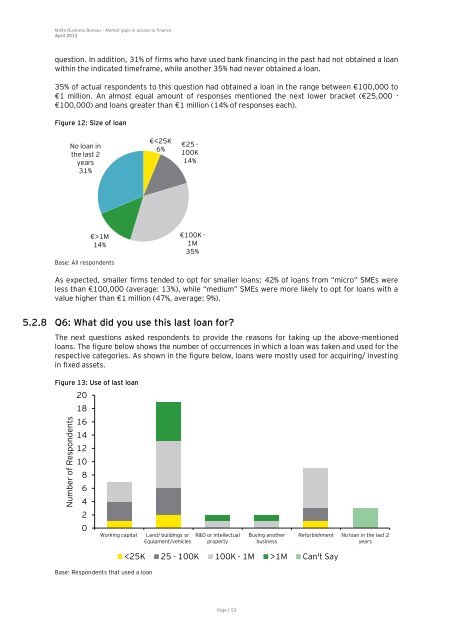

questi<strong>on</strong>. In additi<strong>on</strong>, 31% <strong>of</strong> firms who have used bank financing in the past had not obtained a loan<br />

within the indicated timeframe, while another 35% had never obtained a loan.<br />

35% <strong>of</strong> actual resp<strong>on</strong>dents <strong>to</strong> this questi<strong>on</strong> had obtained a loan in the range between €100,000 <strong>to</strong><br />

€1 milli<strong>on</strong>. An almost equal amount <strong>of</strong> resp<strong>on</strong>ses menti<strong>on</strong>ed the next lower bracket (€25,000 -<br />

€100,000) and loans greater than €1 milli<strong>on</strong> (14% <strong>of</strong> resp<strong>on</strong>ses each).<br />

Figure 12: Size <strong>of</strong> loan<br />

Base: All resp<strong>on</strong>dents<br />

As expected, smaller firms tended <strong>to</strong> opt for smaller loans; 42% <strong>of</strong> loans from “micro” SMEs were<br />

less than €100,000 (average: 13%), while “medium” SMEs were more likely <strong>to</strong> opt for loans with a<br />

value higher than €1 milli<strong>on</strong> (47%, average: 9%).<br />

5.2.8 Q6: What did you use this last loan for?<br />

The next questi<strong>on</strong>s asked resp<strong>on</strong>dents <strong>to</strong> provide the reas<strong>on</strong>s for taking up the above-menti<strong>on</strong>ed<br />

loans. The figure below shows the number <strong>of</strong> occurrences in which a loan was taken and used for the<br />

respective categories. As shown in the figure below, loans were mostly used for acquiring/ investing<br />

in fixed assets.<br />

Figure 13: Use <strong>of</strong> last loan<br />

Number <strong>of</strong> Resp<strong>on</strong>dents<br />

No loan in<br />

the last 2<br />

years<br />

31%<br />

20<br />

18<br />

16<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

€>1M<br />

14%<br />

Base: Resp<strong>on</strong>dents that used a loan<br />

€