Telkom AR front.qxp

Telkom AR front.qxp

Telkom AR front.qxp

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Telkom</strong> Annual Report 2009 243<br />

Notes to the consolidated annual financial statements (continued)<br />

for the three years ended March 31, 2009<br />

45. SUBSEQUENT EVENTS<br />

Dividends<br />

The <strong>Telkom</strong> Board declared an ordinary dividend of 115 cents (2008: 660 cents, 2007: 600 cents) per share and a special dividend<br />

of 260 cents (2008: Nil cents, 2007: 500 cents) per share on June 19, 2009, payable on July 20, 2009 to shareholders registered on<br />

July 17, 2009.<br />

Acquisition of MWEB Africa Limited and majority equity stake in MWEB Namibia (Proprietary) Limited<br />

On November 10, 2008, <strong>Telkom</strong> International (Proprietary) Limited, a wholly owned subsidiary of <strong>Telkom</strong>, announced it has entered into<br />

agreements to acquire 100% of MWEB Africa Limited ("MWEB Africa") and 75% of MWEB Namibia (Proprietary) Limited<br />

(“MWEB Namibia”). The purchase price for the MWEB Africa Group including AFSAT and MWEB Namibia is US$55 million<br />

(approximately R498 million) with a deferred payment of US$14.18 million due when the profits of MWEB Group for the year ended<br />

March 31, 2009 are finalised. These shareholdings will be acquired from Multichoice Africa Limited and MIH Holdings Limited<br />

respectively, which are members of the Naspers Limited Group.<br />

MWEB Africa is an internet services provider in sub-Saharan Africa (excluding South Africa) which also provides network access services<br />

in some countries and is headquartered in Mauritius with operations in Namibia, Nigeria, Kenya, Tanzania, Uganda and Zimbabwe, an<br />

agency arrangement in Botswana and distributors in 26 sub-Saharan African countries.<br />

The acquisition of MWEB is part of the Group’s strategy of growing its broadband and solidifying its market position through acquisitions.<br />

Based on an independent valuation, the MWEB Africa Group does not have any significant contingent liabilities at acquisition date.<br />

The only possible contingent liability, the AFSAT bonus scheme, is reasonably quantified and included in the balance sheet of MWEB Africa<br />

Group at March 31, 2009.<br />

The purchase price of US$69.168 million was determined as follows:<br />

• Namibian cash-generating unit for US$1.5 million;<br />

• Mauritian cash-generating unit for US$53.5 million; and<br />

• US$14.18 million deferred until the profits of the MWEB Group for the year ended March 31, 2009 are finalised.<br />

The successful conclusion of the agreements being entered into is subject to conditions precedent, including regulatory approvals being<br />

obtained in certain African jurisdictions.<br />

Subsequent to year end, on April 21, 2009, the conditions precedent to the sale were fulfilled.<br />

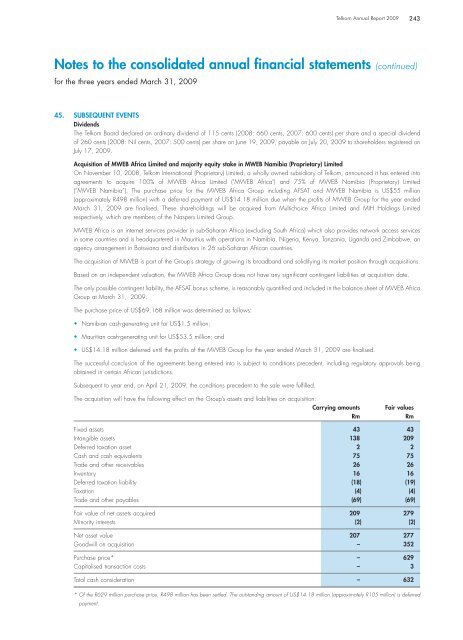

The acquisition will have the following effect on the Group’s assets and liabilities on acquisition:<br />

Carrying amounts Fair values<br />

Rm Rm<br />

Fixed assets 43 43<br />

Intangible assets 138 209<br />

Deferred taxation asset 2 2<br />

Cash and cash equivalents 75 75<br />

Trade and other receivables 26 26<br />

Inventory 16 16<br />

Deferred taxation liability (18) (19)<br />

Taxation (4) (4)<br />

Trade and other payables (69) (69)<br />

Fair value of net assets acquired 209 279<br />

Minority interests (2) (2)<br />

Net asset value 207 277<br />

Goodwill on acquisition – 352<br />

Purchase price* – 629<br />

Capitalised transaction costs – 3<br />

Total cash consideration – 632<br />

* Of the R629 million purchase price, R498 million has been settled. The outstanding amount of US$14.18 million (approximately R105 million) is deferred<br />

payment.