Telkom AR front.qxp

Telkom AR front.qxp

Telkom AR front.qxp

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

130<br />

<strong>Telkom</strong> Annual Report 2009<br />

Financial review (continued)<br />

Liquidity and capital resources<br />

Group liquidity and capital resources<br />

Cash flows<br />

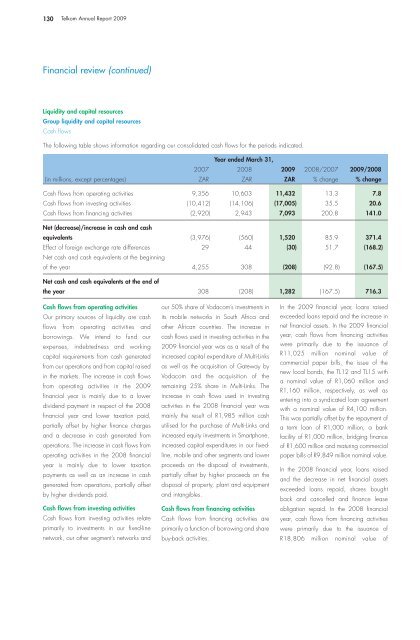

The following table shows information regarding our consolidated cash flows for the periods indicated.<br />

2007<br />

Year ended March 31,<br />

2008 2009 2008/2007 2009/2008<br />

(in millions, except percentages) Z<strong>AR</strong> Z<strong>AR</strong> Z<strong>AR</strong> % change % change<br />

Cash flows from operating activities 9,356 10,603 11,432 13.3 7.8<br />

Cash flows from investing activities (10,412) (14,106) (17,005) 35.5 20.6<br />

Cash flows from financing activities (2,920) 2,943 7,093 200.8 141.0<br />

Net (decrease)/increase in cash and cash<br />

equivalents (3,976) (560) 1,520 85.9 371.4<br />

Effect of foreign exchange rate differences<br />

Net cash and cash equivalents at the beginning<br />

29 44 (30) 51.7 (168.2)<br />

of the year 4,255 308 (208) (92.8) (167.5)<br />

Net cash and cash equivalents at the end of<br />

the year 308 (208) 1,282 (167.5) 716.3<br />

Cash flows from operating activities<br />

Our primary sources of liquidity are cash<br />

flows from operating activities and<br />

borrowings. We intend to fund our<br />

expenses, indebtedness and working<br />

capital requirements from cash generated<br />

from our operations and from capital raised<br />

in the markets. The increase in cash flows<br />

from operating activities in the 2009<br />

financial year is mainly due to a lower<br />

dividend payment in respect of the 2008<br />

financial year and lower taxation paid,<br />

partially offset by higher finance charges<br />

and a decrease in cash generated from<br />

operations. The increase in cash flows from<br />

operating activities in the 2008 financial<br />

year is mainly due to lower taxation<br />

payments as well as an increase in cash<br />

generated from operations, partially offset<br />

by higher dividends paid.<br />

Cash flows from investing activities<br />

Cash flows from investing activities relate<br />

primarily to investments in our fixed-line<br />

network, our other segment’s networks and<br />

our 50% share of Vodacom’s investments in<br />

its mobile networks in South Africa and<br />

other African countries. The increase in<br />

cash flows used in investing activities in the<br />

2009 financial year was as a result of the<br />

increased capital expenditure of Multi-Links<br />

as well as the acquisition of Gateway by<br />

Vodacom and the acquisition of the<br />

remaining 25% share in Multi-Links. The<br />

increase in cash flows used in investing<br />

activities in the 2008 financial year was<br />

mainly the result of R1,985 million cash<br />

utilised for the purchase of Multi-Links and<br />

increased equity investments in Smartphone,<br />

increased capital expenditures in our fixedline,<br />

mobile and other segments and lower<br />

proceeds on the disposal of investments,<br />

partially offset by higher proceeds on the<br />

disposal of property, plant and equipment<br />

and intangibles.<br />

Cash flows from financing activities<br />

Cash flows from financing activities are<br />

primarily a function of borrowing and share<br />

buy-back activities.<br />

In the 2009 financial year, loans raised<br />

exceeded loans repaid and the increase in<br />

net financial assets. In the 2009 financial<br />

year, cash flows from financing activities<br />

were primarily due to the issuance of<br />

R11,025 million nominal value of<br />

commercial paper bills, the issue of the<br />

new local bonds, the TL12 and TL15 with<br />

a nominal value of R1,060 million and<br />

R1,160 million, respectively, as well as<br />

entering into a syndicated loan agreement<br />

with a nominal value of R4,100 million.<br />

This was partially offset by the repayment of<br />

a term loan of R1,000 million, a bank<br />

facility of R1,000 million, bridging finance<br />

of R1,600 million and maturing commercial<br />

paper bills of R9,849 million nominal value.<br />

In the 2008 financial year, loans raised<br />

and the decrease in net financial assets<br />

exceeded loans repaid, shares bought<br />

back and cancelled and finance lease<br />

obligation repaid. In the 2008 financial<br />

year, cash flows from financing activities<br />

were primarily due to the issuance of<br />

R18,806 million nominal value of