Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

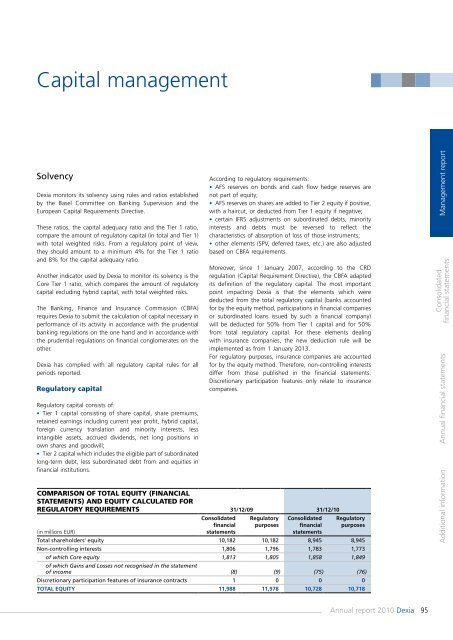

Capital managementSolvency<strong>Dexia</strong> monitors its solvency using rules and ratios establishedby the Basel Committee on Banking Supervision and theEuropean Capital Requirements Directive.These ratios, the capital adequacy ratio and the Tier 1 ratio,<strong>com</strong>pare the amount of regulatory capital (in total and Tier 1)with total weighted risks. From a regulatory point of view,they should amount to a minimum 4% for the Tier 1 ratioand 8% for the capital adequacy ratio.Another indicator used by <strong>Dexia</strong> to monitor its solvency is theCore Tier 1 ratio, which <strong>com</strong>pares the amount of regulatorycapital excluding hybrid capital, with total weighted risks.The Banking, Finance and Insurance Commission (CBFA)requires <strong>Dexia</strong> to submit the calculation of capital necessary inperformance of its activity in accordance with the prudentialbanking regulations on the one hand and in accordance withthe prudential regulations on financial conglomerates on theother.<strong>Dexia</strong> has <strong>com</strong>plied with all regulatory capital rules for allperiods <strong>report</strong>ed.Regulatory capitalRegulatory capital consists of:• Tier 1 capital consisting of share capital, share premiums,retained earnings including current year profit, hybrid capital,foreign currency translation and minority interests, lessintangible assets, accrued dividends, net long positions inown shares and goodwill;• Tier 2 capital which includes the eligible part of subordinatedlong-term debt, less subordinated debt from and equities infinancial institutions.According to regulatory requirements:• AFS reserves on bonds and cash flow hedge reserves arenot part of equity;• AFS reserves on shares are added to Tier 2 equity if positive,with a haircut, or deducted from Tier 1 equity if negative;• certain IFRS adjustments on subordinated debts, minorityinterests and debts must be reversed to reflect thecharacteristics of absorption of loss of those instruments;• other elements (SPV, deferred taxes, etc.) are also adjustedbased on CBFA requirements.Moreover, since 1 January 2007, according to the CRDregulation (Capital Requirement Directive), the CBFA adaptedits definition of the regulatory capital. The most importantpoint impacting <strong>Dexia</strong> is that the elements which werededucted from the total regulatory capital (banks accountedfor by the equity method, participations in financial <strong>com</strong>paniesor subordinated loans issued by such a financial <strong>com</strong>pany)will be deducted for 50% from Tier 1 capital and for 50%from total regulatory capital. For these elements dealingwith insurance <strong>com</strong>panies, the new deduction rule will beimplemented as from 1 January 2013.For regulatory purposes, insurance <strong>com</strong>panies are accountedfor by the equity method. Therefore, non-controlling interestsdiffer from those published in the financial statements.Discretionary participation features only relate to insurance<strong>com</strong>panies.Comparison of total equity (financialstatements) and equity calculated forregulatory requirements 31/12/09 31/12/10ConsolidatedfinancialRegulatorypurposesConsolidatedfinancialRegulatorypurposes(in millions EUR)statementsstatementsTotal shareholders’ equity 10,182 10,182 8,945 8,945Non-controlling interests 1,806 1,796 1,783 1,773of which Core equity 1,813 1,805 1,858 1,849of which Gains and Losses not recognised in the statementof in<strong>com</strong>e (8) (9) (75) (76)Discretionary participation features of insurance contracts 1 0 0 0Total equity 11,988 11,978 10,728 10,718Management <strong>report</strong>Consolidatedfinancial statementsAdditional information <strong>Annual</strong> financial statements<strong>Annual</strong> <strong>report</strong> <strong>2010</strong> <strong>Dexia</strong>95