Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Malta Business Bureau – <str<strong>on</strong>g>Market</str<strong>on</strong>g> gaps in access <strong>to</strong> finance<br />

April 2013<br />

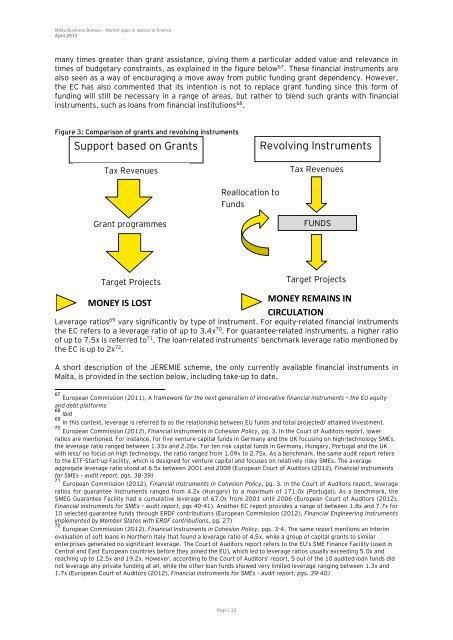

many times greater than grant assistance, giving them a particular added value and relevance in<br />

times <strong>of</strong> budgetary c<strong>on</strong>straints, as explained in the figure below 67 . These financial instruments are<br />

also seen as a way <strong>of</strong> encouraging a move away from public funding grant dependency. However,<br />

the EC has also commented that its intenti<strong>on</strong> is not <strong>to</strong> replace grant funding since this form <strong>of</strong><br />

funding will still be necessary in a range <strong>of</strong> areas, but rather <strong>to</strong> blend such grants with financial<br />

instruments, such as loans from financial instituti<strong>on</strong>s 68 .<br />

Figure 3: Comparis<strong>on</strong> <strong>of</strong> grants and revolving instruments<br />

Support based <strong>on</strong> Grants<br />

Tax Revenues<br />

Grant programmes<br />

Target Projects<br />

MONEY IS LOST<br />

Reallocati<strong>on</strong> <strong>to</strong><br />

Funds<br />

Leverage ratios 69 vary significantly by type <strong>of</strong> instrument. For equity-related financial instruments<br />

the EC refers <strong>to</strong> a leverage ratio <strong>of</strong> up <strong>to</strong> 3.4x 70 . For guarantee-related instruments, a higher ratio<br />

<strong>of</strong> up <strong>to</strong> 7.5x is referred <strong>to</strong> 71 . The loan-related instruments’ benchmark leverage ratio menti<strong>on</strong>ed by<br />

the EC is up <strong>to</strong> 2x 72 .<br />

A short descripti<strong>on</strong> <strong>of</strong> the JEREMIE scheme, the <strong>on</strong>ly currently available financial instruments in<br />

Malta, is provided in the secti<strong>on</strong> below, including take-up <strong>to</strong> date.<br />

67<br />

European Commissi<strong>on</strong> (2011), A framework for the next generati<strong>on</strong> <strong>of</strong> innovative financial instruments – the EU equity<br />

and debt platforms<br />

68<br />

Ibid<br />

69<br />

In this c<strong>on</strong>text, leverage is referred <strong>to</strong> as the relati<strong>on</strong>ship between EU funds and <strong>to</strong>tal projected/ attained investment.<br />

70<br />

European Commissi<strong>on</strong> (2012), Financial Instruments in Cohesi<strong>on</strong> Policy, pg. 3. In the Court <strong>of</strong> Audi<strong>to</strong>rs report, lower<br />

ratios are menti<strong>on</strong>ed. For instance, for five venture capital funds in Germany and the UK focusing <strong>on</strong> high-technology SMEs,<br />

the leverage ratio ranged between 1.33x and 2.26x. For ten risk capital funds in Germany, Hungary, Portugal and the UK<br />

with less/ no focus <strong>on</strong> high technology, the ratio ranged from 1.09x <strong>to</strong> 2.75x. As a benchmark, the same audit report refers<br />

<strong>to</strong> the ETF-Start-up Facility, which is designed for venture capital and focuses <strong>on</strong> relatively risky SMEs. The average<br />

aggregate leverage ratio s<strong>to</strong>od at 6.5x between 2001 and 2008 (European Court <strong>of</strong> Audi<strong>to</strong>rs (2012), Financial instruments<br />

for SMEs – audit report, pgs. 38-39)<br />

71<br />

European Commissi<strong>on</strong> (2012), Financial Instruments in Cohesi<strong>on</strong> Policy, pg. 3. In the Court <strong>of</strong> Audi<strong>to</strong>rs report, leverage<br />

ratios for guarantee instruments ranged from 4.2x (Hungary) <strong>to</strong> a maximum <strong>of</strong> 171.0x (Portugal). As a benchmark, the<br />

SMEG Guarantee Facility had a cumulative leverage <strong>of</strong> 67.0x from 2001 until 2006 (European Court <strong>of</strong> Audi<strong>to</strong>rs (2012),<br />

Financial instruments for SMEs – audit report, pgs 40-41). Another EC report provides a range <strong>of</strong> between 1.8x and 7.7x for<br />

10 selected guarantee funds through ERDF c<strong>on</strong>tributi<strong>on</strong>s (European Commissi<strong>on</strong> (2012), Financial Engineering Instruments<br />

implemented by Member States with ERDF c<strong>on</strong>tributi<strong>on</strong>s, pg. 27)<br />

72<br />

European Commissi<strong>on</strong> (2012), Financial Instruments in Cohesi<strong>on</strong> Policy, pgs. 3-4. The same report menti<strong>on</strong>s an interim<br />

evaluati<strong>on</strong> <strong>of</strong> s<strong>of</strong>t loans in Northern Italy that found a leverage ratio <strong>of</strong> 4.5x, while a group <strong>of</strong> capital grants <strong>to</strong> similar<br />

enterprises generated no significant leverage. The Court <strong>of</strong> Audi<strong>to</strong>rs report refers <strong>to</strong> the EU’s SME <strong>Finance</strong> Facility (used in<br />

Central and East European countries before they joined the EU), which led <strong>to</strong> leverage ratios usually exceeding 5.0x and<br />

reaching up <strong>to</strong> 12.5x and 19.2x. However, according <strong>to</strong> the Court <strong>of</strong> Audi<strong>to</strong>rs’ report, 5 out <strong>of</strong> the 10 audited loan funds did<br />

not leverage any private funding at all, while the other loan funds showed very limited leverage ranging between 1.3x and<br />

1.7x (European Court <strong>of</strong> Audi<strong>to</strong>rs (2012), Financial instruments for SMEs – audit report, pgs. 39-40)<br />

Page | 32<br />

Revolving Instruments<br />

Tax Revenues<br />

FUNDS<br />

Target Projects<br />

MONEY REMAINS IN<br />

CIRCULATION