Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

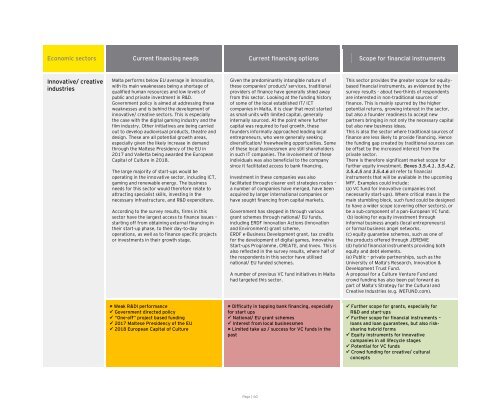

Ec<strong>on</strong>omic sec<strong>to</strong>rs Current financing needs Current financing opti<strong>on</strong>s Scope for financial instruments<br />

Innovative/ creative<br />

industries<br />

Malta performs below EU average in innovati<strong>on</strong>,<br />

with its main weaknesses being a shortage <strong>of</strong><br />

qualified human resources and low levels <strong>of</strong><br />

public and private investment in R&D.<br />

Government policy is aimed at addressing these<br />

weaknesses and is behind the development <strong>of</strong><br />

innovative/ creative sec<strong>to</strong>rs. This is especially<br />

the case with the digital gaming industry and the<br />

film industry. Other initiatives are being carried<br />

out <strong>to</strong> develop audiovisual products, theatre and<br />

design. These are all potential growth areas,<br />

especially given the likely increase in demand<br />

through the Maltese Presidency <strong>of</strong> the EU in<br />

2017 and <strong>Valletta</strong> being awarded the European<br />

Capital <strong>of</strong> Culture in 2018.<br />

The large majority <strong>of</strong> start-ups would be<br />

operating in the innovative sec<strong>to</strong>r, including ICT,<br />

gaming and renewable energy. The business<br />

needs for this sec<strong>to</strong>r would therefore relate <strong>to</strong><br />

attracting specialist skills, investing in the<br />

necessary infrastructure, and R&D expenditure.<br />

According <strong>to</strong> the survey results, firms in this<br />

sec<strong>to</strong>r have the largest access <strong>to</strong> finance issues –<br />

starting <strong>of</strong>f from obtaining external financing in<br />

their start-up phase, <strong>to</strong> their day-<strong>to</strong>-day<br />

operati<strong>on</strong>s, as well as <strong>to</strong> finance specific projects<br />

or investments in their growth stage.<br />

Weak R&DI performance<br />

Government directed policy<br />

“One-<strong>of</strong>f” project based funding<br />

2017 Maltese Presidency <strong>of</strong> the EU<br />

2018 European Capital <strong>of</strong> Culture<br />

Given the predominantly intangible nature <strong>of</strong><br />

these companies’ product/ services, traditi<strong>on</strong>al<br />

providers <strong>of</strong> finance have generally shied away<br />

from this sec<strong>to</strong>r. Looking at the funding his<strong>to</strong>ry<br />

<strong>of</strong> some <strong>of</strong> the local established IT/ ICT<br />

companies in Malta, it is clear that most started<br />

as small units with limited capital, generally<br />

internally sourced. At the point where further<br />

capital was required <strong>to</strong> fuel growth, these<br />

founders informally approached leading local<br />

entrepreneurs, who were generally seeking<br />

diversificati<strong>on</strong>/ freewheeling opportunities. Some<br />

<strong>of</strong> these local businessmen are still shareholders<br />

in such IT companies. The involvement <strong>of</strong> these<br />

individuals was also beneficial <strong>to</strong> the company<br />

since it facilitated access <strong>to</strong> bank financing.<br />

Investment in these companies was also<br />

facilitated through clearer exit strategies routes –<br />

a number <strong>of</strong> companies have merged, have been<br />

acquired by larger internati<strong>on</strong>al companies or<br />

have sought financing from capital markets.<br />

Government has stepped in through various<br />

grant schemes through nati<strong>on</strong>al/ EU funds,<br />

including ERDF Innovati<strong>on</strong> Acti<strong>on</strong>s (Innovati<strong>on</strong><br />

and Envir<strong>on</strong>ment) grant scheme,<br />

ERDF e-Business Development grant, tax credits<br />

for the development <strong>of</strong> digital games, Innovative<br />

Start-ups Programme, CREATE, and Invex. This is<br />

also reflected in the survey results, where half <strong>of</strong><br />

the resp<strong>on</strong>dents in this sec<strong>to</strong>r have utilised<br />

nati<strong>on</strong>al/ EU funded schemes.<br />

A number <strong>of</strong> previous VC fund initiatives in Malta<br />

had targeted this sec<strong>to</strong>r.<br />

Difficulty in tapping bank financing, especially<br />

for start ups<br />

Nati<strong>on</strong>al/ EU grant schemes<br />

Interest from local businessmen<br />

Limited take up / success for VC funds in the<br />

past<br />

Page | 60<br />

This sec<strong>to</strong>r provides the greater scope for equitybased<br />

financial instruments, as evidenced by the<br />

survey results - about two-thirds <strong>of</strong> resp<strong>on</strong>dents<br />

are interested in n<strong>on</strong>-traditi<strong>on</strong>al sources <strong>of</strong><br />

finance. This is mainly spurred by the higher<br />

potential returns, growing interest in the sec<strong>to</strong>r,<br />

but also a founder readiness <strong>to</strong> accept new<br />

partners bringing in not <strong>on</strong>ly the necessary capital<br />

but also new business ideas.<br />

This is also the sec<strong>to</strong>r where traditi<strong>on</strong>al sources <strong>of</strong><br />

finance are less likely <strong>to</strong> provide financing. Hence<br />

the funding gap created by traditi<strong>on</strong>al sources can<br />

be <strong>of</strong>fset by the increased interest from the<br />

private sec<strong>to</strong>r.<br />

There is therefore significant market scope for<br />

further equity investment. Boxes 3.5.4.1, 3.5.4.2,<br />

3.5.4.5 and 3.5.4.6 all refer <strong>to</strong> financial<br />

instruments that will be available in the upcoming<br />

MFF. Examples could include:<br />

(a) VC fund for innovative companies (not<br />

necessarily start-ups). Where critical mass is the<br />

main stumbling block, such fund could be designed<br />

<strong>to</strong> have a wider scope (covering other sec<strong>to</strong>rs), or<br />

be a sub-comp<strong>on</strong>ent <strong>of</strong> a pan-European VC fund.<br />

(b) looking for equity investment through<br />

informal business angels (local entrepreneurs)<br />

or formal business angel networks.<br />

(c) equity guarantee schemes, such as <strong>on</strong>e <strong>of</strong><br />

the products <strong>of</strong>fered through JEREMIE<br />

(d) hybrid financial instruments providing both<br />

equity and debt elements.<br />

(e) Public – private partnerships, such as the<br />

University <strong>of</strong> Malta’s Research, Innovati<strong>on</strong> &<br />

Development Trust Fund.<br />

A proposal for a Culture Venture Fund and<br />

crowd funding has also been put forward as<br />

part <strong>of</strong> Malta’s Strategy for the Cultural and<br />

Creative Industries (e.g. WEFUND.com).<br />

Further scope for grants, especially for<br />

R&D and start-ups<br />

Further scope for financial instruments –<br />

loans and loan guarantees, but also risksharing<br />

hybrid forms<br />

Equity instruments for innovative<br />

companies in all lifecycle stages<br />

Potential for VC funds<br />

Crowd funding for creative/ cultural<br />

c<strong>on</strong>cepts