Financing Child Care in the United States - Ewing Marion Kauffman ...

Financing Child Care in the United States - Ewing Marion Kauffman ...

Financing Child Care in the United States - Ewing Marion Kauffman ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TAX CREDITS, DEDUCTIONS<br />

AND EXEMPTIONS<br />

CHILD AND DEPENDENT CARE TAX<br />

CREDIT (FEDERAL)<br />

DESCRIPTION<br />

The federal <strong>Child</strong> and Dependent <strong>Care</strong> Tax Credit<br />

(CDCTC) allows all families with child care expenses to<br />

claim a credit aga<strong>in</strong>st federal taxes owed equal to a<br />

percentage of <strong>the</strong>ir employment–related expenditures for<br />

any form of child care. <strong>Child</strong>ren must be under age 13<br />

and live with <strong>the</strong> parent(s) claim<strong>in</strong>g <strong>the</strong> credit. The law<br />

limits creditable expenses to $2,400 for one child and<br />

$4,800 for two or more children. The expense limits were<br />

set <strong>in</strong> 1981 and reflected average prices for care at that<br />

time. The credit is not <strong>in</strong>dexed for <strong>in</strong>flation as o<strong>the</strong>r parts<br />

of <strong>the</strong> tax code are (e.g., <strong>the</strong> personal exemption,<br />

standard deduction and earned <strong>in</strong>come tax credit).<br />

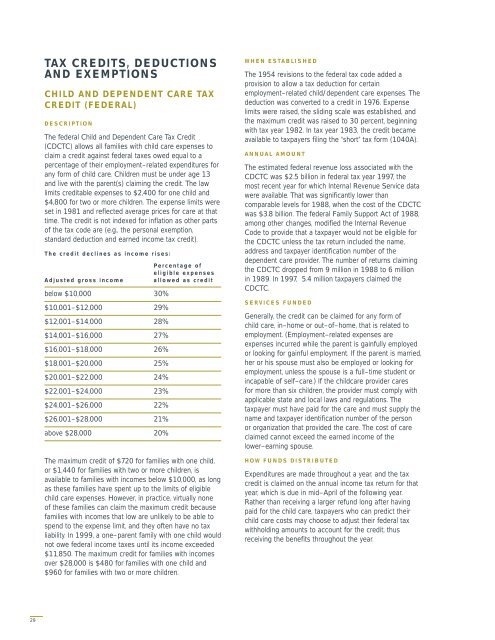

The credit decl<strong>in</strong>es as <strong>in</strong>come rises:<br />

Adjusted gross <strong>in</strong>come<br />

below $10,000 30%<br />

$10,001–$12,000 29%<br />

$12,001–$14,000 28%<br />

$14,001–$16,000 27%<br />

$16,001–$18,000 26%<br />

$18,001–$20,000 25%<br />

$20,001–$22,000 24%<br />

$22,001–$24,000 23%<br />

$24,001–$26,000 22%<br />

$26,001–$28,000 21%<br />

above $28,000 20%<br />

Percentage of<br />

eligible expenses<br />

allowed as credit<br />

The maximum credit of $720 for families with one child,<br />

or $1,440 for families with two or more children, is<br />

available to families with <strong>in</strong>comes below $10,000, as long<br />

as <strong>the</strong>se families have spent up to <strong>the</strong> limits of eligible<br />

child care expenses. However, <strong>in</strong> practice, virtually none<br />

of <strong>the</strong>se families can claim <strong>the</strong> maximum credit because<br />

families with <strong>in</strong>comes that low are unlikely to be able to<br />

spend to <strong>the</strong> expense limit, and <strong>the</strong>y often have no tax<br />

liability. In 1999, a one–parent family with one child would<br />

not owe federal <strong>in</strong>come taxes until its <strong>in</strong>come exceeded<br />

$11,850. The maximum credit for families with <strong>in</strong>comes<br />

over $28,000 is $480 for families with one child and<br />

$960 for families with two or more children.<br />

WHEN ESTABLISHED<br />

The 1954 revisions to <strong>the</strong> federal tax code added a<br />

provision to allow a tax deduction for certa<strong>in</strong><br />

employment–related child/dependent care expenses. The<br />

deduction was converted to a credit <strong>in</strong> 1976. Expense<br />

limits were raised, <strong>the</strong> slid<strong>in</strong>g scale was established, and<br />

<strong>the</strong> maximum credit was raised to 30 percent, beg<strong>in</strong>n<strong>in</strong>g<br />

with tax year 1982. In tax year 1983, <strong>the</strong> credit became<br />

available to taxpayers fil<strong>in</strong>g <strong>the</strong> “short” tax form (1040A).<br />

ANNUAL AMOUNT<br />

The estimated federal revenue loss associated with <strong>the</strong><br />

CDCTC was $2.5 billion <strong>in</strong> federal tax year 1997, <strong>the</strong><br />

most recent year for which Internal Revenue Service data<br />

were available. That was significantly lower than<br />

comparable levels for 1988, when <strong>the</strong> cost of <strong>the</strong> CDCTC<br />

was $3.8 billion. The federal Family Support Act of 1988,<br />

among o<strong>the</strong>r changes, modified <strong>the</strong> Internal Revenue<br />

Code to provide that a taxpayer would not be eligible for<br />

<strong>the</strong> CDCTC unless <strong>the</strong> tax return <strong>in</strong>cluded <strong>the</strong> name,<br />

address and taxpayer identification number of <strong>the</strong><br />

dependent care provider. The number of returns claim<strong>in</strong>g<br />

<strong>the</strong> CDCTC dropped from 9 million <strong>in</strong> 1988 to 6 million<br />

<strong>in</strong> 1989. In 1997, 5.4 million taxpayers claimed <strong>the</strong><br />

CDCTC.<br />

SERVICES FUNDED<br />

Generally, <strong>the</strong> credit can be claimed for any form of<br />

child care, <strong>in</strong>–home or out–of–home, that is related to<br />

employment. (Employment–related expenses are<br />

expenses <strong>in</strong>curred while <strong>the</strong> parent is ga<strong>in</strong>fully employed<br />

or look<strong>in</strong>g for ga<strong>in</strong>ful employment. If <strong>the</strong> parent is married,<br />

her or his spouse must also be employed or look<strong>in</strong>g for<br />

employment, unless <strong>the</strong> spouse is a full–time student or<br />

<strong>in</strong>capable of self–care.) If <strong>the</strong> childcare provider cares<br />

for more than six children, <strong>the</strong> provider must comply with<br />

applicable state and local laws and regulations. The<br />

taxpayer must have paid for <strong>the</strong> care and must supply <strong>the</strong><br />

name and taxpayer identification number of <strong>the</strong> person<br />

or organization that provided <strong>the</strong> care. The cost of care<br />

claimed cannot exceed <strong>the</strong> earned <strong>in</strong>come of <strong>the</strong><br />

lower–earn<strong>in</strong>g spouse.<br />

HOW FUNDS DISTRIBUTED<br />

Expenditures are made throughout a year, and <strong>the</strong> tax<br />

credit is claimed on <strong>the</strong> annual <strong>in</strong>come tax return for that<br />

year, which is due <strong>in</strong> mid–April of <strong>the</strong> follow<strong>in</strong>g year.<br />

Ra<strong>the</strong>r than receiv<strong>in</strong>g a larger refund long after hav<strong>in</strong>g<br />

paid for <strong>the</strong> child care, taxpayers who can predict <strong>the</strong>ir<br />

child care costs may choose to adjust <strong>the</strong>ir federal tax<br />

withhold<strong>in</strong>g amounts to account for <strong>the</strong> credit, thus<br />

receiv<strong>in</strong>g <strong>the</strong> benefits throughout <strong>the</strong> year.<br />

29