Telkom AR front.qxp

Telkom AR front.qxp

Telkom AR front.qxp

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

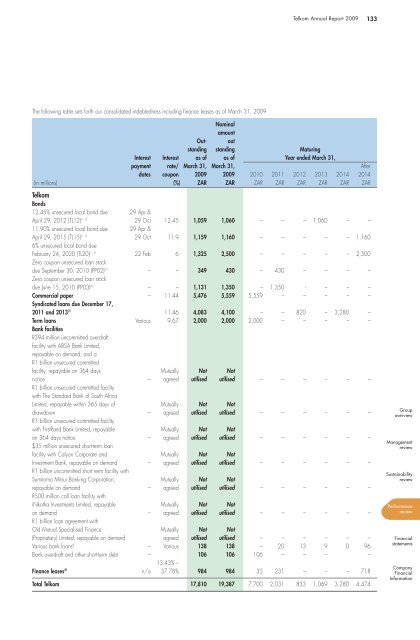

The following table sets forth our consolidated indebtedness including finance leases as of March 31, 2009<br />

<strong>Telkom</strong> Annual Report 2009 133<br />

Nominal<br />

amount<br />

Out- out<br />

standing standing Maturing<br />

Interest Interest as of as of Year ended March 31,<br />

payment rate/ March 31, March 31, After<br />

dates coupon 2009 2009 2010 2011 2012 2013 2014 2014<br />

(in millions) (%) Z<strong>AR</strong> Z<strong>AR</strong> Z<strong>AR</strong> Z<strong>AR</strong> Z<strong>AR</strong> Z<strong>AR</strong> Z<strong>AR</strong> Z<strong>AR</strong><br />

<strong>Telkom</strong><br />

Bonds<br />

12.45% unsecured local bond due 29 Apr &<br />

April 29, 2012 (TL12) (1, 2) 29 Oct 12.45 1,059 1,060 – – – 1,060 – –<br />

11.90% unsecured local bond due 29 Apr &<br />

April 29, 2015 (TL15) (1, 3) 29 Oct 11.9 1,159 1,160 – – – – – 1,160<br />

6% unsecured local bond due<br />

February 24, 2020 (TL20) (1, 4) 22 Feb 6 1,325 2,500 – – – – – 2,500<br />

Zero coupon unsecured loan stock<br />

due September 30, 2010 (PP02) (5) – – 349 430 – 430 – – – –<br />

Zero coupon unsecured loan stock<br />

due June 15, 2010 (PP03) (6) – – 1,131 1,350 – 1,350 - – – –<br />

Commercial paper – 11.44 5,476 5,559 5,559 – – – – –<br />

Syndicated loans due December 17,<br />

2011 and 2013 (7) 11.46 4,083 4,100 – – 820 – 3,280 –<br />

Term loans Various 9.67 2,000 2,000 2,000 – – – – –<br />

Bank facilities<br />

R394 million uncommitted overdraft<br />

facility with ABSA Bank Limited,<br />

repayable on demand, and a<br />

R1 billion unsecured committed<br />

facility, repayable on 364 days Mutually Not Not<br />

notice – agreed utilised utilised – – – – – –<br />

R1 billion unsecured committed facility<br />

with The Standard Bank of South Africa<br />

Limited, repayable within 365 days of Mutually Not Not<br />

drawdown – agreed utilised utilised – – – – – –<br />

R1 billion unsecured committed facility<br />

with FirstRand Bank Limited, repayable Mutually Not Not<br />

on 364 days notice – agreed utilised utilised – – – – – –<br />

$35 million unsecured short-term loan<br />

facility with Calyon Corporate and Mutually Not Not<br />

Investment Bank, repayable on demand – agreed utilised utilised – – – – – –<br />

R1 billion uncommitted short term facility with<br />

Sumitomo Mitsui Banking Corporation, Mutually Not Not<br />

repayable on demand – agreed utilised utilised – – – – – –<br />

R500 million call loan facility with<br />

iNkotha Investments Limited, repayable Mutually Not Not<br />

on demand – agreed utilised utilised – – – – – –<br />

R1 billion loan agreement with<br />

Old Mutual Specialised Finance Mutually Not Not<br />

(Proprietary) Limited, repayable on demand agreed utilised utilised – – – – – –<br />

Various bank loans 8 – Various 138 138 – 20 13 9 0 96<br />

Bank overdraft and other short-term debt – 106 106 106 – – – –<br />

13.43% –<br />

Finance leases (9) n/a 37.78% 984 984 35 231 – – – 718<br />

Total <strong>Telkom</strong> 17,810 19,387 7,700 2,031 833 1,069 3,280 4,474<br />

Group<br />

overview<br />

Management<br />

review<br />

Sustainability<br />

review<br />

Performance<br />

review<br />

Financial<br />

statements<br />

Company<br />

Financial<br />

Information