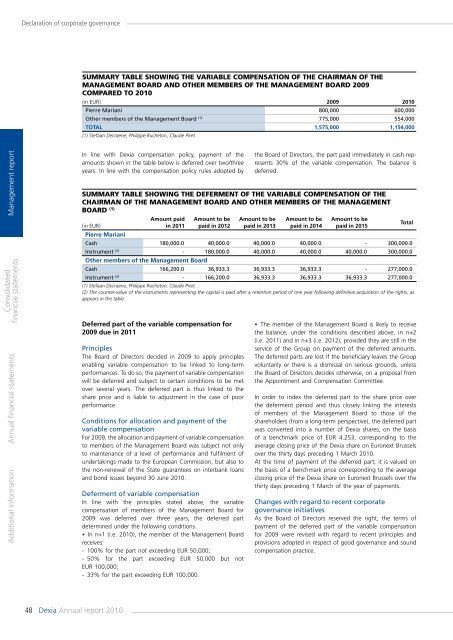

Declaration of corporate governanceSummary table showing the variable <strong>com</strong>pensation of the Chairman of theManagement Board and other members of the Management Board 2009<strong>com</strong>pared to <strong>2010</strong>(in EUR) 2009 <strong>2010</strong>Pierre Mariani 800,000 600,000Other members of the Management Board (1) 775,000 554,000Total 1,575,000 1,154,000(1) Stefaan Decraene, Philippe Rucheton, Claude Piret.Management <strong>report</strong>Consolidatedfinancial statementsAdditional information <strong>Annual</strong> financial statementsIn line with <strong>Dexia</strong> <strong>com</strong>pensation policy, payment of theamounts shown in the table below is deferred over two/threeyears. In line with the <strong>com</strong>pensation policy rules adopted bySummary table showing the deferment of the variable <strong>com</strong>pensation of theChairman of the Management Board and other members of the ManagementBoard (1)Amount paid Amount to be Amount to be Amount to be Amount to be(in EUR)in 2011 paid in 2012 paid in 2013 paid in 2014 paid in 2015TotalPierre MarianiCash 180,000.0 40,000.0 40,000.0 40,000.0 - 300,000.0Instrument (2) - 180,000.0 40,000.0 40,000.0 40,000.0 300,000.0Other members of the Management BoardCash 166,200.0 36,933.3 36,933.3 36,933.3 - 277,000.0Instrument (2) - 166,200.0 36,933.3 36,933.3 36,933.3 277,000.0(1) Stefaan Decraene, Philippe Rucheton, Claude Piret.(2) The counter-value of the instruments representing the capital is paid after a retention period of one year following definitive acquisition of the rights, asappears in the table.Deferred part of the variable <strong>com</strong>pensation for2009 due in 2011PrinciplesThe Board of Directors decided in 2009 to apply principlesenabling variable <strong>com</strong>pensation to be linked to long-termperformances. To do so, the payment of variable <strong>com</strong>pensationwill be deferred and subject to certain conditions to be metover several years. The deferred part is thus linked to theshare price and is liable to adjustment in the case of poorperformance.Conditions for allocation and payment of thevariable <strong>com</strong>pensationFor 2009, the allocation and payment of variable <strong>com</strong>pensationto members of the Management Board was subject not onlyto maintenance of a level of performance and fulfilment ofundertakings made to the European Commission, but also tothe non-renewal of the State guarantees on interbank loansand bond issues beyond 30 June <strong>2010</strong>.Deferment of variable <strong>com</strong>pensationIn line with the principles stated above, the variable<strong>com</strong>pensation of members of the Management Board for2009 was deferred over three years, the deferred partdetermined under the following conditions.• In n+1 (i.e. <strong>2010</strong>), the member of the Management Boardreceives:- 100% for the part not exceeding EUR 50,000;- 50% for the part exceeding EUR 50,000 but notEUR 100,000;- 33% for the part exceeding EUR 100,000.the Board of Directors, the part paid immediately in cash represents30% of the variable <strong>com</strong>pensation. The balance isdeferred.• The member of the Management Board is likely to receivethe balance, under the conditions described above, in n+2(i.e. 2011) and in n+3 (i.e. 2012), provided they are still in theservice of the Group on payment of the deferred amounts.The deferred parts are lost if the beneficiary leaves the Groupvoluntarily or there is a dismissal on serious grounds, unlessthe Board of Directors decides otherwise, on a proposal fromthe Appointment and Compensation Committee.In order to index the deferred part to the share price overthe deferment period and thus closely linking the interestsof members of the Management Board to those of theshareholders (from a long-term perspective), the deferred partwas converted into a number of <strong>Dexia</strong> shares, on the basisof a benchmark price of EUR 4.253, corresponding to theaverage closing price of the <strong>Dexia</strong> share on Euronext Brusselsover the thirty days preceding 1 March <strong>2010</strong>.At the time of payment of the deferred part, it is valued onthe basis of a benchmark price corresponding to the averageclosing price of the <strong>Dexia</strong> share on Euronext Brussels over thethirty days preceding 1 March of the year of payments.Changes with regard to recent corporategovernance initiativesAs the Board of Directors reserved the right, the terms ofpayment of the deferred part of the variable <strong>com</strong>pensationfor 2009 were revised with regard to recent principles andprovisions adopted in respect of good governance and sound<strong>com</strong>pensation practice.48 <strong>Dexia</strong> <strong>Annual</strong> <strong>report</strong> <strong>2010</strong>

Declaration of corporate governanceEvolution of the deferred part of the <strong>com</strong>pensation for 2009 due in 2011 and2012 to the Chairman of the Management Board and other members of theManagement Board (1)Amount paid Amount paid Amount to be(in EUR)in <strong>2010</strong> in 2011 paid in 2012TotalPierre MarianiCash 308,333.0 128,768.1 128,768.1 565,869.2Value of the instruments when granted (2) (3) - 128,768.1 128,768.1 257,536.2Value of the instruments at payment date (2) (3) - 95,523.9Other members of the Management BoardCash 525,001.0 144,036.5 144,036.5 813,074.0Value of the instruments when granted (2) (3) - 144,036.5 144,036.5 288,073.0Value of the instruments at payment date (2) (3) - 106,850.5(1) Stefaan Decraene, Philippe Rucheton, Claude Piret.(2) The amounts shown for 2012 must be adjusted in relation to the market price in March 2012.(3) The amounts are different to those presented in the annual <strong>report</strong> 2009 given their adjustment following the issue of bonus shares decided by theExtraordinary Shareholders’ Meeting on 12 May <strong>2010</strong>.Management <strong>report</strong>Under the provisions of European Directive CRD III (1) as statedby the re<strong>com</strong>mendations of the Committee of EuropeanBanking Supervisors, the principle of indexation of variable<strong>com</strong>pensation to the share price may be limited to one halfof total variable <strong>com</strong>pensation.It was therefore decided that one half of the sharesrepresenting the capital to which the deferred part of thevariable <strong>com</strong>pensation for 2009 relates will be valued at thebenchmark price on the basis of which the conversion intocapital shares was initially made.Considering the adjustment following the issue of bonusshares decided by the Extraordinary Shareholders’ Meetingon 12 May <strong>2010</strong> and the evolution of the share price, theamounts paid to members of the Management Board inMarch 2011 are reduced by 13% on their initial value.Extralegal pensionsCertain members of the Management Board have anadditional extralegal pension put in place by <strong>Dexia</strong>. Variousschemes are applicable to each of these members:• Claude Piret and Stefaan Decraene are entitled, providedcertain conditions are met, in particular a minimum careerof 35 years, to a benefit equivalent to an annual retirementannuity, if alive at the time of retirement, equivalent to 80%of the fixed limited <strong>com</strong>pensation. In 2007, <strong>Dexia</strong> decided toclose this additional extralegal pension scheme, maintainingthe rights acquired and to <strong>com</strong>e for those persons affiliatedbefore 31 December 2006.• Pierre Mariani and Philippe Rucheton benefit from the newextralegal pension scheme for members of the ManagementBoard on Belgian contracts. At the time of retirement, theywill be entitled to the capital from the capitalisation of annualcontributions. These represent a fixed percentage of theannual fixed limited <strong>com</strong>pensation.<strong>Annual</strong> premiums of EUR 537,450 were paid in <strong>2010</strong> tomembers of the Management Board on Belgian contractsincluding EUR 147,180 for the Chief Executive Officer.Collective annual premiums of EUR 211,110 were paid in<strong>2010</strong> to members of the Management Board on Belgiancontracts for additional cover for death, permanent invalidityand medical costs, including EUR 70,760 for the ChiefExecutive Officer, broken down as follows:Extralegal plans(in EUR)Death, orphan capital 42,370Disability 28,020Hospitalisation 370Collective annual premiums of EUR 6,010 were paid in <strong>2010</strong> tothe member of the Management Board on a French contractfor obligatory and additional cover for death, permanentinvalidity and medical costs.Conditions in relation to departureIf <strong>Dexia</strong> terminates the contract binding him to <strong>Dexia</strong>, PierreMariani will be entitled to a single lump-sum amount of<strong>com</strong>pensation to be determined in relation to the AFEP-MEDEF rules in force.If <strong>Dexia</strong> terminates the contract binding them to <strong>Dexia</strong>, StefaanDecraene and Claude Piret will be entitled to an amount of<strong>com</strong>pensation equal to the fixed and variable <strong>com</strong>pensationand other benefits corresponding to a period of 24 months.If <strong>Dexia</strong> terminates the contract binding him to <strong>Dexia</strong>, withintwelve months of a change of control, Philippe Rucheton willbe entitled to an amount of <strong>com</strong>pensation equal to the fixedand variable <strong>com</strong>pensation corresponding to a period of 18months, notwithstanding the rules of Common Law whichmight be applicable.On termination of his contract with <strong>Dexia</strong>, on his departurePascal Poupelle received the equivalent of his variable<strong>com</strong>pensation due for <strong>2010</strong> and an indemnity equal to 12months of fixed <strong>com</strong>pensation.Consolidatedfinancial statementsAdditional information <strong>Annual</strong> financial statements(1) Directive amending Directives of the European Parliament and Councildated 14 June 2006 No. 2006/48/EC relating to the taking up and pursuit ofthe business of credit institutions and No. 2006/49/EC on the capital adequacyof investment firms and credit institutions.<strong>Annual</strong> <strong>report</strong> <strong>2010</strong> <strong>Dexia</strong>49