Telkom AR front.qxp

Telkom AR front.qxp

Telkom AR front.qxp

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

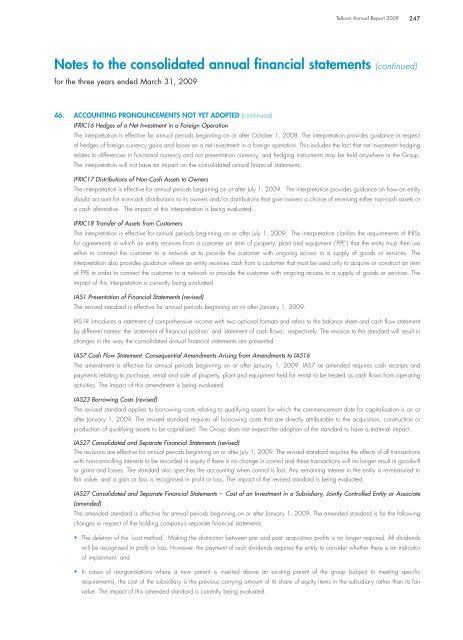

46. ACCOUNTING PRONOUNCEMENTS NOT YET ADOPTED (continued)<br />

IFRIC16 Hedges of a Net Investment in a Foreign Operation<br />

<strong>Telkom</strong> Annual Report 2009 247<br />

Notes to the consolidated annual financial statements (continued)<br />

for the three years ended March 31, 2009<br />

The interpretation is effective for annual periods beginning on or after October 1, 2008. The interpretation provides guidance in respect<br />

of hedges of foreign currency gains and losses on a net investment in a foreign operation. This includes the fact that net investment hedging<br />

relates to differences in functional currency and not presentation currency, and hedging instruments may be held anywhere in the Group.<br />

The interpretation will not have an impact on the consolidated annual financial statements.<br />

IFRIC17 Distributions of Non-Cash Assets to Owners<br />

The interpretation is effective for annual periods beginning on or after July 1, 2009. The interpretation provides guidance on how an entity<br />

should account for non-cash distributions to its owners and/or distributions that give owners a choice of receiving either non-cash assets or<br />

a cash alternative. The impact of this interpretation is being evaluated.<br />

IFRIC18 Transfer of Assets from Customers<br />

The interpretation is effective for annual periods beginning on or after July 1, 2009. The interpretation clarifies the requirements of IFRSs<br />

for agreements in which an entity receives from a customer an item of property, plant and equipment (’PPE’) that the entity must then use<br />

either to connect the customer to a network or to provide the customer with ongoing access to a supply of goods or services. The<br />

interpretation also provides guidance where an entity receives cash from a customer that must be used only to acquire or construct an item<br />

of PPE in order to connect the customer to a network or provide the customer with ongoing access to a supply of goods or services. The<br />

impact of this interpretation is currently being evaluated.<br />

IAS1 Presentation of Financial Statements (revised)<br />

The revised standard is effective for annual periods beginning on or after January 1, 2009.<br />

IAS1R introduces a statement of comprehensive income with two optional formats and refers to the balance sheet and cash flow statement<br />

by different names: the ’statement of financial position’ and ’statement of cash flows’, respectively. The revision to the standard will result in<br />

changes in the way the consolidated annual financial statements are presented.<br />

IAS7 Cash Flow Statement: Consequential Amendments Arising from Amendments to IAS16<br />

The amendment is effective for annual periods beginning on or after January 1, 2009. IAS7 as amended requires cash receipts and<br />

payments relating to purchase, rental and sale of property, plant and equipment held for rental to be treated as cash flows from operating<br />

activities. The impact of this amendment is being evaluated.<br />

IAS23 Borrowing Costs (revised)<br />

The revised standard applies to borrowing costs relating to qualifying assets for which the commencement date for capitalisation is on or<br />

after January 1, 2009. The revised standard requires all borrowing costs that are directly attributable to the acquisition, construction or<br />

production of qualifying assets to be capitalised. The Group does not expect the adoption of the standard to have a material impact.<br />

IAS27 Consolidated and Separate Financial Statements (revised)<br />

The revisions are effective for annual periods beginning on or after July 1, 2009. The revised standard requires the effects of all transactions<br />

with non-controlling interests to be recorded in equity if there is no change in control and these transactions will no longer result in goodwill<br />

or gains and losses. The standard also specifies the accounting when control is lost. Any remaining interest in the entity is re-measured to<br />

fair value, and a gain or loss is recognised in profit or loss. The impact of the revised standard is being evaluated.<br />

IAS27 Consolidated and Separate Financial Statements – Cost of an Investment in a Subsidiary, Jointly Controlled Entity or Associate<br />

(amended)<br />

The amended standard is effective for annual periods beginning on or after January 1, 2009. The amended standard is for the following<br />

changes in respect of the holding company’s separate financial statements:<br />

• The deletion of the ’cost method’. Making the distinction between pre- and post- acquisition profits is no longer required. All dividends<br />

will be recognised in profit or loss. However, the payment of such dividends requires the entity to consider whether there is an indicator<br />

of impairment; and<br />

• In cases of reorganisations where a new parent is inserted above an existing parent of the group (subject to meeting specific<br />

requirements), the cost of the subsidiary is the previous carrying amount of its share of equity items in the subsidiary rather than its fair<br />

value. The impact of this amended standard is currently being evaluated.