- Page 1 and 2:

City of Oviedo Annual Budget FY 201

- Page 3 and 4:

CITY OF OVIEDO ANNUAL BUDGET FOR TH

- Page 5 and 6:

TABLE OF CONTENTS ANNUAL BUDGET Pag

- Page 7 and 8:

Project Summary and Operating Budge

- Page 9 and 10:

The City of Oviedo Florida ________

- Page 11 and 12:

The following “budget highlights

- Page 13 and 14:

Property Taxes (General Fund) At th

- Page 15 and 16:

Debt Service and Lease Financing Su

- Page 17 and 18:

Cash Reserves (Utility Operating Fu

- Page 19 and 20:

1 City of Oviedo The City of Oviedo

- Page 21 and 22:

City of Oviedo Organizational Chart

- Page 23 and 24:

City of Oviedo Strategic Focus Area

- Page 25 and 26:

City of Oviedo Continue to up

- Page 27 and 28:

City of Oviedo Budget and Financial

- Page 29 and 30:

City of Budget Document Format Ovie

- Page 31 and 32:

City of Oviedo certain fixed/sem i-

- Page 33 and 34:

City of Oviedo Budget Development G

- Page 35 and 36:

City of Oviedo afford the City the

- Page 37 and 38:

City of Oviedo Interlocal agreement

- Page 39 and 40:

City of Oviedo Significant Budget A

- Page 41 and 42:

City of Oviedo operating revenues a

- Page 43 and 44:

City of Oviedo Fund Categories and

- Page 45 and 46:

TABLE OF CONTENTS BUDGET GRAPHICS P

- Page 47 and 48:

PROPERTY TAX RATE AND TAXABLE VALUE

- Page 49 and 50:

Gross Taxable Value Tax Year 2011 a

- Page 51 and 52:

FY 2011-12 City of Oviedo Property

- Page 53 and 54:

TOTAL BUDGET SUMMARY AND GRAPHICS B

- Page 55 and 56:

BUDGET COMPARISON BY APPROPRIATED F

- Page 57 and 58:

CITY OF OVIEDO, FLORIDA BUDGET SUMM

- Page 59 and 60:

City of Oviedo FUND BALANCE OVERVIE

- Page 61 and 62:

FUND BALANCE STATUS BY FUND (Unaudi

- Page 63 and 64:

POSITION AUTHORIZATION SUMMARY Auth

- Page 65 and 66:

POSITION AUTHORIZATION SUMMARY FY 0

- Page 67 and 68:

Composition of Personnel Costs: FY

- Page 69 and 70:

GENERAL FUND GRAPHICS OVERVIEW FY 2

- Page 71 and 72:

GENERAL FUND EXPENDITURE SUMMARY FY

- Page 73 and 74:

City of Oviedo REVENUE TRENDS OVERV

- Page 75 and 76:

REVENUE TRENDS MAJOR REVENUE SOURCE

- Page 77 and 78:

Trend↓ REVENUE TRENDS MAJOR REVEN

- Page 79 and 80:

REVENUE TRENDS MAJOR REVENUE SOURCE

- Page 81 and 82:

TABLE OF CONTENTS REVENUE AND EXPEN

- Page 83 and 84:

GENERAL FUND The General Fund accou

- Page 85 and 86:

General Fund Revenues (001) Beginni

- Page 87 and 88:

General Fund Revenues (001) 2008-09

- Page 89 and 90:

General Fund Expenses (001) 2008-09

- Page 91 and 92:

General Fund Expenses (001) 2008-09

- Page 93 and 94:

SPECIAL REVENUE FUNDS Special Reven

- Page 95 and 96:

Administrative Facilities Impact Fe

- Page 97 and 98:

Police Impact Fee Fund (107) Beginn

- Page 99 and 100:

Recreational Impact Fee Fund (109)

- Page 101 and 102:

Federal Law Enforcement Trust Fund

- Page 103 and 104:

Transportation Improvements Fund (1

- Page 105 and 106:

Economic Development Fund (116) Beg

- Page 107 and 108:

Stormwater Fund (138) (Note: In FY

- Page 109 and 110:

DEBT SERVICE FUNDS Debt Service Fun

- Page 111 and 112:

Public Improvement Revenue Bonds De

- Page 113 and 114:

General Obligation Bond Debt Servic

- Page 115 and 116:

Lease Financing Fund (205) 2008-09

- Page 117 and 118:

CAPITAL PROJECT FUNDS Capital Proje

- Page 119 and 120:

Vehicle/Equipment Replacement Fund

- Page 121 and 122:

Local Option Sales Tax Construction

- Page 123 and 124:

Technology Improvements Fund (320)

- Page 125 and 126:

General Facilities Improvements Fun

- Page 127 and 128:

Public Works/Fire Station Construct

- Page 129 and 130:

Recreation Facilities Improvements

- Page 131 and 132:

ENTERPRISE FUNDS Enterprise Funds a

- Page 133 and 134:

Water/Wastewater Operating Fund (40

- Page 135 and 136:

Water/Wastewater Operating (401) Fu

- Page 137 and 138:

Reclaimed Water System Construction

- Page 139 and 140:

Utility Revenue Bond/SRF Loan Sinki

- Page 141 and 142:

Water/Wastewater Renewal and Replac

- Page 143 and 144:

Water System Impact Fee Fund (408)

- Page 145 and 146:

Series 2007 Utility Construction Fu

- Page 147 and 148:

Series 2010B Utility Revenue Bonds

- Page 149 and 150:

INTERNAL SERVICE FUNDS Account for

- Page 151 and 152:

Medical Insurance Fund (510) 2008-0

- Page 153 and 154:

City of Oviedo Legislative & Execut

- Page 155 and 156:

TABLE OF CONTENTS LEGISLATIVE AND E

- Page 157 and 158:

EXPENDITURE AND STAFFING SUMMARY De

- Page 159 and 160:

EXPENDITURE AND STAFFING SUMMARY De

- Page 161 and 162:

EXPENDITURE AND STAFFING SUMMARY De

- Page 163 and 164:

EXPENDITURE AND STAFFING SUMMARY De

- Page 165 and 166:

LEGISLATIVE AND EXECUTIVE SERVICES

- Page 167 and 168:

CONSOLIDATED EXPENDITURE DETAIL Dep

- Page 169 and 170:

City of Oviedo General Government S

- Page 171 and 172:

TABLE OF CONTENTS GENERAL GOVERNMEN

- Page 173 and 174:

Performance Profile (continued) Ris

- Page 175 and 176:

EXPENDITURE AND STAFFING SUMMARY De

- Page 177 and 178:

EXPENDITURE AND STAFFING SUMMARY De

- Page 179 and 180:

EXPENDITURE AND STAFFING SUMMARY De

- Page 181 and 182:

EXPENDITURE AND STAFFING SUMMARY De

- Page 183 and 184:

Department Finance Program Utility

- Page 185 and 186:

PERFORMANCE PROFILE Department Fina

- Page 187 and 188:

PERFORMANCE PROFILE Department Info

- Page 189 and 190:

Geographic Information Systems Meas

- Page 191 and 192:

GENERAL GOVERNMENT SERVICES CONSOLI

- Page 193 and 194:

CONSOLIDATED EXPENDITURE AND STAFFI

- Page 195 and 196:

CONSOLIDATED EXPENDITURE DETAIL Dep

- Page 197 and 198:

City of Oviedo Development Services

- Page 199 and 200:

TABLE OF CONTENTS DEVELOPMENT SERVI

- Page 201 and 202:

EXPENDITURE AND STAFFING SUMMARY De

- Page 203 and 204:

EXPENDITURE AND STAFFING SUMMARY De

- Page 205 and 206:

EXPENDITURE AND STAFFING SUMMARY De

- Page 207 and 208:

EXPENDITURE AND STAFFING SUMMARY De

- Page 209 and 210:

EXPENDITURE AND STAFFING SUMMARY De

- Page 211 and 212:

EXPENDITURE AND STAFFING SUMMARY De

- Page 213 and 214:

DEVELOPMENT SERVICES CONSOLIDATED E

- Page 215 and 216:

2008-09 2009-10 2010-11 2010-11 201

- Page 217 and 218:

City of Oviedo Law Enforcement 198

- Page 219 and 220:

TABLE OF CONTENTS POLICE Page Numbe

- Page 221 and 222:

EXPENDITURE AND STAFFING SUMMARY De

- Page 223 and 224:

EXPENDITURE AND STAFFING SUMMARY De

- Page 225 and 226:

EXPENDITURE AND STAFFING SUMMARY De

- Page 227 and 228:

School Resource Officers FY 08-09 F

- Page 229 and 230:

PERFORMANCE PROFILE Department Poli

- Page 231 and 232:

PERFORMANCE PROFILE Department Poli

- Page 233 and 234:

PERFORMANCE PROFILE Department Poli

- Page 235 and 236:

POLICE DEPARTMENT CONSOLIDATED EXPE

- Page 237 and 238:

2008-09 2009-10 2010-11 2010-11 201

- Page 239 and 240:

City of Oviedo Fire Rescue Services

- Page 241 and 242:

TABLE OF CONTENTS FIRE RESCUE Page

- Page 243 and 244:

EXPENDITURE AND STAFFING SUMMARY De

- Page 245 and 246:

EXPENDITURE AND STAFFING SUMMARY De

- Page 247 and 248:

EXPENDITURE AND STAFFING SUMMARY De

- Page 249 and 250:

EXPENDITURE AND STAFFING SUMMARY De

- Page 251 and 252:

FIRE DEPARTMENT CONSOLIDATED EXPEND

- Page 253 and 254:

CONSOLIDATED EXPENDITURE DETAIL Dep

- Page 255 and 256:

City of Oviedo Octoberfest Snow Mou

- Page 257 and 258:

TABLE OF CONTENTS RECREATION & PARK

- Page 259 and 260:

EXPENDITURE AND STAFFING SUMMARY De

- Page 261 and 262:

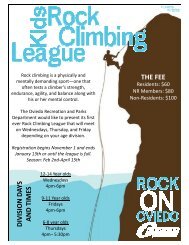

PERFORMANCE PROFILE Department Recr

- Page 263 and 264:

PERFORMANCE PROFILE Department Recr

- Page 265 and 266:

PERFORMANCE PROFILE Department Recr

- Page 267 and 268:

PERFORMANCE PROFILE Department Recr

- Page 269 and 270:

EXPENDITURE AND STAFFING SUMMARY De

- Page 271 and 272:

PERFORMANCE PROFILE Department Recr

- Page 273 and 274:

PERFORMANCE PROFILE Department Recr

- Page 275 and 276:

PERFORMANCE PROFILE Department Recr

- Page 277 and 278:

PERFORMANCE PROFILE Department Recr

- Page 279 and 280:

PERFORMANCE PROFILE Department Recr

- Page 281 and 282:

PERFORMANCE PROFILE Department Recr

- Page 283 and 284:

RECREATION AND PARKS CONSOLIDATED E

- Page 285 and 286:

2008-09 2009-10 2010-11 2010-11 201

- Page 287 and 288:

CONSOLIDATED EXPENDITURE DETAIL Dep

- Page 289 and 290:

City of Oviedo Public Works Operati

- Page 291 and 292:

TABLE OF CONTENTS PUBLIC WORKS Page

- Page 293 and 294:

PERFORMANCE PROFILE Department Publ

- Page 295 and 296:

PERFORMANCE PROFILE Department Publ

- Page 297 and 298:

PERFORMANCE PROFILE Department Publ

- Page 299 and 300:

EXPENDITURE AND STAFFING SUMMARY De

- Page 301 and 302:

PERFORMANCE PROFILE Department Publ

- Page 303 and 304:

STORMWATER UTILITY Stormwater Engin

- Page 305 and 306:

PERFORMANCE PROFILE Department Publ

- Page 307 and 308:

PUBLIC WORKS* CONSOLIDATED EXPENDIT

- Page 309 and 310:

2008-09 2009-10 2010-11 2010-11 201

- Page 311 and 312: CONSOLIDATED EXPENDITURE DETAIL Dep

- Page 313 and 314: City of Oviedo Water / Wastewater U

- Page 315 and 316: TABLE OF CONTENTS WATER/WASTEWATER

- Page 317 and 318: EXPENDITURE AND STAFFING SUMMARY De

- Page 319 and 320: Department Finance Program Utility

- Page 321 and 322: The City of Oviedo 308

- Page 323 and 324: EXPENDITURE AND STAFFING SUMMARY De

- Page 325 and 326: EXPENDITURE AND STAFFING SUMMARY De

- Page 327 and 328: EXPENDITURE AND STAFFING SUMMARY De

- Page 329 and 330: EXPENDITURE AND STAFFING SUMMARY De

- Page 331 and 332: EXPENDITURE AND STAFFING SUMMARY De

- Page 333 and 334: EXPENDITURE AND STAFFING SUMMARY De

- Page 335 and 336: WATER AND WASTEWATER COMBINED EXPEN

- Page 337 and 338: 2008-09 2009-10 2010-11 2010-11 201

- Page 339 and 340: TABLE OF CONTENTS NON-DEPARTMENTAL

- Page 341 and 342: DEBT SERVICE OBLIGATIONS FY 07-08 F

- Page 343 and 344: DEBT SERVICE OBLIGATIONS FY 07-08 F

- Page 345 and 346: Revenue and GO Bond Debt Service Re

- Page 347 and 348: Utility Debt Service Requirements t

- Page 349 and 350: TABLE OF CONTENTS CAPITAL IMPROVEME

- Page 351 and 352: City of ___ Oviedo Five Year Capita

- Page 353 and 354: City of ___ Oviedo approximately 23

- Page 355 and 356: 5 YEAR CIP: EXPENDITURES BY PROJECT

- Page 357 and 358: FY 11-12 FY 12-13 FY 13-14 FY 14-15

- Page 359 and 360: FY 11-12 FY 12-13 FY 13-14 FY 14-15

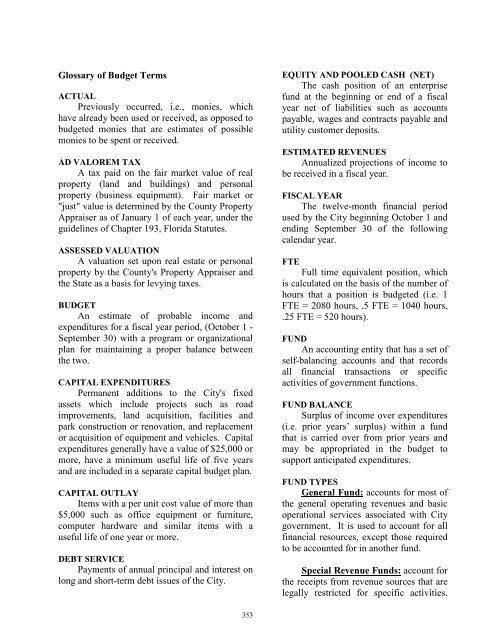

- Page 361: TABLE OF CONTENTS APPENDIX Page Num

- Page 365 and 366: Oviedo Demographics: Fast Facts & S

- Page 367 and 368: 2010 Top Ten Taxpayers for Oviedo T

- Page 369 and 370: The City of Oviedo