Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Malta Business Bureau – <str<strong>on</strong>g>Market</str<strong>on</strong>g> gaps in access <strong>to</strong> finance<br />

April 2013<br />

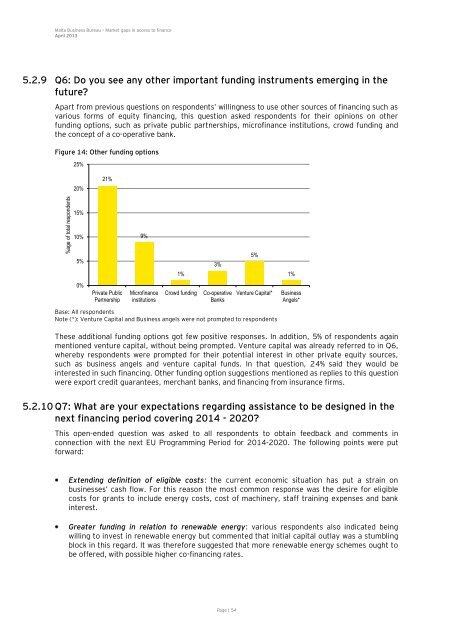

5.2.9 Q6: Do you see any other important funding instruments emerging in the<br />

future?<br />

Apart from previous questi<strong>on</strong>s <strong>on</strong> resp<strong>on</strong>dents’ willingness <strong>to</strong> use other sources <strong>of</strong> financing such as<br />

various forms <strong>of</strong> equity financing, this questi<strong>on</strong> asked resp<strong>on</strong>dents for their opini<strong>on</strong>s <strong>on</strong> other<br />

funding opti<strong>on</strong>s, such as private public partnerships, micr<strong>of</strong>inance instituti<strong>on</strong>s, crowd funding and<br />

the c<strong>on</strong>cept <strong>of</strong> a co-operative bank.<br />

Figure 14: Other funding opti<strong>on</strong>s<br />

%age <strong>of</strong> <strong>to</strong>tal resp<strong>on</strong>dents<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

0%<br />

21%<br />

Private Public<br />

Partnership<br />

9%<br />

Micr<strong>of</strong>inance<br />

instituti<strong>on</strong>s<br />

Base: All resp<strong>on</strong>dents<br />

Note (*): Venture Capital and Business angels were not prompted <strong>to</strong> resp<strong>on</strong>dents<br />

1%<br />

These additi<strong>on</strong>al funding opti<strong>on</strong>s got few positive resp<strong>on</strong>ses. In additi<strong>on</strong>, 5% <strong>of</strong> resp<strong>on</strong>dents again<br />

menti<strong>on</strong>ed venture capital, without being prompted. Venture capital was already referred <strong>to</strong> in Q6,<br />

whereby resp<strong>on</strong>dents were prompted for their potential interest in other private equity sources,<br />

such as business angels and venture capital funds. In that questi<strong>on</strong>, 24% said they would be<br />

interested in such financing. Other funding opti<strong>on</strong> suggesti<strong>on</strong>s menti<strong>on</strong>ed as replies <strong>to</strong> this questi<strong>on</strong><br />

were export credit guarantees, merchant banks, and financing from insurance firms.<br />

5.2.10 Q7: What are your expectati<strong>on</strong>s regarding assistance <strong>to</strong> be designed in the<br />

next financing period covering 2014 - 2020?<br />

3%<br />

Crowd funding Co-operative<br />

<strong>Bank</strong>s<br />

This open-ended questi<strong>on</strong> was asked <strong>to</strong> all resp<strong>on</strong>dents <strong>to</strong> obtain feedback and comments in<br />

c<strong>on</strong>necti<strong>on</strong> with the next EU Programming Period for 2014-2020. The following points were put<br />

forward:<br />

Extending definiti<strong>on</strong> <strong>of</strong> eligible costs: the current ec<strong>on</strong>omic situati<strong>on</strong> has put a strain <strong>on</strong><br />

businesses’ cash flow. For this reas<strong>on</strong> the most comm<strong>on</strong> resp<strong>on</strong>se was the desire for eligible<br />

costs for grants <strong>to</strong> include energy costs, cost <strong>of</strong> machinery, staff training expenses and bank<br />

interest.<br />

Greater funding in relati<strong>on</strong> <strong>to</strong> renewable energy: various resp<strong>on</strong>dents also indicated being<br />

willing <strong>to</strong> invest in renewable energy but commented that initial capital outlay was a stumbling<br />

block in this regard. It was therefore suggested that more renewable energy schemes ought <strong>to</strong><br />

be <strong>of</strong>fered, with possible higher co-financing rates.<br />

Page | 54<br />

5%<br />

1%<br />

Venture Capital* Business<br />

Angels*