Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

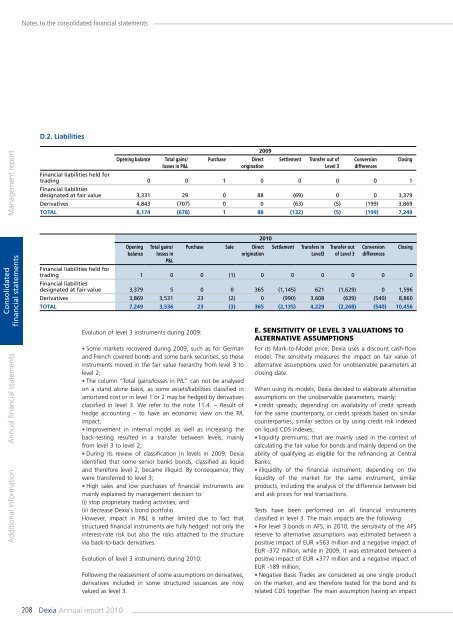

Notes to the consolidated financial statementsD.2. LiabilitiesManagement <strong>report</strong>Opening balanceTotal gains/losses in P&LPurchase2009DirectoriginationSettlementTransfer out ofLevel 3ConversiondifferencesFinancial liabilities held fortrading 0 0 1 0 0 0 0 1Financial liabilitiesdesignated at fair value 3,331 29 0 88 (69) 0 0 3,379Derivatives 4,843 (707) 0 0 (63) (5) (199) 3,869Total 8,174 (678) 1 88 (132) (5) (199) 7,249ClosingConsolidatedfinancial statementsAdditional information <strong>Annual</strong> financial statementsOpeningbalanceTotal gains/losses inP&LEvolution of level 3 instruments during 2009:• Some markets recovered during 2009, such as for Germanand French covered bonds and some bank securities, so thoseinstruments moved in the fair value hierarchy from level 3 tolevel 2;• The column “Total gains/losses in P/L“ can not be analysedon a stand alone basis, as some assets/liabilities classified inamortized cost or in level 1 or 2 may be hedged by derivativesclassified in level 3. We refer to the note 11.4. – Result ofhedge accounting – to have an economic view on the P/Limpact;• Improvement in internal model as well as increasing theback-testing resulted in a transfer between levels; mainlyfrom level 3 to level 2;• During its review of classification in levels in 2009, <strong>Dexia</strong>identified that some senior banks bonds, classified as liquidand therefore level 2, became illiquid. By consequence, theywere transferred to level 3;• High sales and low purchases of financial instruments aremainly explained by management decision to:(i) stop proprietary trading activities; and(ii) decrease <strong>Dexia</strong>'s bond portfolio.However, impact in P&L is rather limited due to fact thatstructured financial instruments are fully hedged: not only theinterest-rate risk but also the risks attached to the structurevia back-to-back derivatives.Evolution of level 3 instruments during <strong>2010</strong>:<strong>2010</strong>Purchase Sale Direct SettlementoriginationFollowing the reassesment of some assumptions on derivatives,derivatives included in some structured issuances are nowvalued as level 3.Transfers inLevel3Transfer outof Level 3ConversiondifferencesFinancial liabilities held fortrading 1 0 0 (1) 0 0 0 0 0 0Financial liabilitiesdesignated at fair value 3,379 5 0 0 365 (1,145) 621 (1,629) 0 1,596Derivatives 3,869 3,531 23 (2) 0 (990) 3,608 (639) (540) 8,860Total 7,249 3,536 23 (3) 365 (2,135) 4,229 (2,268) (540) 10,456ClosingE. sensitivity of level 3 valuations toalternative assumptionsFor its Mark-to-Model price, <strong>Dexia</strong> uses a discount cash-flowmodel. The sensitivity measures the impact on fair value ofalternative assumptions used for unobservable parameters atclosing date.When using its models, <strong>Dexia</strong> decided to elaborate alternativeassumptions on the unobservable parameters, mainly:• credit spreads; depending on availability of credit spreadsfor the same counterparty, or credit spreads based on similarcounterparties, similar sectors or by using credit risk indexedon liquid CDS indexes;• liquidity premiums; that are mainly used in the context ofcalculating the fair value for bonds and mainly depend on theability of qualifying as eligible for the refinancing at CentralBanks;• illiquidity of the financial instrument; depending on theliquidity of the market for the same instrument, similarproducts, including the analysis of the difference between bidand ask prices for real transactions.Tests have been performed on all financial instrumentsclassified in level 3. The main impacts are the following:• For level 3 bonds in AFS, in <strong>2010</strong>, the sensitivity of the AFSreserve to alternative assumptions was estimated between apositive impact of EUR +563 million and a negative impact ofEUR -372 million, while in 2009, it was estimated between apositive impact of EUR +377 million and a negative impact ofEUR -189 million;• Negative Basis Trades are considered as one single producton the market, and are therefore tested for the bond and itsrelated CDS together. The main assumption having an impact208 <strong>Dexia</strong> <strong>Annual</strong> <strong>report</strong> <strong>2010</strong>