FY 2011-12 Adopted Budget - City of Oviedo

FY 2011-12 Adopted Budget - City of Oviedo

FY 2011-12 Adopted Budget - City of Oviedo

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

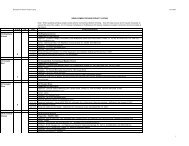

The following “budget highlights” provides a concise summary <strong>of</strong> the <strong>FY</strong> 11-<strong>12</strong> adopted budget:<br />

The General Fund property tax rate for <strong>FY</strong> 11-<strong>12</strong> is 4.8626 - the same tax rate since <strong>FY</strong> 08-09. The<br />

proposed millage rate is 7% lower than the rolled back tax rate <strong>of</strong> 5.222 mills. The tax rate for the General<br />

Obligation Bond <strong>of</strong> .3071 mills debt service is slightly higher due to the lower assessed taxable value<br />

against relatively stable debt service costs. The combined tax rate for <strong>FY</strong> 11-<strong>12</strong> is 5.1697 mills vs. 5.1536<br />

mills in <strong>FY</strong> 10-11.<br />

For the single family homeowner, the average reduction in <strong>City</strong> property taxes will be approximately $50.<br />

The property owner with a $175,000 home adjusted for the 1.5% Save Our Homes inflation adjustment<br />

and the $50,000 homestead exemption would pay approximately $16 more in CITY property taxes.<br />

Approximately one-third <strong>of</strong> residential property owners fall into this category.<br />

Excluding new construction <strong>of</strong> $30.2 million, the <strong>City</strong>’s tax base declined by $133 million or 7%, which<br />

was due to the decline in market values. Some <strong>of</strong> this decrease was <strong>of</strong>fset by the 1.5% Save Our Homes<br />

inflation adjustment for approximately half <strong>of</strong> all residential property owners.<br />

The total proposed General Fund budget is $23,353,462, which is $362,000 or 1.5% less than the <strong>FY</strong> 10-<br />

11 adopted budget <strong>of</strong> $23,715,047.<br />

General Fund operating revenues (excluding transfers and fund balance) are $627,000 or 2.9% lower<br />

than <strong>FY</strong> 10-11. Of this amount, $443,000 is due to lower property tax revenue and $184,000 is related to<br />

lower non-ad valorem revenues. Increased transfers from several funds that are used to <strong>of</strong>fset General<br />

Fund costs are higher by $272,000. The higher transfer amounts are found in the Water/Wastewater<br />

Operating Fund (+$200,000), Building Services Fund (+$28,000), Local Option Gas Tax Fund ($+25,000)<br />

and the Solid Waste Fund (+$30,000 - recycling revenue). The fund balance appropriation <strong>of</strong> $193,000 is<br />

$21,000 less than the amount appropriated in the <strong>FY</strong> 11 adopted budget.<br />

General Fund expenditures are $362,000 or 1.5% lower than <strong>FY</strong> 10-11. The major increases include<br />

higher <strong>City</strong> contributions for the Police and Fire pensions, a 2% wage adjustment for General Employees<br />

effective April 1, 20<strong>12</strong>, the addition <strong>of</strong> a temporary Planner to rewrite the Land Development Code, higher<br />

Fire Department overtime ($317,000 in <strong>FY</strong> 11 based on the adaptive response model vs. $375,000 with the<br />

3 full time firefighter “overhires”). The major decreases include the budget reduction measures outlined<br />

above, operating expense reductions <strong>of</strong> $131,000, the 5% decrease in health insurance premiums and other<br />

personnel cost reductions such as the elimination <strong>of</strong> a vacant Fire Inspector position, recalculation <strong>of</strong><br />

Police holiday pay and reallocation <strong>of</strong> engineering staff to the Stormwater Utility Fund.<br />

Excluding the impact <strong>of</strong> the Police Dispatch consolidation, the size <strong>of</strong> the <strong>City</strong> workforce for <strong>FY</strong> 11-<strong>12</strong><br />

with 266 authorized positions is essentially unchanged from the prior year. The workforce (both full time<br />

and seasonal) has been reduced by 70 positions since <strong>FY</strong> 06-07 and is at the same level for regular full<br />

time and part time positions as in <strong>FY</strong> 03-04.<br />

The <strong>FY</strong> 11-<strong>12</strong> total payroll (salaries and benefits) for all operating funds <strong>of</strong> $17,941,000 is $248,000 or<br />

1.4% less than the total adopted payroll for <strong>FY</strong> 10-11. The lower payroll includes the higher <strong>City</strong><br />

contributions for the Police and Fire pensions and higher Fire Department overtime and funding for a 2%<br />

wage increase for Police bargaining unit members and General Employees that would be granted at midyear.<br />

The total proposed budget for all <strong>City</strong> funds combined <strong>of</strong> $64.2 million (exclusive <strong>of</strong> inter-fund transfers<br />

and internal service operations) is $1.3 million or 2% less than the <strong>FY</strong> 10-11 total adopted budget. The<br />

decrease is due mainly to lower appropriations for capital improvements as projects reached completion in<br />

<strong>FY</strong> 10-11.<br />

The remaining portion <strong>of</strong> the transmittal letter presents more detailed analysis <strong>of</strong> the budget, including more<br />

detailed analysis <strong>of</strong> the tax base, General Fund revenues, expenditures and fund balance. Following the General<br />

Fund analysis are summary discussions about the <strong>City</strong>’s workforce and total payroll, the Water/Wastewater<br />

Operating Fund, the Capital Improvements Program and several other funds.<br />

iii