Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Malta Business Bureau – <str<strong>on</strong>g>Market</str<strong>on</strong>g> gaps in access <strong>to</strong> finance<br />

April 2013<br />

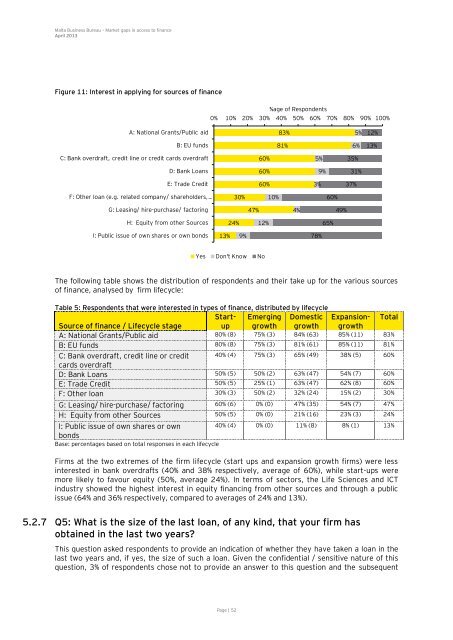

Figure 11: Interest in applying for sources <strong>of</strong> finance<br />

A: Nati<strong>on</strong>al Grants/Public aid<br />

The following table shows the distributi<strong>on</strong> <strong>of</strong> resp<strong>on</strong>dents and their take up for the various sources<br />

<strong>of</strong> finance, analysed by firm lifecycle:<br />

Table 5: Resp<strong>on</strong>dents that were interested in types <strong>of</strong> finance, distributed by lifecycle<br />

Start- Emerging Domestic Expansi<strong>on</strong>- Total<br />

Source <strong>of</strong> finance / Lifecycle stage<br />

up growth growth growth<br />

A: Nati<strong>on</strong>al Grants/Public aid 80% (8) 75% (3) 84% (63) 85% (11) 83%<br />

B: EU funds 80% (8) 75% (3) 81% (61) 85% (11) 81%<br />

C: <strong>Bank</strong> overdraft, credit line or credit<br />

cards overdraft<br />

40% (4) 75% (3) 65% (49) 38% (5) 60%<br />

D: <strong>Bank</strong> Loans 50% (5) 50% (2) 63% (47) 54% (7) 60%<br />

E: Trade Credit 50% (5) 25% (1) 63% (47) 62% (8) 60%<br />

F: Other loan 30% (3) 50% (2) 32% (24) 15% (2) 30%<br />

G: Leasing/ hire-purchase/ fac<strong>to</strong>ring 60% (6) 0% (0) 47% (35) 54% (7) 47%<br />

H: Equity from other Sources 50% (5) 0% (0) 21% (16) 23% (3) 24%<br />

I: Public issue <strong>of</strong> own shares or own<br />

b<strong>on</strong>ds<br />

B: EU funds<br />

C: <strong>Bank</strong> overdraft, credit line or credit cards overdraft<br />

D: <strong>Bank</strong> Loans<br />

E: Trade Credit<br />

F: Other loan (e.g. related company/ shareholders, …<br />

G: Leasing/ hire-purchase/ fac<strong>to</strong>ring<br />

H: Equity from other Sources<br />

I: Public issue <strong>of</strong> own shares or own b<strong>on</strong>ds<br />

Base: percentages based <strong>on</strong> <strong>to</strong>tal resp<strong>on</strong>ses in each lifecycle<br />

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%<br />

40% (4) 0% (0) 11% (8) 8% (1) 13%<br />

Firms at the two extremes <strong>of</strong> the firm lifecycle (start ups and expansi<strong>on</strong> growth firms) were less<br />

interested in bank overdrafts (40% and 38% respectively, average <strong>of</strong> 60%), while start-ups were<br />

more likely <strong>to</strong> favour equity (50%, average 24%). In terms <strong>of</strong> sec<strong>to</strong>rs, the Life Sciences and ICT<br />

industry showed the highest interest in equity financing from other sources and through a public<br />

issue (64% and 36% respectively, compared <strong>to</strong> averages <strong>of</strong> 24% and 13%).<br />

5.2.7 Q5: What is the size <strong>of</strong> the last loan, <strong>of</strong> any kind, that your firm has<br />

obtained in the last two years?<br />

13%<br />

This questi<strong>on</strong> asked resp<strong>on</strong>dents <strong>to</strong> provide an indicati<strong>on</strong> <strong>of</strong> whether they have taken a loan in the<br />

last two years and, if yes, the size <strong>of</strong> such a loan. Given the c<strong>on</strong>fidential / sensitive nature <strong>of</strong> this<br />

questi<strong>on</strong>, 3% <strong>of</strong> resp<strong>on</strong>dents chose not <strong>to</strong> provide an answer <strong>to</strong> this questi<strong>on</strong> and the subsequent<br />

24%<br />

Page | 52<br />

30%<br />

9%<br />

47%<br />

60%<br />

60%<br />

60%<br />

12%<br />

Yes D<strong>on</strong>'t Know No<br />

%age <strong>of</strong> Resp<strong>on</strong>dents<br />

10%<br />

83%<br />

81%<br />

4%<br />

5%<br />

3%<br />

78%<br />

9%<br />

60%<br />

65%<br />

49%<br />

5%<br />

6%<br />

35%<br />

31%<br />

37%<br />

12%<br />

13%