Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

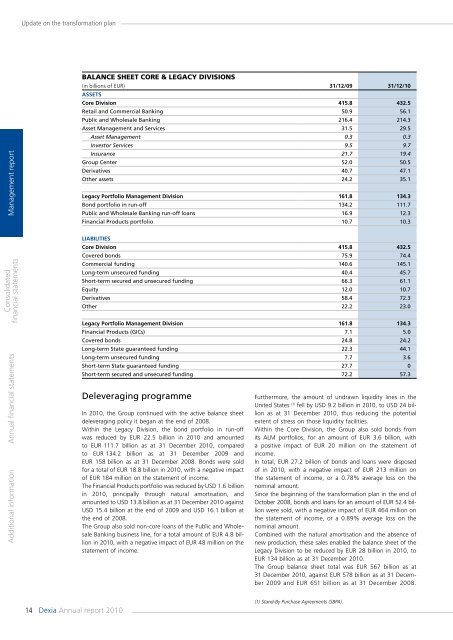

Update on the transformation planManagement <strong>report</strong>Consolidatedfinancial statementsAdditional information <strong>Annual</strong> financial statementsBalance SHEET Core & Legacy DivisionS(in billions of EUR) 31/12/09 31/12/10AssetsCore Division 415.8 432.5Retail and Commercial Banking 50.9 56.1Public and Wholesale Banking 216.4 214.3Asset Management and Services 31.5 29.5Asset Management 0.3 0.3Investor Services 9.5 9.7Insurance 21.7 19.4Group Center 52.0 50.5Derivatives 40.7 47.1Other assets 24.2 35.1Legacy Portfolio Management Division 161.8 134.3Bond portfolio in run-off 134.2 111.7Public and Wholesale Banking run-off loans 16.9 12.3Financial Products portfolio 10.7 10.3liabilitiesCore Division 415.8 432.5Covered bonds 75.9 74.4Commercial funding 140.6 145.1Long-term unsecured funding 40.4 45.7Short-term secured and unsecured funding 66.3 61.1Equity 12.0 10.7Derivatives 58.4 72.3Other 22.2 23.0Legacy Portfolio Management Division 161.8 134.3Financial Products (GICs) 7.1 5.0Covered bonds 24.8 24.2Long-term State guaranteed funding 22.3 44.1Long-term unsecured funding 7.7 3.6Short-term State guaranteed funding 27.7 0Short-term secured and unsecured funding 72.2 57.3Deleveraging programmeIn <strong>2010</strong>, the Group continued with the active balance sheetdeleveraging policy it began at the end of 2008.Within the Legacy Division, the bond portfolio in run-offwas reduced by EUR 22.5 billion in <strong>2010</strong> and amountedto EUR 111.7 billion as at 31 December <strong>2010</strong>, <strong>com</strong>paredto EUR 134.2 billion as at 31 December 2009 andEUR 158 billion as at 31 December 2008. Bonds were soldfor a total of EUR 18.8 billion in <strong>2010</strong>, with a negative impactof EUR 184 million on the statement of in<strong>com</strong>e.The Financial Products portfolio was reduced by USD 1.6 billionin <strong>2010</strong>, principally through natural amortisation, andamounted to USD 13.8 billion as at 31 December <strong>2010</strong> againstUSD 15.4 billion at the end of 2009 and USD 16.1 billion atthe end of 2008.The Group also sold non-core loans of the Public and WholesaleBanking business line, for a total amount of EUR 4.8 billionin <strong>2010</strong>, with a negative impact of EUR 48 million on thestatement of in<strong>com</strong>e.Furthermore, the amount of undrawn liquidity lines in theUnited States (1) fell by USD 9.2 billion in <strong>2010</strong>, to USD 24 billionas at 31 December <strong>2010</strong>, thus reducing the potentialextent of stress on those liquidity facilities.Within the Core Division, the Group also sold bonds fromits ALM portfolios, for an amount of EUR 3.6 billion, witha positive impact of EUR 20 million on the statement ofin<strong>com</strong>e.In total, EUR 27.2 billion of bonds and loans were disposedof in <strong>2010</strong>, with a negative impact of EUR 213 million onthe statement of in<strong>com</strong>e, or a 0.78% average loss on thenominal amount.Since the beginning of the transformation plan in the end ofOctober 2008, bonds and loans for an amount of EUR 52.4 billionwere sold, with a negative impact of EUR 464 million onthe statement of in<strong>com</strong>e, or a 0.89% average loss on thenominal amount.Combined with the natural amortisation and the absence ofnew production, these sales enabled the balance sheet of theLegacy Division to be reduced by EUR 28 billion in <strong>2010</strong>, toEUR 134 billion as at 31 December <strong>2010</strong>.The Group balance sheet total was EUR 567 billion as at31 December <strong>2010</strong>, against EUR 578 billion as at 31 December2009 and EUR 651 billion as at 31 December 2008.14 <strong>Dexia</strong> <strong>Annual</strong> <strong>report</strong> <strong>2010</strong>(1) Stand-By Purchase Agreements (SBPA).