Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

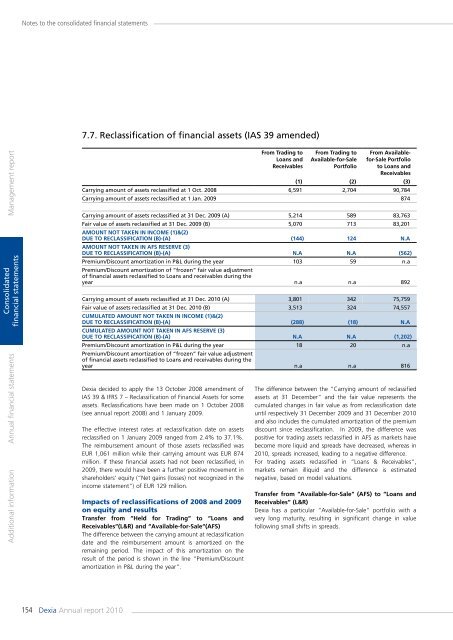

Notes to the consolidated financial statements7.7. Reclassification of financial assets (IAS 39 amended)Management <strong>report</strong>Consolidatedfinancial statementsAdditional information <strong>Annual</strong> financial statementsFrom Trading toLoans andReceivablesFrom Trading toAvailable-for-SalePortfolioFrom Availablefor-SalePortfolioto Loans andReceivables(1) (2) (3)Carrying amount of assets reclassified at 1 Oct. 2008 6,591 2,704 90,784Carrying amount of assets reclassified at 1 Jan. 2009 874Carrying amount of assets reclassified at 31 Dec. 2009 (A) 5,214 589 83,763Fair value of assets reclassified at 31 Dec. 2009 (B) 5,070 713 83,201Amount not taken in in<strong>com</strong>e (1)&(2)due to reclassification (B)-(A) (144) 124 n.aAmount not taken in AFS Reserve (3)due to reclassification (B)-(A) n.a n.a (562)Premium/Discount amortization in P&L during the year 103 59 n.aPremium/Discount amortization of “frozen” fair value adjustmentof financial assets reclassified to Loans and receivables during theyear n.a n.a 892Carrying amount of assets reclassified at 31 Dec. <strong>2010</strong> (A) 3,801 342 75,759Fair value of assets reclassified at 31 Dec. <strong>2010</strong> (B) 3,513 324 74,557Cumulated amount not taken in in<strong>com</strong>e (1)&(2)due to reclassification (B)-(A) (288) (18) n.aCumulated amount not taken in AFS Reserve (3)due to reclassification (B)-(A) n.a n.a (1,202)Premium/Discount amortization in P&L during the year 18 20 n.aPremium/Discount amortization of “frozen” fair value adjustmentof financial assets reclassified to Loans and receivables during theyear n.a n.a 816<strong>Dexia</strong> decided to apply the 13 October 2008 amendment ofIAS 39 & IFRS 7 – Reclassification of Financial Assets for someassets. Reclassifications have been made on 1 October 2008(see annual <strong>report</strong> 2008) and 1 January 2009.The effective interest rates at reclassification date on assetsreclassified on 1 January 2009 ranged from 2.4% to 37.1%.The reimbursement amount of those assets reclassified wasEUR 1,061 million while their carrying amount was EUR 874million. If these financial assets had not been reclassified, in2009, there would have been a further positive movement inshareholders' equity (“Net gains (losses) not recognized in thein<strong>com</strong>e statement“) of EUR 129 million.Impacts of reclassifications of 2008 and 2009on equity and resultsTransfer from “Held for Trading“ to “Loans andReceivables“(L&R) and “Available-for-Sale“(AFS)The difference between the carrying amount at reclassificationdate and the reimbursement amount is amortized on theremaining period. The impact of this amortization on theresult of the period is shown in the line “Premium/Discountamortization in P&L during the year“.The difference between the “Carrying amount of reclassifiedassets at 31 December“ and the fair value represents thecumulated changes in fair value as from reclassification dateuntil respectively 31 December 2009 and 31 December <strong>2010</strong>and also includes the cumulated amortization of the premiumdiscount since reclassification. In 2009, the difference waspositive for trading assets reclassified in AFS as markets havebe<strong>com</strong>e more liquid and spreads have decreased, whereas in<strong>2010</strong>, spreads increased, leading to a negative difference.For trading assets reclassified in “Loans & Receivables“,markets remain illiquid and the difference is estimatednegative, based on model valuations.Transfer from “Available-for-Sale“ (AFS) to “Loans andReceivables“ (L&R)<strong>Dexia</strong> has a particular “Available-for-Sale“ portfolio with avery long maturity, resulting in significant change in valuefollowing small shifts in spreads.154 <strong>Dexia</strong> <strong>Annual</strong> <strong>report</strong> <strong>2010</strong>