SENATE - Louisiana

SENATE - Louisiana

SENATE - Louisiana

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

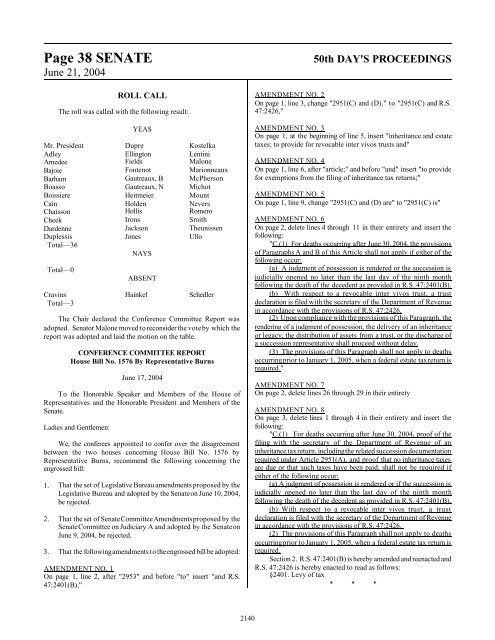

Page 38 <strong>SENATE</strong><br />

June 21, 2004<br />

ROLL CALL<br />

The roll was called with the following result:<br />

YEAS<br />

Mr. President Dupre Kostelka<br />

Adley Ellington Lentini<br />

Amedee Fields Malone<br />

Bajoie Fontenot Marionneaux<br />

Barham Gautreaux, B McPherson<br />

Boasso Gautreaux, N Michot<br />

Boissiere Heitmeier Mount<br />

Cain Holden Nevers<br />

Chaisson Hollis Romero<br />

Cheek Irons Smith<br />

Dardenne Jackson Theunissen<br />

Duplessis Jones Ullo<br />

Total—36<br />

NAYS<br />

Total—0<br />

ABSENT<br />

Cravins Hainkel Schedler<br />

Total—3<br />

The Chair declared the Conference Committee Report was<br />

adopted. Senator Malone moved to reconsider the vote by which the<br />

report was adopted and laid the motion on the table.<br />

CONFERENCE COMMITTEE REPORT<br />

House Bill No. 1576 By Representative Burns<br />

June 17, 2004<br />

To the Honorable Speaker and Members of the House of<br />

Representatives and the Honorable President and Members of the<br />

Senate.<br />

Ladies and Gentlemen:<br />

We, the conferees appointed to confer over the disagreement<br />

between the two houses concerning House Bill No. 1576 by<br />

Representative Burns, recommend the following concerning the<br />

engrossed bill:<br />

1. That the set of Legislative Bureau amendments proposed by the<br />

Legislative Bureau and adopted by the Senate on June 10, 2004,<br />

be rejected.<br />

2. That the set of Senate Committee Amendments proposed by the<br />

Senate Committee on Judiciary A and adopted by the Senate on<br />

June 9, 2004, be rejected.<br />

3. That the following amendments to the engrossed bill be adopted:<br />

AMENDMENT NO. 1<br />

On page 1, line 2, after "2953" and before "to" insert "and R.S.<br />

47:2401(B),"<br />

50th DAY'S PROCEEDINGS<br />

AMENDMENT NO. 2<br />

On page 1, line 3, change "2951(C) and (D)," to "2951(C) and R.S.<br />

47:2426,"<br />

AMENDMENT NO. 3<br />

On page 1, at the beginning of line 5, insert "inheritance and estate<br />

taxes; to provide for revocable inter vivos trusts and"<br />

AMENDMENT NO. 4<br />

On page 1, line 6, after "article;" and before "and" insert "to provide<br />

for exemptions from the filing of inheritance tax returns;"<br />

AMENDMENT NO. 5<br />

On page 1, line 9, change "2951(C) and (D) are" to "2951(C) is"<br />

AMENDMENT NO. 6<br />

On page 2, delete lines 4 through 11 in their entirety and insert the<br />

following:<br />

"C.(1) For deaths occurring after June 30, 2004, the provisions<br />

of Paragraphs A and B of this Article shall not apply if either of the<br />

following occur:<br />

(a) A judgment of possession is rendered or the succession is<br />

judicially opened no later than the last day of the ninth month<br />

following the death of the decedent as provided in R.S. 47:2401(B).<br />

(b) With respect to a revocable inter vivos trust, a trust<br />

declaration is filed with the secretary of the Department of Revenue<br />

in accordance with the provisions of R.S. 47:2426.<br />

(2) Upon compliance with the provisions of this Paragraph, the<br />

rendering of a judgment of possession, the delivery of an inheritance<br />

or legacy, the distribution of assets from a trust, or the discharge of<br />

a succession representative shall proceed without delay.<br />

(3) The provisions of this Paragraph shall not apply to deaths<br />

occurring prior to January 1, 2005, when a federal estate tax return is<br />

required."<br />

AMENDMENT NO. 7<br />

On page 2, delete lines 26 through 29 in their entirety<br />

AMENDMENT NO. 8<br />

On page 3, delete lines 1 through 4 in their entirety and insert the<br />

following:<br />

"C.(1) For deaths occurring after June 30, 2004, proof of the<br />

filing with the secretary of the Department of Revenue of an<br />

inheritance tax return, including the related succession documentation<br />

required under Article 2951(A), and proof that no inheritance taxes<br />

are due or that such taxes have been paid, shall not be required if<br />

either of the following occur:<br />

(a) A judgment of possession is rendered or if the succession is<br />

judicially opened no later than the last day of the ninth month<br />

following the death of the decedent as provided in R.S. 47:2401(B).<br />

(b) With respect to a revocable inter vivos trust, a trust<br />

declaration is filed with the secretary of the Department of Revenue<br />

in accordance with the provisions of R.S. 47:2426.<br />

(2) The provisions of this Paragraph shall not apply to deaths<br />

occurring prior to January 1, 2005, when a federal estate tax return is<br />

required.<br />

Section 2. R.S. 47:2401(B) is hereby amended and reenacted and<br />

R.S. 47:2426 is hereby enacted to read as follows:<br />

§2401. Levy of tax<br />

* * *<br />

2140