Telkom AR front.qxp

Telkom AR front.qxp

Telkom AR front.qxp

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Telkom</strong> Annual Report 2009 197<br />

Notes to the consolidated annual financial statements (continued)<br />

for the three years ended March 31, 2009<br />

2007 2008 2009<br />

Rm Rm Rm<br />

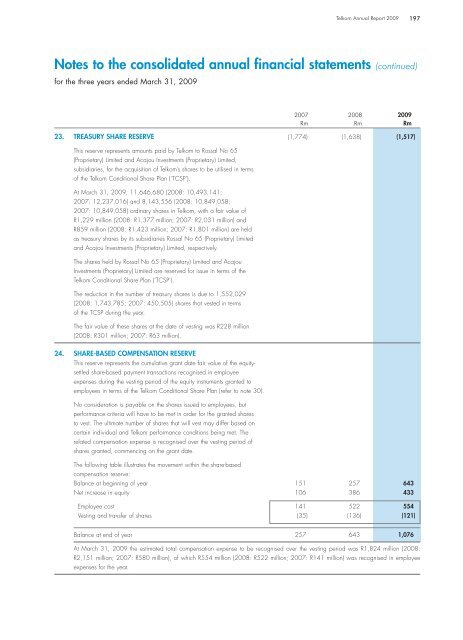

23. TREASURY SH<strong>AR</strong>E RESERVE (1,774) (1,638) (1,517)<br />

This reserve represents amounts paid by <strong>Telkom</strong> to Rossal No 65<br />

(Proprietary) Limited and Acajou Investments (Proprietary) Limited,<br />

subsidiaries, for the acquisition of <strong>Telkom</strong>’s shares to be utilised in terms<br />

of the <strong>Telkom</strong> Conditional Share Plan (’TCSP’).<br />

At March 31, 2009, 11,646,680 (2008: 10,493,141;<br />

2007: 12,237,016) and 8,143,556 (2008: 10,849,058;<br />

2007: 10,849,058) ordinary shares in <strong>Telkom</strong>, with a fair value of<br />

R1,229 million (2008: R1,377 million; 2007: R2,031 million) and<br />

R859 million (2008: R1,423 million; 2007: R1,801 million) are held<br />

as treasury shares by its subsidiaries Rossal No 65 (Proprietary) Limited<br />

and Acajou Investments (Proprietary) Limited, respectively.<br />

The shares held by Rossal No 65 (Proprietary) Limited and Acajou<br />

Investments (Proprietary) Limited are reserved for issue in terms of the<br />

<strong>Telkom</strong> Conditional Share Plan (’TCSP’).<br />

The reduction in the number of treasury shares is due to 1,552,029<br />

(2008: 1,743,785; 2007: 450,505) shares that vested in terms<br />

of the TCSP during the year.<br />

The fair value of these shares at the date of vesting was R228 million<br />

(2008: R301 million; 2007: R63 million).<br />

24. SH<strong>AR</strong>E-BASED COMPENSATION RESERVE<br />

This reserve represents the cumulative grant date fair value of the equitysettled<br />

share-based payment transactions recognised in employee<br />

expenses during the vesting period of the equity instruments granted to<br />

employees in terms of the <strong>Telkom</strong> Conditional Share Plan (refer to note 30).<br />

No consideration is payable on the shares issued to employees, but<br />

performance criteria will have to be met in order for the granted shares<br />

to vest. The ultimate number of shares that will vest may differ based on<br />

certain individual and <strong>Telkom</strong> performance conditions being met. The<br />

related compensation expense is recognised over the vesting period of<br />

shares granted, commencing on the grant date.<br />

The following table illustrates the movement within the share-based<br />

compensation reserve:<br />

Balance at beginning of year 151 257 643<br />

Net increase in equity 106 386 433<br />

Employee cost 141 522 554<br />

Vesting and transfer of shares (35) (136) (121)<br />

Balance at end of year 257 643 1,076<br />

At March 31, 2009 the estimated total compensation expense to be recognised over the vesting period was R1,824 million (2008:<br />

R2,151 million; 2007: R580 million), of which R554 million (2008: R522 million; 2007: R141 million) was recognised in employee<br />

expenses for the year.