Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

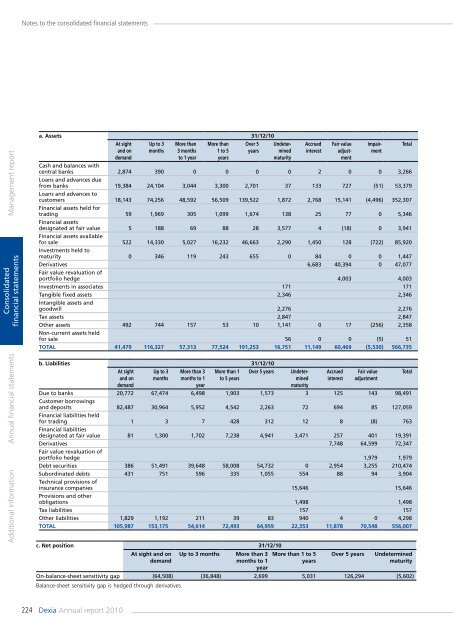

Notes to the consolidated financial statementsManagement <strong>report</strong>Consolidatedfinancial statementsAdditional information <strong>Annual</strong> financial statementsa. Assets 31/12/10At sightand ondemandUp to 3monthsMore than3 monthsto 1 yearMore than1 to 5yearsOver 5yearsUndeterminedmaturityAccruedinterestCash and balances withcentral banks 2,874 390 0 0 0 0 2 0 0 3,266Loans and advances duefrom banks 19,384 24,104 3,044 3,300 2,701 37 133 727 (51) 53,379Loans and advances tocustomers 18,143 74,256 48,592 56,509 139,522 1,872 2,768 15,141 (4,496) 352,307Financial assets held fortrading 59 1,969 305 1,099 1,674 138 25 77 0 5,346Financial assetsdesignated at fair value 5 188 69 88 28 3,577 4 (18) 0 3,941Financial assets availablefor sale 522 14,330 5,027 16,232 46,663 2,290 1,450 128 (722) 85,920Investments held tomaturity 0 346 119 243 655 0 84 0 0 1,447Derivatives 6,683 40,394 0 47,077Fair value revaluation ofportfolio hedge 4,003 4,003Investments in associates 171 171Tangible fixed assets 2,346 2,346Intangible assets andgoodwill 2,276 2,276Tax assets 2,847 2,847Other assets 492 744 157 53 10 1,141 0 17 (256) 2,358Non-current assets heldfor sale 56 0 0 (5) 51Total 41,479 116,327 57,313 77,524 191,253 16,751 11,149 60,469 (5,530) 566,735b. Liabilities 31/12/10At sightand ondemandUp to 3monthsMore than 3months to 1yearMore than 1to 5 yearsOver 5 yearsImpairmentUndeterminedmaturityAccruedinterestFair valueadjustmentFair valueadjustmentDue to banks 20,772 67,474 6,498 1,903 1,573 3 125 143 98,491Customer borrowingsand deposits 82,487 30,964 5,952 4,542 2,263 72 694 85 127,059Financial liabilities heldfor trading 1 3 7 428 312 12 8 (8) 763Financial liabilitiesdesignated at fair value 81 1,300 1,702 7,238 4,941 3,471 257 401 19,391Derivatives 7,748 64,599 72,347Fair value revaluation ofportfolio hedge 1,979 1,979Debt securities 386 51,491 39,648 58,008 54,732 0 2,954 3,255 210,474Subordinated debts 431 751 596 335 1,055 554 88 94 3,904Technical provisions ofinsurance <strong>com</strong>panies 15,646 15,646Provisions and otherobligations 1,498 1,498Tax liabilities 157 157Other liabilities 1,829 1,192 211 39 83 940 4 0 4,298Total 105,987 153,175 54,614 72,493 64,959 22,353 11,878 70,548 556,007c. Net position 31/12/10At sight and ondemandUp to 3 months More than 3months to 1yearMore than 1 to 5yearsOver 5 yearsTotalTotalUndeterminedmaturityOn-balance-sheet sensitivity gap (64,508) (36,848) 2,699 5,031 126,294 (5,602)Balance-sheet sensitivity gap is hedged through derivatives.224 <strong>Dexia</strong> <strong>Annual</strong> <strong>report</strong> <strong>2010</strong>