Telkom AR front.qxp

Telkom AR front.qxp

Telkom AR front.qxp

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

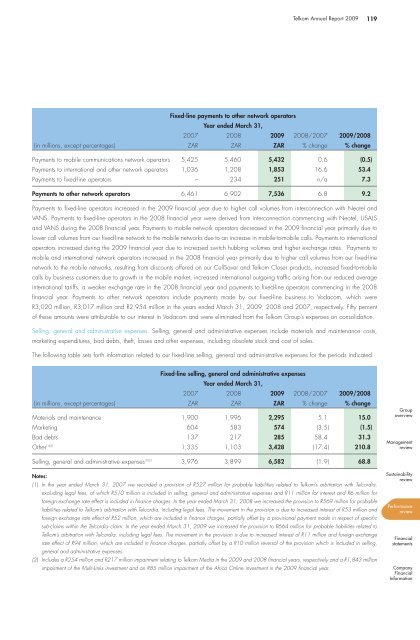

Fixed-line payments to other network operators<br />

Year ended March 31,<br />

<strong>Telkom</strong> Annual Report 2009 119<br />

2007 2008 2009 2008/2007 2009/2008<br />

(in millions, except percentages) Z<strong>AR</strong> Z<strong>AR</strong> Z<strong>AR</strong> % change % change<br />

Payments to mobile communications network operators 5,425 5,460 5,432 0.6 (0.5)<br />

Payments to international and other network operators 1,036 1,208 1,853 16.6 53.4<br />

Payments to fixed-line operators – 234 251 n/a 7.3<br />

Payments to other network operators 6,461 6,902 7,536 6.8 9.2<br />

Payments to fixed-line operators increased in the 2009 financial year due to higher call volumes from interconnection with Neotel and<br />

VANS. Payments to fixed-line operators in the 2008 financial year were derived from interconnection commencing with Neotel, USALS<br />

and VANS during the 2008 financial year. Payments to mobile network operators decreased in the 2009 financial year primarily due to<br />

lower call volumes from our fixed-line network to the mobile networks due to an increase in mobile-to-mobile calls. Payments to international<br />

operators increased during the 2009 financial year due to increased switch hubbing volumes and higher exchange rates. Payments to<br />

mobile and international network operators increased in the 2008 financial year primarily due to higher call volumes from our fixed-line<br />

network to the mobile networks, resulting from discounts offered on our CellSaver and <strong>Telkom</strong> Closer products, increased fixed-to-mobile<br />

calls by business customers due to growth in the mobile market, increased international outgoing traffic arising from our reduced average<br />

international tariffs, a weaker exchange rate in the 2008 financial year and payments to fixed-line operators commencing in the 2008<br />

financial year. Payments to other network operators include payments made by our fixed-line business to Vodacom, which were<br />

R3,020 million, R3,017 million and R2,954 million in the years ended March 31, 2009, 2008 and 2007, respectively. Fifty percent<br />

of these amounts were attributable to our interest in Vodacom and were eliminated from the <strong>Telkom</strong> Group’s expenses on consolidation.<br />

Selling, general and administrative expenses. Selling, general and administrative expenses include materials and maintenance costs,<br />

marketing expenditures, bad debts, theft, losses and other expenses, including obsolete stock and cost of sales.<br />

The following table sets forth information related to our fixed-line selling, general and administrative expenses for the periods indicated.<br />

Fixed-line selling, general and administrative expenses<br />

Year ended March 31,<br />

2007 2008 2009 2008/2007 2009/2008<br />

(in millions, except percentages) Z<strong>AR</strong> Z<strong>AR</strong> Z<strong>AR</strong> % change % change<br />

Materials and maintenance 1,900 1,996 2,295 5.1 15.0<br />

Marketing 604 583 574 (3.5) (1.5)<br />

Bad debts 137 217 285 58.4 31.3<br />

Other (1)(2) 1,335 1,103 3,428 (17.4) 210.8<br />

Selling, general and administrative expenses (1)(2) 3,976 3,899 6,582 (1.9) 68.8<br />

Notes:<br />

(1) In the year ended March 31, 2007 we recorded a provision of R527 million for probable liabilities related to <strong>Telkom</strong>’s arbitration with Telcordia,<br />

excluding legal fees, of which R510 million is included in selling, general and administrative expenses and R11 million for interest and R6 million for<br />

foreign exchange rate effect is included in finance charges. In the year ended March 31, 2008 we increased the provision to R569 million for probable<br />

liabilities related to <strong>Telkom</strong>’s arbitration with Telcordia, including legal fees. The movement in the provision is due to increased interest of R53 million and<br />

foreign exchange rate effect of R52 million, which are included in finance charges, partially offset by a provisional payment made in respect of specific<br />

sub-claims within the Telcordia claim. In the year ended March 31, 2009 we increased the provision to R664 million for probable liabilities related to<br />

<strong>Telkom</strong>’s arbitration with Telcordia, including legal fees. The movement in the provision is due to increased interest of R11 million and foreign exchange<br />

rate effect of R94 million, which are included in finance charges, partially offset by a R10 million reversal of the provision which is included in selling,<br />

general and administrative expenses.<br />

(2) Includes a R254 million and R217 million impairment relating to <strong>Telkom</strong> Media in the 2009 and 2008 financial years, respectively and a R1,843 million<br />

impairment of the Multi-Links investment and an R85 million impairment of the Africa Online investment in the 2009 financial year.<br />

Group<br />

overview<br />

Management<br />

review<br />

Sustainability<br />

review<br />

Performance<br />

review<br />

Financial<br />

statements<br />

Company<br />

Financial<br />

Information