Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

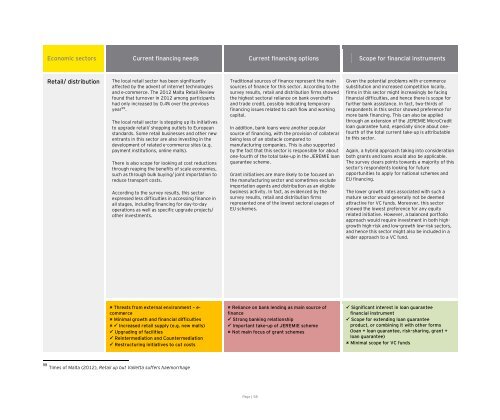

Ec<strong>on</strong>omic sec<strong>to</strong>rs Current financing needs Current financing opti<strong>on</strong>s Scope for financial instruments<br />

Retail/ distributi<strong>on</strong><br />

The local retail sec<strong>to</strong>r has been significantly<br />

affected by the advent <strong>of</strong> internet technologies<br />

and e-commerce. The 2012 Malta Retail Review<br />

found that turnover in 2012 am<strong>on</strong>g participants<br />

had <strong>on</strong>ly increased by 0.4% over the previous<br />

year 99 .<br />

The local retail sec<strong>to</strong>r is stepping up its initiatives<br />

<strong>to</strong> upgrade retail/ shopping outlets <strong>to</strong> European<br />

standards. Some retail businesses and other new<br />

entrants in this sec<strong>to</strong>r are also investing in the<br />

development <strong>of</strong> related e-commerce sites (e.g.<br />

payment instituti<strong>on</strong>s, <strong>on</strong>line malls).<br />

There is also scope for looking at cost reducti<strong>on</strong>s<br />

through reaping the benefits <strong>of</strong> scale ec<strong>on</strong>omies,<br />

such as through bulk buying/ joint importati<strong>on</strong> <strong>to</strong><br />

reduce transport costs.<br />

According <strong>to</strong> the survey results, this sec<strong>to</strong>r<br />

expressed less difficulties in accessing finance in<br />

all stages, including financing for day-<strong>to</strong>-day<br />

operati<strong>on</strong>s as well as specific upgrade projects/<br />

other investments.<br />

Threats from external envir<strong>on</strong>ment – ecommerce<br />

Minimal growth and financial difficulties<br />

Increased retail supply (e.g. new malls)<br />

Upgrading <strong>of</strong> facilities<br />

Reintermediati<strong>on</strong> and Countermediati<strong>on</strong><br />

Restructuring initiatives <strong>to</strong> cut costs<br />

99 Times <strong>of</strong> Malta (2012), Retail up but <strong>Valletta</strong> suffers haemorrhage<br />

Traditi<strong>on</strong>al sources <strong>of</strong> finance represent the main<br />

sources <strong>of</strong> finance for this sec<strong>to</strong>r. According <strong>to</strong> the<br />

survey results, retail and distributi<strong>on</strong> firms showed<br />

the highest sec<strong>to</strong>ral reliance <strong>on</strong> bank overdrafts<br />

and trade credit, possibly indicating temporary<br />

financing issues related <strong>to</strong> cash flow and working<br />

capital.<br />

In additi<strong>on</strong>, bank loans were another popular<br />

source <strong>of</strong> financing, with the provisi<strong>on</strong> <strong>of</strong> collateral<br />

being less <strong>of</strong> an obstacle compared <strong>to</strong><br />

manufacturing companies. This is also supported<br />

by the fact that this sec<strong>to</strong>r is resp<strong>on</strong>sible for about<br />

<strong>on</strong>e-fourth <strong>of</strong> the <strong>to</strong>tal take-up in the JEREMIE loan<br />

guarantee scheme.<br />

Grant initiatives are more likely <strong>to</strong> be focused <strong>on</strong><br />

the manufacturing sec<strong>to</strong>r and sometimes exclude<br />

importati<strong>on</strong> agents and distributi<strong>on</strong> as an eligible<br />

business activity. In fact, as evidenced by the<br />

survey results, retail and distributi<strong>on</strong> firms<br />

represented <strong>on</strong>e <strong>of</strong> the lowest sec<strong>to</strong>ral usages <strong>of</strong><br />

EU schemes.<br />

Reliance <strong>on</strong> bank lending as main source <strong>of</strong><br />

finance<br />

Str<strong>on</strong>g banking relati<strong>on</strong>ship<br />

Important take-up <strong>of</strong> JEREMIE scheme<br />

Not main focus <strong>of</strong> grant schemes<br />

Page | 58<br />

Given the potential problems with e-commerce<br />

substituti<strong>on</strong> and increased competiti<strong>on</strong> locally,<br />

firms in this sec<strong>to</strong>r might increasingly be facing<br />

financial difficulties, and hence there is scope for<br />

further bank assistance. In fact, two-thirds <strong>of</strong><br />

resp<strong>on</strong>dents in this sec<strong>to</strong>r showed preference for<br />

more bank financing. This can also be applied<br />

through an extensi<strong>on</strong> <strong>of</strong> the JEREMIE MicroCredit<br />

loan guarantee fund, especially since about <strong>on</strong>efourth<br />

<strong>of</strong> the <strong>to</strong>tal current take-up is attributable<br />

<strong>to</strong> this sec<strong>to</strong>r.<br />

Again, a hybrid approach taking in<strong>to</strong> c<strong>on</strong>siderati<strong>on</strong><br />

both grants and loans would also be applicable.<br />

The survey clears points <strong>to</strong>wards a majority <strong>of</strong> this<br />

sec<strong>to</strong>r’s resp<strong>on</strong>dents looking for future<br />

opportunities <strong>to</strong> apply for nati<strong>on</strong>al schemes and<br />

EU financing.<br />

The lower growth rates associated with such a<br />

mature sec<strong>to</strong>r would generally not be deemed<br />

attractive for VC funds. Moreover, this sec<strong>to</strong>r<br />

showed the lowest preference for any equity<br />

related initiative. However, a balanced portfolio<br />

approach would require investment in both highgrowth<br />

high-risk and low-growth low-risk sec<strong>to</strong>rs,<br />

and hence this sec<strong>to</strong>r might also be included in a<br />

wider approach <strong>to</strong> a VC fund.<br />

Significant interest in loan guarantee<br />

financial instrument<br />

Scope for extending loan guarantee<br />

product, or combining it with other forms<br />

(loan + loan guarantee, risk-sharing, grant +<br />

loan guarantee)<br />

Minimal scope for VC funds