Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

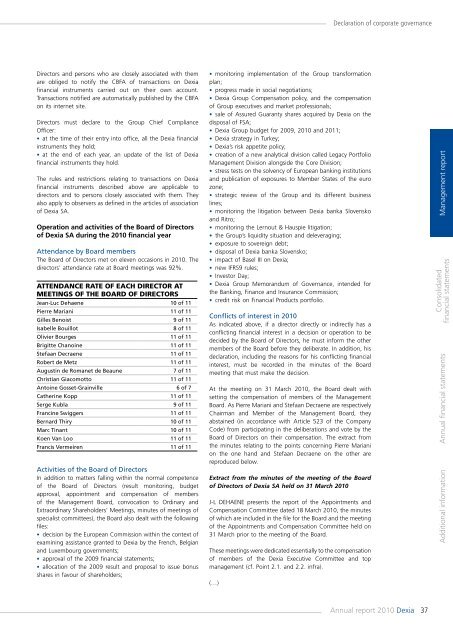

Declaration of corporate governanceDirectors and persons who are closely associated with themare obliged to notify the CBFA of transactions on <strong>Dexia</strong>financial instruments carried out on their own account.Transactions notified are automatically published by the CBFAon its internet site.Directors must declare to the Group Chief ComplianceOfficer:• at the time of their entry into office, all the <strong>Dexia</strong> financialinstruments they hold;• at the end of each year, an update of the list of <strong>Dexia</strong>financial instruments they hold.The rules and restrictions relating to transactions on <strong>Dexia</strong>financial instruments described above are applicable todirectors and to persons closely associated with them. Theyalso apply to observers as defined in the articles of associationof <strong>Dexia</strong> SA.Operation and activities of the Board of Directorsof <strong>Dexia</strong> SA during the <strong>2010</strong> financial yearAttendance by Board membersThe Board of Directors met on eleven occasions in <strong>2010</strong>. Thedirectors’ attendance rate at Board meetings was 92%.ATTENDANCE RATE OF EACH DIRECTOR ATMEETINGS OF THE BOARD OF DIRECTORSJean-Luc Dehaene 10 of 11Pierre Mariani 11 of 11Gilles Benoist 9 of 11Isabelle Bouillot 8 of 11Olivier Bourges 11 of 11Brigitte Chanoine 11 of 11Stefaan Decraene 11 of 11Robert de Metz 11 of 11Augustin de Romanet de Beaune 7 of 11Christian Gia<strong>com</strong>otto 11 of 11Antoine Gosset-Grainville 6 of 7Catherine Kopp 11 of 11Serge Kubla 9 of 11Francine Swiggers 11 of 11Bernard Thiry 10 of 11Marc Tinant 10 of 11Koen Van Loo 11 of 11Francis Vermeiren 11 of 11Activities of the Board of DirectorsIn addition to matters falling within the normal <strong>com</strong>petenceof the Board of Directors (result monitoring, budgetapproval, appointment and <strong>com</strong>pensation of membersof the Management Board, convocation to Ordinary andExtraordinary Shareholders’ Meetings, minutes of meetings ofspecialist <strong>com</strong>mittees), the Board also dealt with the followingfiles:• decision by the European Commission within the context ofexamining assistance granted to <strong>Dexia</strong> by the French, Belgianand Luxembourg governments;• approval of the 2009 financial statements;• allocation of the 2009 result and proposal to issue bonusshares in favour of shareholders;• monitoring implementation of the Group transformationplan;• progress made in social negotiations;• <strong>Dexia</strong> Group Compensation policy, and the <strong>com</strong>pensationof Group executives and market professionals;• sale of Assured Guaranty shares acquired by <strong>Dexia</strong> on thedisposal of FSA;• <strong>Dexia</strong> Group budget for 2009, <strong>2010</strong> and 2011;• <strong>Dexia</strong> strategy in Turkey;• <strong>Dexia</strong>’s risk appetite policy;• creation of a new analytical division called Legacy PortfolioManagement Division alongside the Core Division;• stress tests on the solvency of European banking institutionsand publication of exposures to Member States of the eurozone;• strategic review of the Group and its different businesslines;• monitoring the litigation between <strong>Dexia</strong> banka Slovenskoand Ritro;• monitoring the Lernout & Hauspie litigation;• the Group’s liquidity situation and deleveraging;• exposure to sovereign debt;• disposal of <strong>Dexia</strong> banka Slovensko;• impact of Basel III on <strong>Dexia</strong>;• new IFRS9 rules;• Investor Day;• <strong>Dexia</strong> Group Memorandum of Governance, intended forthe Banking, Finance and Insurance Commission;• credit risk on Financial Products portfolio.Conflicts of interest in <strong>2010</strong>As indicated above, if a director directly or indirectly has aconflicting financial interest in a decision or operation to bedecided by the Board of Directors, he must inform the othermembers of the Board before they deliberate. In addition, hisdeclaration, including the reasons for his conflicting financialinterest, must be recorded in the minutes of the Boardmeeting that must make the decision.At the meeting on 31 March <strong>2010</strong>, the Board dealt withsetting the <strong>com</strong>pensation of members of the ManagementBoard. As Pierre Mariani and Stefaan Decraene are respectivelyChairman and Member of the Management Board, theyabstained (in accordance with Article 523 of the CompanyCode) from participating in the deliberations and vote by theBoard of Directors on their <strong>com</strong>pensation. The extract fromthe minutes relating to the points concerning Pierre Marianion the one hand and Stefaan Decraene on the other arereproduced below.Extract from the minutes of the meeting of the Boardof Directors of <strong>Dexia</strong> SA held on 31 March <strong>2010</strong>J-L DEHAENE presents the <strong>report</strong> of the Appointments andCompensation Committee dated 18 March <strong>2010</strong>, the minutesof which are included in the file for the Board and the meetingof the Appointments and Compensation Committee held on31 March prior to the meeting of the Board.These meetings were dedicated essentially to the <strong>com</strong>pensationof members of the <strong>Dexia</strong> Executive Committee and topmanagement (cf. Point 2.1. and 2.2. infra).(…)Management <strong>report</strong>Consolidatedfinancial statementsAdditional information <strong>Annual</strong> financial statements<strong>Annual</strong> <strong>report</strong> <strong>2010</strong> <strong>Dexia</strong>37