Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

Market Gaps on Access to Finance - Bank of Valletta

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

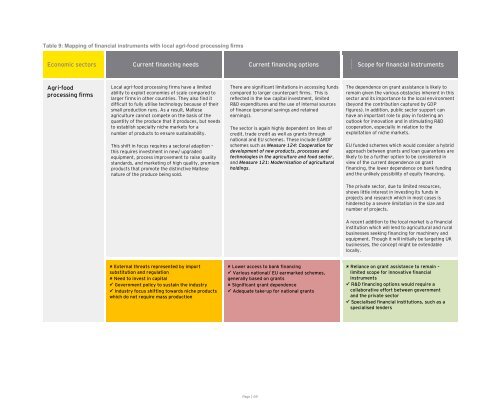

Table 9: Mapping <strong>of</strong> financial instruments with local agri-food processing firms<br />

Ec<strong>on</strong>omic sec<strong>to</strong>rs Current financing needs Current financing opti<strong>on</strong>s Scope for financial instruments<br />

Agri-food<br />

processing firms<br />

Local agri-food processing firms have a limited<br />

ability <strong>to</strong> exploit ec<strong>on</strong>omies <strong>of</strong> scale compared <strong>to</strong><br />

larger firms in other countries. They also find it<br />

difficult <strong>to</strong> fully utilise technology because <strong>of</strong> their<br />

small producti<strong>on</strong> runs. As a result, Maltese<br />

agriculture cannot compete <strong>on</strong> the basis <strong>of</strong> the<br />

quantity <strong>of</strong> the produce that it produces, but needs<br />

<strong>to</strong> establish specialty niche markets for a<br />

number <strong>of</strong> products <strong>to</strong> ensure sustainability.<br />

This shift in focus requires a sec<strong>to</strong>ral adapti<strong>on</strong> –<br />

this requires investment in new/ upgraded<br />

equipment, process improvement <strong>to</strong> raise quality<br />

standards, and marketing <strong>of</strong> high quality, premium<br />

products that promote the distinctive Maltese<br />

nature <strong>of</strong> the produce being sold.<br />

External threats represented by import<br />

substituti<strong>on</strong> and regulati<strong>on</strong><br />

Need <strong>to</strong> invest in capital<br />

Government policy <strong>to</strong> sustain the industry<br />

Industry focus shifting <strong>to</strong>wards niche products<br />

which do not require mass producti<strong>on</strong><br />

There are significant limitati<strong>on</strong>s in accessing funds<br />

compared <strong>to</strong> larger counterpart firms. This is<br />

reflected in the low capital investment, limited<br />

R&D expenditures and the use <strong>of</strong> internal sources<br />

<strong>of</strong> finance (pers<strong>on</strong>al savings and retained<br />

earnings).<br />

The sec<strong>to</strong>r is again highly dependent <strong>on</strong> lines <strong>of</strong><br />

credit, trade credit as well as grants through<br />

nati<strong>on</strong>al and EU schemes. These include EARDF<br />

schemes such as Measure 124: Cooperati<strong>on</strong> for<br />

development <strong>of</strong> new products, processes and<br />

technologies in the agriculture and food sec<strong>to</strong>r,<br />

and Measure 121: Modernisati<strong>on</strong> <strong>of</strong> agricultural<br />

holdings.<br />

Lower access <strong>to</strong> bank financing<br />

Various nati<strong>on</strong>al/ EU earmarked schemes,<br />

generally based <strong>on</strong> grants<br />

Significant grant dependence<br />

Adequate take-up for nati<strong>on</strong>al grants<br />

Page | 69<br />

The dependence <strong>on</strong> grant assistance is likely <strong>to</strong><br />

remain given the various obstacles inherent in this<br />

sec<strong>to</strong>r and its importance <strong>to</strong> the local envir<strong>on</strong>ment<br />

(bey<strong>on</strong>d the c<strong>on</strong>tributi<strong>on</strong> captured by GDP<br />

figures). In additi<strong>on</strong>, public sec<strong>to</strong>r support can<br />

have an important role <strong>to</strong> play in fostering an<br />

outlook for innovati<strong>on</strong> and in stimulating R&D<br />

cooperati<strong>on</strong>, especially in relati<strong>on</strong> <strong>to</strong> the<br />

exploitati<strong>on</strong> <strong>of</strong> niche markets.<br />

EU funded schemes which would c<strong>on</strong>sider a hybrid<br />

approach between grants and loan guarantees are<br />

likely <strong>to</strong> be a further opti<strong>on</strong> <strong>to</strong> be c<strong>on</strong>sidered in<br />

view <strong>of</strong> the current dependence <strong>on</strong> grant<br />

financing, the lower dependence <strong>on</strong> bank funding<br />

and the unlikely possibility <strong>of</strong> equity financing.<br />

The private sec<strong>to</strong>r, due <strong>to</strong> limited resources,<br />

shows little interest in investing its funds in<br />

projects and research which in most cases is<br />

hindered by a severe limitati<strong>on</strong> in the size and<br />

number <strong>of</strong> projects.<br />

A recent additi<strong>on</strong> <strong>to</strong> the local market is a financial<br />

instituti<strong>on</strong> which will lend <strong>to</strong> agricultural and rural<br />

businesses seeking financing for machinery and<br />

equipment. Though it will initially be targeting UK<br />

businesses, the c<strong>on</strong>cept might be extendable<br />

locally.<br />

Reliance <strong>on</strong> grant assistance <strong>to</strong> remain –<br />

limited scope for innovative financial<br />

instruments<br />

R&D financing opti<strong>on</strong>s would require a<br />

collaborative effort between government<br />

and the private sec<strong>to</strong>r<br />

Specialised financial instituti<strong>on</strong>s, such as a<br />

specialised lenders