Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

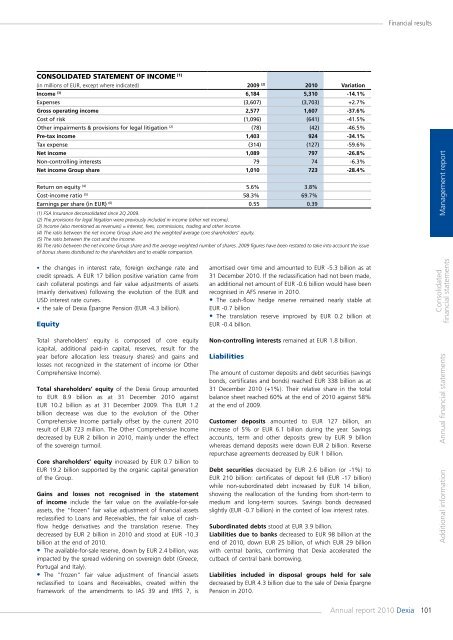

Financial resultsConsolidated statement of in<strong>com</strong>e (1)(in millions of EUR, except where indicated) 2009 (2) <strong>2010</strong> VariationIn<strong>com</strong>e (3) 6,184 5,310 -14.1%Expenses (3,607) (3,703) +2.7%Gross operating in<strong>com</strong>e 2,577 1,607 -37.6%Cost of risk (1,096) (641) -41.5%Other impairments & provisions for legal litigation (2) (78) (42) -46.5%Pre-tax in<strong>com</strong>e 1,403 924 -34.1%Tax expense (314) (127) -59.6%Net in<strong>com</strong>e 1,089 797 -26.8%Non-controlling interests 79 74 -6.3%Net in<strong>com</strong>e Group share 1,010 723 -28.4%Return on equity (4) 5.6% 3.8%Cost-in<strong>com</strong>e ratio (5) 58.3% 69.7%Earnings per share (in EUR) (6) 0.55 0.39(1) FSA Insurance deconsolidated since 2Q 2009.(2) The provisions for legal litigation were previously included in in<strong>com</strong>e (other net in<strong>com</strong>e).(3) In<strong>com</strong>e (also mentioned as revenues) = interest, fees, <strong>com</strong>missions, trading and other in<strong>com</strong>e.(4) The ratio between the net in<strong>com</strong>e Group share and the weighted average core shareholders’ equity.(5) The ratio between the cost and the in<strong>com</strong>e.(6) The ratio between the net in<strong>com</strong>e Group share and the average weighted number of shares. 2009 figures have been restated to take into account the issueof bonus shares distributed to the shareholders and to enable <strong>com</strong>parison.Management <strong>report</strong>• the changes in interest rate, foreign exchange rate andcredit spreads. A EUR 17 billion positive variation came fromcash collateral postings and fair value adjustments of assets(mainly derivatives) following the evolution of the EUR andUSD interest rate curves.• the sale of <strong>Dexia</strong> Épargne Pension (EUR -4.3 billion).EquityTotal shareholders’ equity is <strong>com</strong>posed of core equity(capital, additional paid-in capital, reserves, result for theyear before allocation less treasury shares) and gains andlosses not recognized in the statement of in<strong>com</strong>e (or OtherComprehensive In<strong>com</strong>e).Total shareholders’ equity of the <strong>Dexia</strong> Group amountedto EUR 8.9 billion as at 31 December <strong>2010</strong> againstEUR 10.2 billion as at 31 December 2009. This EUR 1.2billion decrease was due to the evolution of the OtherComprehensive In<strong>com</strong>e partially offset by the current <strong>2010</strong>result of EUR 723 million. The Other Comprehensive In<strong>com</strong>edecreased by EUR 2 billion in <strong>2010</strong>, mainly under the effectof the sovereign turmoil.Core shareholders’ equity increased by EUR 0.7 billion toEUR 19.2 billion supported by the organic capital generationof the Group.Gains and losses not recognised in the statementof in<strong>com</strong>e include the fair value on the available-for-saleassets, the "frozen" fair value adjustment of financial assetsreclassified to Loans and Receivables, the fair value of cashflowhedge derivatives and the translation reserve. Theydecreased by EUR 2 billion in <strong>2010</strong> and stood at EUR -10.3billion at the end of <strong>2010</strong>.• The available-for-sale reserve, down by EUR 2.4 billion, wasimpacted by the spread widening on sovereign debt (Greece,Portugal and Italy).• The "frozen" fair value adjustment of financial assetsreclassified to Loans and Receivables, created within theframework of the amendments to IAS 39 and IFRS 7, isamortised over time and amounted to EUR -5.3 billion as at31 December <strong>2010</strong>. If the reclassification had not been made,an additional net amount of EUR -0.6 billion would have beenrecognised in AFS reserve in <strong>2010</strong>.• The cash-flow hedge reserve remained nearly stable atEUR -0.7 billion• The translation reserve improved by EUR 0.2 billion atEUR -0.4 billion.Non-controlling interests remained at EUR 1.8 billion.LiabilitiesThe amount of customer deposits and debt securities (savingsbonds, certificates and bonds) reached EUR 338 billion as at31 December <strong>2010</strong> (+1%). Their relative share in the totalbalance sheet reached 60% at the end of <strong>2010</strong> against 58%at the end of 2009.Customer deposits amounted to EUR 127 billion, anincrease of 5% or EUR 6.1 billion during the year. Savingsaccounts, term and other deposits grew by EUR 9 billionwhereas demand deposits were down EUR 2 billion. Reverserepurchase agreements decreased by EUR 1 billion.Debt securities decreased by EUR 2.6 billion (or -1%) toEUR 210 billion: certificates of deposit fell (EUR -17 billion)while non-subordinated debt increased by EUR 14 billion,showing the reallocation of the funding from short-term tomedium and long-term sources. Savings bonds decreasedslightly (EUR -0.7 billion) in the context of low interest rates.Subordinated debts stood at EUR 3.9 billion.Liabilities due to banks decreased to EUR 98 billion at theend of <strong>2010</strong>, down EUR 25 billion, of which EUR 29 billionwith central banks, confirming that <strong>Dexia</strong> accelerated thecutback of central bank borrowing.Liabilities included in disposal groups held for saledecreased by EUR 4.3 billion due to the sale of <strong>Dexia</strong> ÉpargnePension in <strong>2010</strong>.Consolidatedfinancial statementsAdditional information <strong>Annual</strong> financial statements<strong>Annual</strong> <strong>report</strong> <strong>2010</strong> <strong>Dexia</strong>101