Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

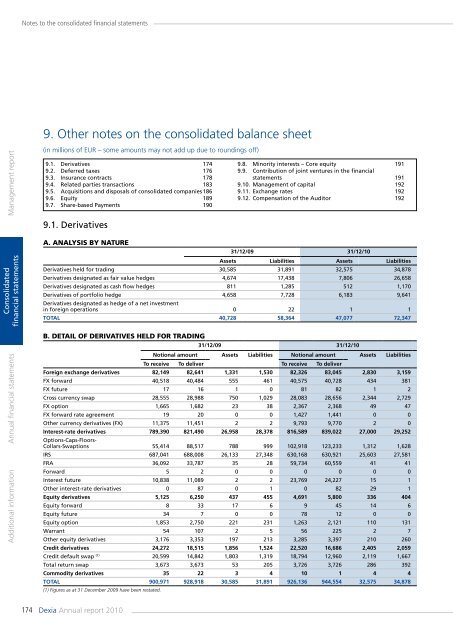

Notes to the consolidated financial statements9. Other notes on the consolidated balance sheetManagement <strong>report</strong>Consolidatedfinancial statementsAdditional information <strong>Annual</strong> financial statements(in millions of EUR – some amounts may not add up due to roundings off)9.1. Derivatives 1749.2. Deferred taxes 1769.3. Insurance contracts 1789.4. Related parties transactions 1839.5. Acquisitions and disposals of consolidated <strong>com</strong>panies 1869.6. Equity 1899.7. Share-based Payments 1909.1. DerivativesA. Analysis by nature31/12/09 31/12/10Assets Liabilities Assets LiabilitiesDerivatives held for trading 30,585 31,891 32,575 34,878Derivatives designated as fair value hedges 4,674 17,438 7,806 26,658Derivatives designated as cash flow hedges 811 1,285 512 1,170Derivatives of portfolio hedge 4,658 7,728 6,183 9,641Derivatives designated as hedge of a net investmentin foreign operations 0 22 1 1Total 40,728 58,364 47,077 72,347B. Detail of derivatives held for trading31/12/09 31/12/10Notional amount Assets Liabilities Notional amount Assets LiabilitiesTo receive To deliver To receive To deliverForeign exchange derivatives 82,149 82,641 1,331 1,530 82,326 83,045 2,830 3,159FX forward 40,518 40,484 555 461 40,575 40,728 434 381FX future 17 16 1 0 81 82 1 2Cross currency swap 28,555 28,988 750 1,029 28,083 28,656 2,344 2,729FX option 1,665 1,682 23 38 2,367 2,368 49 47FX forward rate agreement 19 20 0 0 1,427 1,441 0 0Other currency derivatives (FX) 11,375 11,451 2 2 9,793 9,770 2 0Interest-rate derivatives 789,390 821,490 26,958 28,378 816,589 839,022 27,000 29,252Options-Caps-Floors-Collars-Swaptions 55,414 88,517 788 999 102,918 123,233 1,312 1,628IRS 687,041 688,008 26,133 27,348 630,168 630,921 25,603 27,581FRA 36,092 33,787 35 28 59,734 60,559 41 41Forward 5 2 0 0 0 0 0 0Interest future 10,838 11,089 2 2 23,769 24,227 15 1Other interest-rate derivatives 0 87 0 1 0 82 29 1Equity derivatives 5,125 6,250 437 455 4,691 5,800 336 404Equity forward 8 33 17 6 9 45 14 6Equity future 34 7 0 0 78 12 0 0Equity option 1,853 2,750 221 231 1,263 2,121 110 131Warrant 54 107 2 5 56 225 2 7Other equity derivatives 3,176 3,353 197 213 3,285 3,397 210 260Credit derivatives 24,272 18,515 1,856 1,524 22,520 16,686 2,405 2,059Credit default swap (1) 20,599 14,842 1,803 1,319 18,794 12,960 2,119 1,667Total return swap 3,673 3,673 53 205 3,726 3,726 286 392Commodity derivatives 35 22 3 4 10 1 4 4Total 900,971 928,918 30,585 31,891 926,136 944,554 32,575 34,878(1) Figures as at 31 December 2009 have been restated.9.8. Minority interests – Core equity 1919.9. Contribution of joint ventures in the financialstatements 1919.10. Management of capital 1929.11. Exchange rates 1929.12. Compensation of the Auditor 192174 <strong>Dexia</strong> <strong>Annual</strong> <strong>report</strong> <strong>2010</strong>