Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

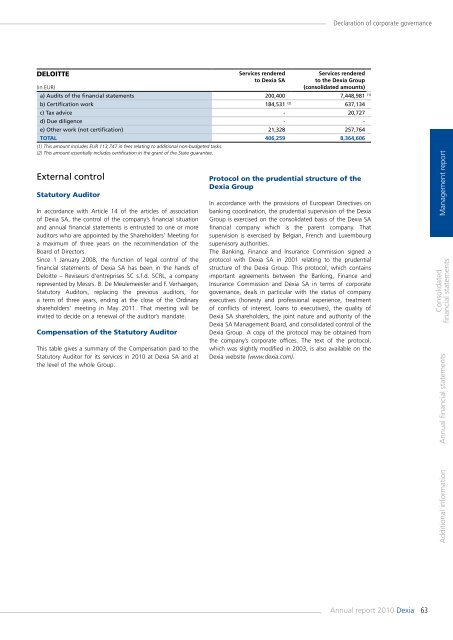

Declaration of corporate governanceDeloitte(in EUR)Services renderedto <strong>Dexia</strong> SAServices renderedto the <strong>Dexia</strong> Group(consolidated amounts)a) Audits of the financial statements 200,400 7,448,981 (1)b) Certification work 184,531 (2) 637,134c) Tax advice - 20,727d) Due diligence - -e) Other work (not certification) 21,328 257,764Total 406,259 8,364,606(1) This amount includes EUR 113,747 in fees relating to additional non-budgeted tasks.(2) This amount essentially includes certification in the grant of the State guarantee.External controlStatutory AuditorIn accordance with Article 14 of the articles of associationof <strong>Dexia</strong> SA, the control of the <strong>com</strong>pany’s financial situationand annual financial statements is entrusted to one or moreauditors who are appointed by the Shareholders’ Meeting fora maximum of three years on the re<strong>com</strong>mendation of theBoard of Directors.Since 1 January 2008, the function of legal control of thefinancial statements of <strong>Dexia</strong> SA has been in the hands ofDeloitte – Reviseurs d’entreprises SC s.f.d. SCRL, a <strong>com</strong>panyrepresented by Messrs. B. De Meulemeester and F. Verhaegen,Statutory Auditors, replacing the previous auditors, fora term of three years, ending at the close of the Ordinaryshareholders' meeting in May 2011. That meeting will beinvited to decide on a renewal of the auditor’s mandate.Compensation of the Statutory AuditorThis table gives a summary of the Compensation paid to theStatutory Auditor for its services in <strong>2010</strong> at <strong>Dexia</strong> SA and atthe level of the whole Group.Protocol on the prudential structure of the<strong>Dexia</strong> GroupIn accordance with the provisions of European Directives onbanking coordination, the prudential supervision of the <strong>Dexia</strong>Group is exercised on the consolidated basis of the <strong>Dexia</strong> SAfinancial <strong>com</strong>pany which is the parent <strong>com</strong>pany. Thatsupervision is exercised by Belgian, French and Luxembourgsupervisory authorities.The Banking, Finance and Insurance Commission signed aprotocol with <strong>Dexia</strong> SA in 2001 relating to the prudentialstructure of the <strong>Dexia</strong> Group. This protocol, which containsimportant agreements between the Banking, Finance andInsurance Commission and <strong>Dexia</strong> SA in terms of corporategovernance, deals in particular with the status of <strong>com</strong>panyexecutives (honesty and professional experience, treatmentof conflicts of interest, loans to executives), the quality of<strong>Dexia</strong> SA shareholders, the joint nature and authority of the<strong>Dexia</strong> SA Management Board, and consolidated control of the<strong>Dexia</strong> Group. A copy of the protocol may be obtained fromthe <strong>com</strong>pany’s corporate offices. The text of the protocol,which was slightly modified in 2003, is also available on the<strong>Dexia</strong> website (www.dexia.<strong>com</strong>).Management <strong>report</strong>Consolidatedfinancial statementsAdditional information <strong>Annual</strong> financial statements<strong>Annual</strong> <strong>report</strong> <strong>2010</strong> <strong>Dexia</strong>63