- Page 1 and 2:

We are... one of Africa’s largest

- Page 3 and 4:

Telkom shareholding as at March 31,

- Page 5 and 6:

Grow profitable revenue through wir

- Page 7 and 8:

600 500 400 300 200 100 0 07 08 09

- Page 9 and 10:

The telecommunications industry Con

- Page 11 and 12:

egulation that stipulated standard

- Page 13 and 14:

a - Euros a - Euros a - Euros 0.25

- Page 15 and 16:

ated management team with experienc

- Page 17 and 18:

The regulatory environment The regu

- Page 19 and 20:

On target for 2010 Telkom Annual Re

- Page 21 and 22:

Online impairments, the fixed-line

- Page 23 and 24:

• Remodelling - reaching for new

- Page 25 and 26:

in this annual report has been upda

- Page 27 and 28:

Capital expenditure for the Group i

- Page 29 and 30:

More than100 years of combined tele

- Page 31 and 32:

Management team Telkom Annual Repor

- Page 33 and 34:

Telkom Annual Report 2009 33 Age at

- Page 35 and 36:

uild a partnership with communities

- Page 37 and 38:

Customers: Through our Customer Cen

- Page 39 and 40:

• Interfacing with the media Whil

- Page 41 and 42:

Partnering with Human Resources Gro

- Page 43 and 44:

The members’ resignations and app

- Page 45 and 46:

Share dealings In line with JSE Lis

- Page 47 and 48:

NYSE rules Telkom practice Telkom A

- Page 49 and 50:

the codes of conduct and ethics tha

- Page 51 and 52:

Telkom Annual Report 2009 51 Enterp

- Page 53 and 54:

provider, we practice a risk manage

- Page 55 and 56:

egulate the business of dealers in

- Page 57 and 58:

addressing a number of significant

- Page 59 and 60:

There was a major Over the past dec

- Page 61 and 62:

payment policy that facilitates the

- Page 63 and 64:

Headcount movement Compensation and

- Page 65 and 66:

• Accelerated development of wome

- Page 67 and 68:

14,500 union members participated i

- Page 69 and 70:

were admitted to the university in

- Page 71 and 72:

ole in exposing students to the rea

- Page 73 and 74:

Sick leave indices • We saved R2

- Page 75 and 76:

These will be augmented by another

- Page 77 and 78:

Some of the key deliverables are:

- Page 79 and 80:

Fittingly, the initiative was launc

- Page 81 and 82:

Sponsorships Sponsorships continue

- Page 83 and 84:

Item Comment and reference Governan

- Page 85 and 86:

espond to competitive challenges Pe

- Page 87 and 88:

Operational review History and deve

- Page 89 and 90:

service. All costs including instal

- Page 91 and 92:

Traffic was adversely affected in b

- Page 93 and 94:

Telkom’s focus on bringing new in

- Page 95 and 96:

esponse of the CDMA operators to ou

- Page 97 and 98:

MWEB Africa On April 21, 2009, we a

- Page 99 and 100:

VPN model that allows other service

- Page 101 and 102:

services and also to support Telkom

- Page 103 and 104:

Telkom’s fixed-line voice busines

- Page 105 and 106:

Results of operations The Telkom Gr

- Page 107 and 108:

EBITDA can be reconciled to operati

- Page 109 and 110:

Telkom Annual Report 2009 109 Finan

- Page 111 and 112:

Fixed-line operating revenue increa

- Page 113 and 114:

The following table sets forth info

- Page 115 and 116:

Interconnection revenue Year ended

- Page 117 and 118:

Telkom Annual Report 2009 117 Fixed

- Page 119 and 120:

Fixed-line payments to other networ

- Page 121 and 122:

Service fees increased in the year

- Page 123 and 124:

Vodacom’s operating revenue from

- Page 125 and 126:

our fixed-line business, which were

- Page 127 and 128:

Vodacom’s selling, general and ad

- Page 129 and 130:

The increase in other operating rev

- Page 131 and 132:

commercial paper bills, as well as

- Page 133 and 134:

The following table sets forth our

- Page 135:

challeng Consolidated financial sta

- Page 138 and 139:

138 Telkom Annual Report 2009

- Page 140 and 141:

140 Telkom Annual Report 2009 Direc

- Page 142 and 143:

142 Telkom Annual Report 2009 Conso

- Page 144 and 145:

144 Telkom Annual Report 2009 Conso

- Page 146 and 147:

146 Telkom Annual Report 2009 Notes

- Page 148 and 149:

148 Telkom Annual Report 2009 Notes

- Page 150 and 151:

150 Telkom Annual Report 2009 Notes

- Page 152 and 153:

152 Telkom Annual Report 2009 Notes

- Page 154 and 155:

154 Telkom Annual Report 2009 Notes

- Page 156 and 157:

156 Telkom Annual Report 2009 Notes

- Page 158 and 159:

158 Telkom Annual Report 2009 Notes

- Page 160 and 161:

160 Telkom Annual Report 2009 Notes

- Page 162 and 163:

162 Telkom Annual Report 2009 Notes

- Page 164 and 165:

164 Telkom Annual Report 2009 Notes

- Page 166 and 167:

166 Telkom Annual Report 2009 Notes

- Page 168 and 169:

168 Telkom Annual Report 2009 Notes

- Page 170 and 171:

170 Telkom Annual Report 2009 Notes

- Page 172 and 173:

172 Telkom Annual Report 2009 Notes

- Page 174 and 175:

174 Telkom Annual Report 2009 Notes

- Page 176 and 177:

176 Telkom Annual Report 2009 Notes

- Page 178 and 179:

178 Telkom Annual Report 2009 Notes

- Page 180 and 181:

180 Telkom Annual Report 2009 Notes

- Page 182 and 183:

182 Telkom Annual Report 2009 Notes

- Page 184 and 185:

184 Telkom Annual Report 2009 Notes

- Page 186 and 187:

186 Telkom Annual Report 2009 Notes

- Page 188 and 189:

188 Telkom Annual Report 2009 Notes

- Page 190 and 191:

190 Telkom Annual Report 2009 Notes

- Page 192 and 193:

192 Telkom Annual Report 2009 Notes

- Page 194 and 195:

194 Telkom Annual Report 2009 Notes

- Page 196 and 197:

196 Telkom Annual Report 2009 Notes

- Page 198 and 199:

198 Telkom Annual Report 2009 Notes

- Page 200 and 201:

200 Telkom Annual Report 2009 Notes

- Page 202 and 203:

202 Telkom Annual Report 2009 Notes

- Page 204 and 205:

204 Telkom Annual Report 2009 Notes

- Page 206 and 207:

206 Telkom Annual Report 2009 Notes

- Page 208 and 209:

208 Telkom Annual Report 2009 Notes

- Page 210 and 211:

210 Telkom Annual Report 2009 Notes

- Page 212 and 213:

212 Telkom Annual Report 2009 Notes

- Page 214 and 215:

214 Telkom Annual Report 2009 Notes

- Page 216 and 217:

216 Telkom Annual Report 2009 Notes

- Page 218 and 219:

218 Telkom Annual Report 2009 Notes

- Page 220 and 221:

220 Telkom Annual Report 2009 Notes

- Page 222 and 223:

222 Telkom Annual Report 2009 Notes

- Page 224 and 225:

224 Telkom Annual Report 2009 Notes

- Page 226 and 227:

226 Telkom Annual Report 2009 Notes

- Page 228 and 229:

228 Telkom Annual Report 2009 Notes

- Page 230 and 231:

230 Telkom Annual Report 2009 Notes

- Page 232 and 233:

232 Telkom Annual Report 2009 Notes

- Page 234 and 235:

234 Telkom Annual Report 2009 Notes

- Page 236 and 237: 236 Telkom Annual Report 2009 Notes

- Page 238 and 239: 238 Telkom Annual Report 2009 Notes

- Page 240 and 241: 240 Telkom Annual Report 2009 Notes

- Page 242 and 243: 242 Telkom Annual Report 2009 Notes

- Page 244 and 245: 244 Telkom Annual Report 2009 Notes

- Page 246 and 247: 246 Telkom Annual Report 2009 Notes

- Page 248 and 249: 248 Telkom Annual Report 2009 Notes

- Page 250 and 251: 250 Telkom Annual Report 2009 Compa

- Page 252 and 253: 252 Telkom Annual Report 2009 Compa

- Page 254 and 255: 254 Telkom Annual Report 2009 Notes

- Page 256 and 257: 256 Telkom Annual Report 2009 Notes

- Page 258 and 259: 258 Telkom Annual Report 2009 Notes

- Page 260 and 261: 260 Telkom Annual Report 2009 Notes

- Page 262 and 263: 262 Telkom Annual Report 2009 Notes

- Page 264 and 265: 264 Telkom Annual Report 2009 Notes

- Page 266 and 267: 266 Telkom Annual Report 2009 Notes

- Page 268 and 269: 268 Telkom Annual Report 2009 Notes

- Page 270 and 271: 270 Telkom Annual Report 2009 Notes

- Page 272 and 273: 272 Telkom Annual Report 2009 Notes

- Page 274 and 275: 274 Telkom Annual Report 2009 Notes

- Page 276 and 277: 276 Telkom Annual Report 2009 Notes

- Page 278 and 279: 278 Telkom Annual Report 2009 Notes

- Page 280 and 281: 280 Telkom Annual Report 2009 Notes

- Page 282 and 283: 282 Telkom Annual Report 2009 Notes

- Page 284 and 285: 284 Telkom Annual Report 2009 Notes

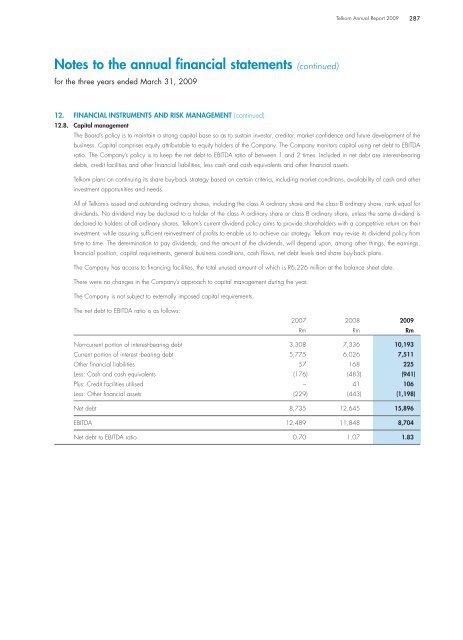

- Page 288 and 289: 288 Telkom Annual Report 2009 Notes

- Page 290 and 291: 290 Telkom Annual Report 2009 Notes

- Page 292 and 293: 292 Telkom Annual Report 2009 Notes

- Page 294 and 295: 294 Telkom Annual Report 2009 Notes

- Page 296 and 297: 296 Telkom Annual Report 2009 Notes

- Page 298 and 299: 298 Telkom Annual Report 2009 Notes

- Page 300 and 301: 300 Telkom Annual Report 2009 Notes

- Page 302 and 303: 302 Telkom Annual Report 2009 Notes

- Page 304 and 305: 304 Telkom Annual Report 2009 Notes

- Page 306 and 307: 306 Telkom Annual Report 2009 Notes

- Page 308 and 309: 308 Telkom Annual Report 2009 Notes

- Page 310 and 311: 310 Telkom Annual Report 2009 Notes

- Page 312 and 313: 312 Telkom Annual Report 2009 Notes

- Page 314 and 315: 314 Telkom Annual Report 2009 Notes

- Page 316 and 317: 316 Telkom Annual Report 2009 Notes

- Page 318 and 319: 318 Telkom Annual Report 2009 Notes

- Page 320 and 321: 320 Telkom Annual Report 2009 Notes

- Page 322 and 323: 322 Telkom Annual Report 2009 Notes

- Page 324 and 325: 324 Telkom Annual Report 2009 Notes

- Page 326 and 327: 326 Telkom Annual Report 2009 Notes

- Page 328 and 329: 328 Telkom Annual Report 2009 Notes

- Page 330 and 331: 330 Telkom Annual Report 2009 Notes

- Page 332 and 333: 332 Telkom Annual Report 2009 Notes

- Page 334 and 335: 334 Telkom Annual Report 2009 Notes

- Page 336 and 337:

336 Telkom Annual Report 2009 Notes

- Page 338 and 339:

338 Telkom Annual Report 2009 Share

- Page 340 and 341:

340 Telkom Annual Report 2009 Defin

- Page 342 and 343:

342 Telkom Annual Report 2009 Defin

- Page 344 and 345:

344 Telkom Annual Report 2009 Notic

- Page 346 and 347:

346 VOTING AND PROXIES Ordinary sha

- Page 348:

Notes Telkom Annual Report 2009 1.