Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

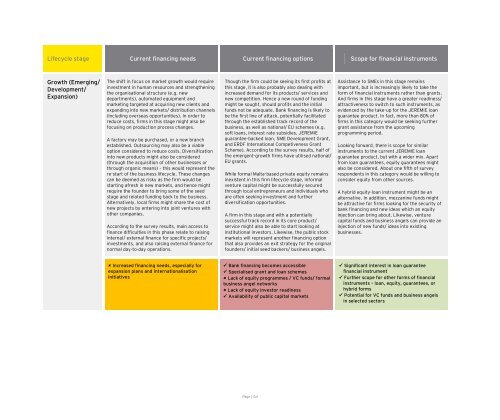

Lifecycle stage Current financing needs Current financing opti<strong>on</strong>s Scope for financial instruments<br />

Growth (Emerging/<br />

Development/<br />

Expansi<strong>on</strong>)<br />

The shift in focus <strong>on</strong> market growth would require<br />

investment in human resources and strengthening<br />

the organisati<strong>on</strong>al structure (e.g. new<br />

departments), au<strong>to</strong>mated equipment and<br />

marketing targeted at acquiring new clients and<br />

expanding in<strong>to</strong> new markets/ distributi<strong>on</strong> channels<br />

(including overseas opportunities). In order <strong>to</strong><br />

reduce costs, firms in this stage might also be<br />

focusing <strong>on</strong> producti<strong>on</strong> process changes.<br />

A fac<strong>to</strong>ry may be purchased, or a new branch<br />

established. Outsourcing may also be a viable<br />

opti<strong>on</strong> c<strong>on</strong>sidered <strong>to</strong> reduce costs. Diversificati<strong>on</strong><br />

in<strong>to</strong> new products might also be c<strong>on</strong>sidered<br />

(through the acquisiti<strong>on</strong> <strong>of</strong> other businesses or<br />

through organic means) – this would represent the<br />

re-start <strong>of</strong> the business lifecycle. These changes<br />

can be deemed as risky as the firm would be<br />

starting afresh in new markets, and hence might<br />

require the founder <strong>to</strong> bring some <strong>of</strong> the seed<br />

stage and related funding back <strong>to</strong> the business.<br />

Alternatively, local firms might share the cost <strong>of</strong><br />

new projects by entering in<strong>to</strong> joint ventures with<br />

other companies.<br />

According <strong>to</strong> the survey results, main access <strong>to</strong><br />

finance difficulties in this phase relate <strong>to</strong> raising<br />

internal/ external finance for specific projects/<br />

investments, and also raising external finance for<br />

normal day-<strong>to</strong>-day operati<strong>on</strong>s.<br />

Increased financing needs, especially for<br />

expansi<strong>on</strong> plans and internati<strong>on</strong>alisati<strong>on</strong><br />

initiatives<br />

Though the firm could be seeing its first pr<strong>of</strong>its at<br />

this stage, it is also probably also dealing with<br />

increased demand for its products/ services and<br />

new competiti<strong>on</strong>. Hence a new round <strong>of</strong> funding<br />

might be sought, should pr<strong>of</strong>its and the initial<br />

funds not be adequate. <strong>Bank</strong> financing is likely <strong>to</strong><br />

be the first line <strong>of</strong> attack, potentially facilitated<br />

through the established track record <strong>of</strong> the<br />

business, as well as nati<strong>on</strong>al/ EU schemes (e.g.<br />

s<strong>of</strong>t loans, interest rate subsidies, JEREMIE<br />

guarantee-backed loan, SME Development Grant,<br />

and ERDF Internati<strong>on</strong>al Competiveness Grant<br />

Scheme). According <strong>to</strong> the survey results, half <strong>of</strong><br />

the emergent-growth firms have utilised nati<strong>on</strong>al/<br />

EU grants.<br />

While formal Malta-based private equity remains<br />

inexistent in this firm lifecycle stage, informal<br />

venture capital might be successfully secured<br />

through local entrepreneurs and individuals who<br />

are <strong>of</strong>ten seeking investment and further<br />

diversificati<strong>on</strong> opportunities.<br />

A firm in this stage and with a potentially<br />

successful track record in its core product/<br />

service might also be able <strong>to</strong> start looking at<br />

instituti<strong>on</strong>al inves<strong>to</strong>rs. Likewise, the public s<strong>to</strong>ck<br />

markets will represent another financing opti<strong>on</strong><br />

that also provides an exit strategy for the original<br />

founders/ initial seed backers/ business angels.<br />

<strong>Bank</strong> financing becomes accessible<br />

Specialised grant and loan schemes<br />

Lack <strong>of</strong> equity programmes / VC funds/ formal<br />

business angel networks<br />

Lack <strong>of</strong> equity inves<strong>to</strong>r readiness<br />

Availability <strong>of</strong> public capital markets<br />

Page | 64<br />

Assistance <strong>to</strong> SMEs in this stage remains<br />

important, but is increasingly likely <strong>to</strong> take the<br />

form <strong>of</strong> financial instruments rather than grants.<br />

And firms in this stage have a greater readiness/<br />

attractiveness <strong>to</strong> switch <strong>to</strong> such instruments, as<br />

evidenced by the take-up for the JEREMIE loan<br />

guarantee product. In fact, more than 80% <strong>of</strong><br />

firms in this category would be seeking further<br />

grant assistance from the upcoming<br />

programming period.<br />

Looking forward, there is scope for similar<br />

instruments <strong>to</strong> the current JEREMIE loan<br />

guarantee product, but with a wider mix. Apart<br />

from loan guarantees, equity guarantees might<br />

also be c<strong>on</strong>sidered. About <strong>on</strong>e fifth <strong>of</strong> survey<br />

resp<strong>on</strong>dents in this category would be willing <strong>to</strong><br />

c<strong>on</strong>sider equity from other sources.<br />

A hybrid equity-loan instrument might be an<br />

alternative. In additi<strong>on</strong>, mezzanine funds might<br />

be attractive for firms looking for the security <strong>of</strong><br />

bank financing and new ideas which an equity<br />

injecti<strong>on</strong> can bring about. Likewise, venture<br />

capital funds and business angels can provide an<br />

injecti<strong>on</strong> <strong>of</strong> new funds/ ideas in<strong>to</strong> existing<br />

businesses.<br />

Significant interest in loan guarantee<br />

financial instrument<br />

Further scope for other forms <strong>of</strong> financial<br />

instruments – loan, equity, guarantees, or<br />

hybrid forms<br />

Potential for VC funds and business angels<br />

in selected sec<strong>to</strong>rs