Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

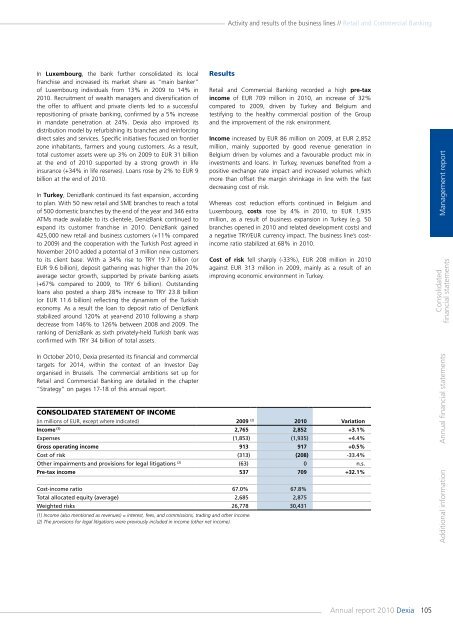

Activity and results of the business lines // Retail and Commercial BankingIn Luxembourg, the bank further consolidated its localfranchise and increased its market share as “main banker”of Luxembourg individuals from 13% in 2009 to 14% in<strong>2010</strong>. Recruitment of wealth managers and diversification ofthe offer to affluent and private clients led to a successfulrepositioning of private banking, confirmed by a 5% increasein mandate penetration at 24%. <strong>Dexia</strong> also improved itsdistribution model by refurbishing its branches and reinforcingdirect sales and services. Specific initiatives focused on frontierzone inhabitants, farmers and young customers. As a result,total customer assets were up 3% on 2009 to EUR 31 billionat the end of <strong>2010</strong> supported by a strong growth in lifeinsurance (+34% in life reserves). Loans rose by 2% to EUR 9billion at the end of <strong>2010</strong>.In Turkey, DenizBank continued its fast expansion, accordingto plan. With 50 new retail and SME branches to reach a totalof 500 domestic branches by the end of the year and 346 extraATMs made available to its clientele, DenizBank continued toexpand its customer franchise in <strong>2010</strong>. DenizBank gained425,000 new retail and business customers (+11% <strong>com</strong>paredto 2009) and the cooperation with the Turkish Post agreed inNovember <strong>2010</strong> added a potential of 3 million new customersto its client base. With a 34% rise to TRY 19.7 billion (orEUR 9.6 billion), deposit gathering was higher than the 20%average sector growth, supported by private banking assets(+67% <strong>com</strong>pared to 2009, to TRY 6 billion). Outstandingloans also posted a sharp 28% increase to TRY 23.8 billion(or EUR 11.6 billion) reflecting the dynamism of the Turkisheconomy. As a result the loan to deposit ratio of DenizBankstabilized around 120% at year-end <strong>2010</strong> following a sharpdecrease from 146% to 126% between 2008 and 2009. Theranking of DenizBank as sixth privately-held Turkish bank wasconfirmed with TRY 34 billion of total assets.ResultsRetail and Commercial Banking recorded a high pre-taxin<strong>com</strong>e of EUR 709 million in <strong>2010</strong>, an increase of 32%<strong>com</strong>pared to 2009, driven by Turkey and Belgium andtestifying to the healthy <strong>com</strong>mercial position of the Groupand the improvement of the risk environment.In<strong>com</strong>e increased by EUR 86 million on 2009, at EUR 2,852million, mainly supported by good revenue generation inBelgium driven by volumes and a favourable product mix ininvestments and loans. In Turkey, revenues benefited from apositive exchange rate impact and increased volumes whichmore than offset the margin shrinkage in line with the fastdecreasing cost of risk.Whereas cost reduction efforts continued in Belgium andLuxembourg, costs rose by 4% in <strong>2010</strong>, to EUR 1,935million, as a result of business expansion in Turkey (e.g. 50branches opened in <strong>2010</strong> and related development costs) anda negative TRY/EUR currency impact. The business line’s costin<strong>com</strong>eratio stabilized at 68% in <strong>2010</strong>.Cost of risk fell sharply (-33%), EUR 208 million in <strong>2010</strong>against EUR 313 million in 2009, mainly as a result of animproving economic environment in Turkey.Management <strong>report</strong>Consolidatedfinancial statementsIn October <strong>2010</strong>, <strong>Dexia</strong> presented its financial and <strong>com</strong>mercialtargets for 2014, within the context of an Investor Dayorganised in Brussels. The <strong>com</strong>mercial ambitions set up forRetail and Commercial Banking are detailed in the chapter“Strategy” on pages 17-18 of this annual <strong>report</strong>.Consolidated statement of in<strong>com</strong>e(in millions of EUR, except where indicated) 2009 (2) <strong>2010</strong> VariationIn<strong>com</strong>e (1) 2,765 2,852 +3.1%Expenses (1,853) (1,935) +4.4%Gross operating in<strong>com</strong>e 913 917 +0.5%Cost of risk (313) (208) -33.4%Other impairments and provisions for legal litigations (2) (63) 0 n.s.Pre-tax in<strong>com</strong>e 537 709 +32.1%Cost-in<strong>com</strong>e ratio 67.0% 67.8%Total allocated equity (average) 2,685 2,875Weighted risks 26,778 30,431(1) In<strong>com</strong>e (also mentioned as revenues) = interest, fees, and <strong>com</strong>missions, trading and other in<strong>com</strong>e.(2) The provisions for legal litigations were previously included in in<strong>com</strong>e (other net in<strong>com</strong>e).Additional information <strong>Annual</strong> financial statements<strong>Annual</strong> <strong>report</strong> <strong>2010</strong> <strong>Dexia</strong>105