Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

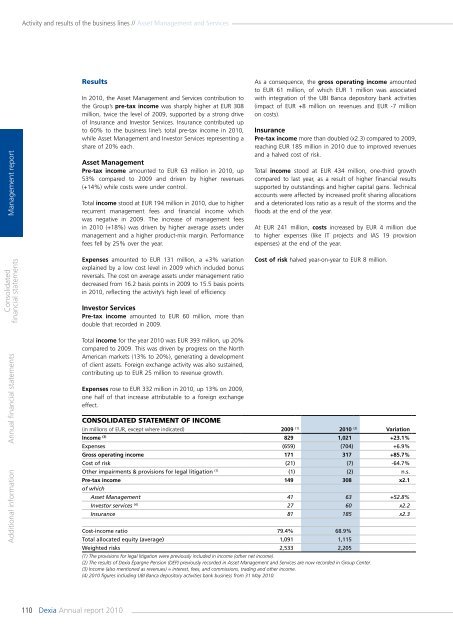

Activity and results of the business lines // Asset Management and ServicesManagement <strong>report</strong>Consolidatedfinancial statementsResultsIn <strong>2010</strong>, the Asset Management and Services contribution tothe Group’s pre-tax in<strong>com</strong>e was sharply higher at EUR 308million, twice the level of 2009, supported by a strong driveof Insurance and Investor Services. Insurance contributed upto 60% to the business line’s total pre-tax in<strong>com</strong>e in <strong>2010</strong>,while Asset Management and Investor Services representing ashare of 20% each.Asset ManagementPre-tax in<strong>com</strong>e amounted to EUR 63 million in <strong>2010</strong>, up53% <strong>com</strong>pared to 2009 and driven by higher revenues(+14%) while costs were under control.Total in<strong>com</strong>e stood at EUR 194 million in <strong>2010</strong>, due to higherrecurrent management fees and financial in<strong>com</strong>e whichwas negative in 2009. The increase of management feesin <strong>2010</strong> (+18%) was driven by higher average assets undermanagement and a higher product-mix margin. Performancefees fell by 25% over the year.Expenses amounted to EUR 131 million, a +3% variationexplained by a low cost level in 2009 which included bonusreversals. The cost on average assets under management ratiodecreased from 16.2 basis points in 2009 to 15.5 basis pointsin <strong>2010</strong>, reflecting the activity’s high level of efficiency.Investor ServicesPre-tax in<strong>com</strong>e amounted to EUR 60 million, more thandouble that recorded in 2009.As a consequence, the gross operating in<strong>com</strong>e amountedto EUR 61 million, of which EUR 1 million was associatedwith integration of the UBI Banca depository bank activities(impact of EUR +8 million on revenues and EUR -7 millionon costs).InsurancePre-tax in<strong>com</strong>e more than doubled (x2.3) <strong>com</strong>pared to 2009,reaching EUR 185 million in <strong>2010</strong> due to improved revenuesand a halved cost of risk.Total in<strong>com</strong>e stood at EUR 434 million, one-third growth<strong>com</strong>pared to last year, as a result of higher financial resultssupported by outstandings and higher capital gains. Technicalaccounts were affected by increased profit sharing allocationsand a deteriorated loss ratio as a result of the storms and thefloods at the end of the year.At EUR 241 million, costs increased by EUR 4 million dueto higher expenses (like IT projects and IAS 19 provisionexpenses) at the end of the year.Cost of risk halved year-on-year to EUR 8 million.Additional information <strong>Annual</strong> financial statementsTotal in<strong>com</strong>e for the year <strong>2010</strong> was EUR 393 million, up 20%<strong>com</strong>pared to 2009. This was driven by progress on the NorthAmerican markets (13% to 20%), generating a developmentof client assets. Foreign exchange activity was also sustained,contributing up to EUR 25 million to revenue growth.Expenses rose to EUR 332 million in <strong>2010</strong>, up 13% on 2009,one half of that increase attributable to a foreign exchangeeffect.consolidated Statement of in<strong>com</strong>e(in millions of EUR, except where indicated) 2009 (1) <strong>2010</strong> (2) VariationIn<strong>com</strong>e (3) 829 1,021 +23.1%Expenses (659) (704) +6.9%Gross operating in<strong>com</strong>e 171 317 +85.7%Cost of risk (21) (7) -64.7%Other impairments & provisions for legal litigation (1) (1) (2) n.s.Pre-tax in<strong>com</strong>e 149 308 x2.1of whichAsset Management 41 63 +52.8%Investor services (4) 27 60 x2.2Insurance 81 185 x2.3Cost-in<strong>com</strong>e ratio 79.4% 68.9%Total allocated equity (average) 1,091 1,115Weighted risks 2,533 2,205(1) The provisions for legal litigation were previously included in in<strong>com</strong>e (other net in<strong>com</strong>e).(2) The results of <strong>Dexia</strong> Épargne Pension (DEP) previously recorded in Asset Management and Services are now recorded in Group Center.(3) In<strong>com</strong>e (also mentioned as revenues) = interest, fees, and <strong>com</strong>missions, trading and other in<strong>com</strong>e.(4) <strong>2010</strong> figures including UBI Banca depository activities bank business from 31 May <strong>2010</strong>.110 <strong>Dexia</strong> <strong>Annual</strong> <strong>report</strong> <strong>2010</strong>