basic-guide-to-exporting_Latest_eg_main_086196

basic-guide-to-exporting_Latest_eg_main_086196

basic-guide-to-exporting_Latest_eg_main_086196

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

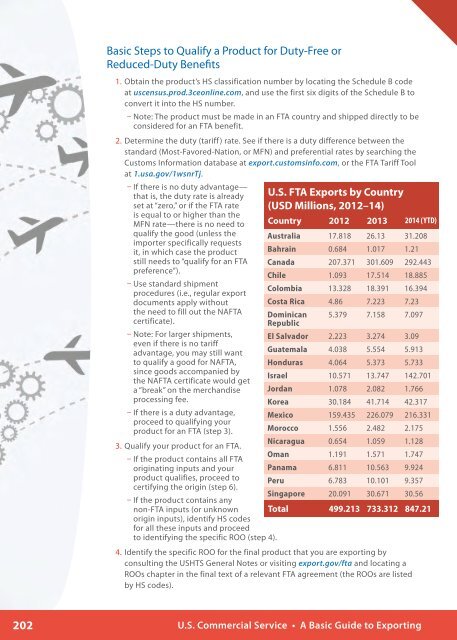

Basic Steps <strong>to</strong> Qualify a Product for Duty-Free orReduced-Duty Benefits1. Obtain the product’s HS classification number by locating the Schedule B codeat uscensus.prod.3ceonline.com, and use the first six digits of the Schedule B <strong>to</strong>convert it in<strong>to</strong> the HS number.ŦŦNote: The product must be made in an FTA country and shipped directly <strong>to</strong> beconsidered for an FTA benefit.2. Determine the duty (tariff) rate. See if there is a duty difference between thestandard (Most-Favored-Nation, or MFN) and preferential rates by searching theCus<strong>to</strong>ms Information database at export.cus<strong>to</strong>msinfo.com, or the FTA Tariff Toolat 1.usa.gov/1wsnrTj.ŦŦIf there is no duty advantage—that is, the duty rate is alreadyset at “zero,” or if the FTA rateis equal <strong>to</strong> or higher than theMFN rate—there is no need <strong>to</strong>qualify the good (unless the Australia 17.818 26.13 31.208importer specifically requestsit, in which case the product Bahrain 0.684 1.017 1.21still needs <strong>to</strong> “qualify for an FTA Canada 207.371 301.609 292.443preference”).Chile 1.093 17.514 18.885ŦŦUse standard shipmentColombia 13.328 18.391 16.394procedures (i.e., r<strong>eg</strong>ular exportdocuments apply withoutCosta Rica 4.86 7.223 7.23the need <strong>to</strong> fill out the NAFTA Dominican 5.379 7.158 7.097certificate).RepublicŦŦNote: For larger shipments,El Salvador 2.223 3.274 3.09even if there is no tariffadvantage, you may still wantGuatemala 4.038 5.554 5.913<strong>to</strong> qualify a good for NAFTA, Honduras 4.064 5.373 5.733since goods accompanied byIsrael 10.571 13.747 142.701the NAFTA certificate would geta “break” on the merchandise Jordan 1.078 2.082 1.766processing fee.Korea 30.184 41.714 42.317ŦŦIf there is a duty advantage,Mexico 159.435 226.079 216.331proceed <strong>to</strong> qualifying yourproduct for an FTA (step 3).Morocco 1.556 2.482 2.175Nicaragua 0.654 1.059 1.1283. Qualify your product for an FTA.Oman 1.191 1.571 1.747ŦŦIf the product contains all FTAoriginating inputs and yourPanama 6.811 10.563 9.924product qualifies, proceed <strong>to</strong> Peru 6.783 10.101 9.357certifying the origin (step 6).Singapore 20.091 30.671 30.56ŦŦIf the product contains anynon-FTA inputs (or unknown Total 499.213 733.312 847.21origin inputs), identify HS codesfor all these inputs and proceed<strong>to</strong> identifying the specific ROO (step 4).U.S. FTA Exports by Country(USD Millions, 2012–14)Country 2012 2013 2014 (YTD)4. Identify the specific ROO for the final product that you are <strong>exporting</strong> byconsulting the USHTS General Notes or visiting export.gov/fta and locating aROOs chapter in the final text of a relevant FTA agreement (the ROOs are listedby HS codes).202U.S. Commercial Service • A Basic Guide <strong>to</strong> Exporting