Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

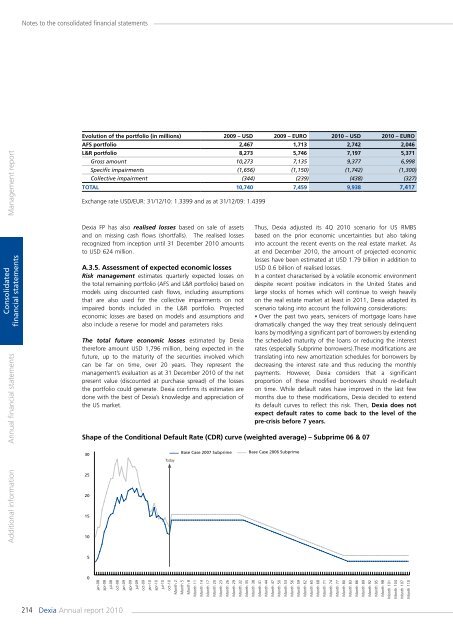

Notes to the consolidated financial statementsManagement <strong>report</strong>Consolidatedfinancial statementsAdditional information <strong>Annual</strong> financial statementsEvolution of the portfolio (in millions) 2009 – USD 2009 – EURO <strong>2010</strong> – USD <strong>2010</strong> – EUROAFS portfolio 2,467 1,713 2,742 2,046L&R portfolio 8,273 5,746 7,197 5,371Shape of the Conditional Default Rate (CDR) curve (weighted average) – Subprime 06 & 073025201510Gross amount 10,273 7,135 9,377 6,998Specific impairments (1,656) (1,150) (1,742) (1,300)Collective impairment (344) (239) (438) (327)Total 10,740 7,459 9,938 7,417Exchange rate USD/EUR: 31/12/10: 1.3399 and as at 31/12/09: 1.4399<strong>Dexia</strong> FP has also realised losses based on sale of assetsand on missing cash flows (shortfalls). The realised lossesrecognized from inception until 31 December <strong>2010</strong> amountsto USD 624 million.A.3.5. Assessment of expected economic lossesRisk management estimates quarterly expected losses onthe total remaining portfolio (AFS and L&R portfolio) based onmodels using discounted cash flows, including assumptionsthat are also used for the collective impairments on notimpaired bonds included in the L&R portfolio. Projectedeconomic losses are based on models and assumptions andalso include a reserve for model and parameters risksThe total future economic losses estimated by <strong>Dexia</strong>therefore amount USD 1,796 million, being expected in thefuture, up to the maturity of the securities involved whichcan be far on time, over 20 years. They represent themanagement’s evaluation as at 31 December <strong>2010</strong> of the netpresent value (discounted at purchase spread) of the lossesthe portfolio could generate. <strong>Dexia</strong> confirms its estimates aredone with the best of <strong>Dexia</strong>’s knowledge and appreciation ofthe US market.TodayBase Case 2007 SubprimeThus, <strong>Dexia</strong> adjusted its 4Q <strong>2010</strong> scenario for US RMBSbased on the prior economic uncertainties but also takinginto account the recent events on the real estate market. Asat end December <strong>2010</strong>, the amount of projected economiclosses have been estimated at USD 1.79 billion in addition toUSD 0.6 billion of realised losses.In a context characterised by a volatile economic environmentdespite recent positive indicators in the United States andlarge stocks of homes which will continue to weigh heavilyon the real estate market at least in 2011, <strong>Dexia</strong> adapted itsscenario taking into account the following considerations:• Over the past two years, servicers of mortgage loans havedramatically changed the way they treat seriously delinquentloans by modifying a significant part of borrowers by extendingthe scheduled maturity of the loans or reducing the interestrates (especially Subprime borrowers).These modifications aretranslating into new amortization schedules for borrowers bydecreasing the interest rate and thus reducing the monthlypayments. However, <strong>Dexia</strong> considers that a significantproportion of these modified borrowers should re-defaulton time. While default rates have improved in the last fewmonths due to these modifications, <strong>Dexia</strong> decided to extendits default curves to reflect this risk. Then, <strong>Dexia</strong> does notexpect default rates to <strong>com</strong>e back to the level of thepre-crisis before 7 years.Base Case 2006 Subprime50jan-08apr-08jul-08oct-08jan-09apr-09jul-09oct-09jan-10apr-10jul-10oct-10Month 2Month 5Month 8Month 11Month 14Month 17Month 20Month 23Month 26Month 29Month 32Month 35Month 38Month 41Month 44Month 47Month 50Month 53Month 56Month 59Month 62Month 65Month 68Month 71Month 74Month 77Month 80Month 83Month 86Month 89Month 92Month 95Month 98Month 101Month 104Month 107Month 110214 <strong>Dexia</strong> <strong>Annual</strong> <strong>report</strong> <strong>2010</strong>