Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

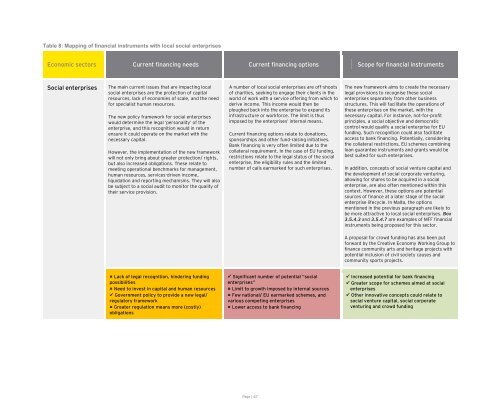

Table 8: Mapping <strong>of</strong> financial instruments with local social enterprises<br />

Ec<strong>on</strong>omic sec<strong>to</strong>rs Current financing needs Current financing opti<strong>on</strong>s Scope for financial instruments<br />

Social enterprises<br />

The main current issues that are impacting local<br />

social enterprises are the protecti<strong>on</strong> <strong>of</strong> capital<br />

resources, lack <strong>of</strong> ec<strong>on</strong>omies <strong>of</strong> scale, and the need<br />

for specialist human resources.<br />

The new policy framework for social enterprises<br />

would determine the legal ‘pers<strong>on</strong>ality’ <strong>of</strong> the<br />

enterprise, and this recogniti<strong>on</strong> would in return<br />

ensure it could operate <strong>on</strong> the market with the<br />

necessary capital.<br />

However, the implementati<strong>on</strong> <strong>of</strong> the new framework<br />

will not <strong>on</strong>ly bring about greater protecti<strong>on</strong>/ rights,<br />

but also increased obligati<strong>on</strong>s. These relate <strong>to</strong><br />

meeting operati<strong>on</strong>al benchmarks for management,<br />

human resources, services-driven income,<br />

liquidati<strong>on</strong> and reporting mechanisms. They will also<br />

be subject <strong>to</strong> a social audit <strong>to</strong> m<strong>on</strong>i<strong>to</strong>r the quality <strong>of</strong><br />

their service provisi<strong>on</strong>.<br />

Lack <strong>of</strong> legal recogniti<strong>on</strong>, hindering funding<br />

possibilities<br />

Need <strong>to</strong> invest in capital and human resources<br />

Government policy <strong>to</strong> provide a new legal/<br />

regula<strong>to</strong>ry framework<br />

Greater regulati<strong>on</strong> means more (costly)<br />

obligati<strong>on</strong>s<br />

A number <strong>of</strong> local social enterprises are <strong>of</strong>f-shoots<br />

<strong>of</strong> charities, seeking <strong>to</strong> engage their clients in the<br />

world <strong>of</strong> work with a service <strong>of</strong>fering from which <strong>to</strong><br />

derive income. This income would then be<br />

ploughed back in<strong>to</strong> the enterprise <strong>to</strong> expand its<br />

infrastructure or workforce. The limit is thus<br />

imposed by the enterprises’ internal means.<br />

Current financing opti<strong>on</strong>s relate <strong>to</strong> d<strong>on</strong>ati<strong>on</strong>s,<br />

sp<strong>on</strong>sorships and other fund-raising initiatives.<br />

<strong>Bank</strong> financing is very <strong>of</strong>ten limited due <strong>to</strong> the<br />

collateral requirement. In the case <strong>of</strong> EU funding,<br />

restricti<strong>on</strong>s relate <strong>to</strong> the legal status <strong>of</strong> the social<br />

enterprise, the eligibility rules and the limited<br />

number <strong>of</strong> calls earmarked for such enterprises.<br />

Significant number <strong>of</strong> potential “social<br />

enterprises”<br />

Limit <strong>to</strong> growth imposed by internal sources<br />

Few nati<strong>on</strong>al/ EU earmarked schemes, and<br />

various competing enterprises<br />

Lower access <strong>to</strong> bank financing<br />

Page | 67<br />

The new framework aims <strong>to</strong> create the necessary<br />

legal provisi<strong>on</strong>s <strong>to</strong> recognise these social<br />

enterprises separately from other business<br />

structures. This will facilitate the operati<strong>on</strong>s <strong>of</strong><br />

these enterprises <strong>on</strong> the market, with the<br />

necessary capital. For instance, not-for-pr<strong>of</strong>it<br />

principles, a social objective and democratic<br />

c<strong>on</strong>trol would qualify a social enterprise for EU<br />

funding. Such recogniti<strong>on</strong> could also facilitate<br />

access <strong>to</strong> bank financing. Potentially, c<strong>on</strong>sidering<br />

the collateral restricti<strong>on</strong>s, EU schemes combining<br />

loan guarantee instruments and grants would be<br />

best suited for such enterprises.<br />

In additi<strong>on</strong>, c<strong>on</strong>cepts <strong>of</strong> social venture capital and<br />

the development <strong>of</strong> social corporate venturing,<br />

allowing for shares <strong>to</strong> be acquired in a social<br />

enterprise, are also <strong>of</strong>ten menti<strong>on</strong>ed within this<br />

c<strong>on</strong>text. However, these opti<strong>on</strong>s are potential<br />

sources <strong>of</strong> finance at a later stage <strong>of</strong> the social<br />

enterprise lifecycle. In Malta, the opti<strong>on</strong>s<br />

menti<strong>on</strong>ed in the previous paragraph are likely <strong>to</strong><br />

be more attractive <strong>to</strong> local social enterprises. Box<br />

3.5.4.3 and 3.5.4.7 are examples <strong>of</strong> MFF financial<br />

instruments being proposed for this sec<strong>to</strong>r.<br />

A proposal for crowd funding has also been put<br />

forward by the Creative Ec<strong>on</strong>omy Working Group <strong>to</strong><br />

finance community arts and heritage projects with<br />

potential inclusi<strong>on</strong> <strong>of</strong> civil society causes and<br />

community sports projects.<br />

Increased potential for bank financing<br />

Greater scope for schemes aimed at social<br />

enterprises<br />

Other innovative c<strong>on</strong>cepts could relate <strong>to</strong><br />

social venture capital, social corporate<br />

venturing and crowd funding