Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

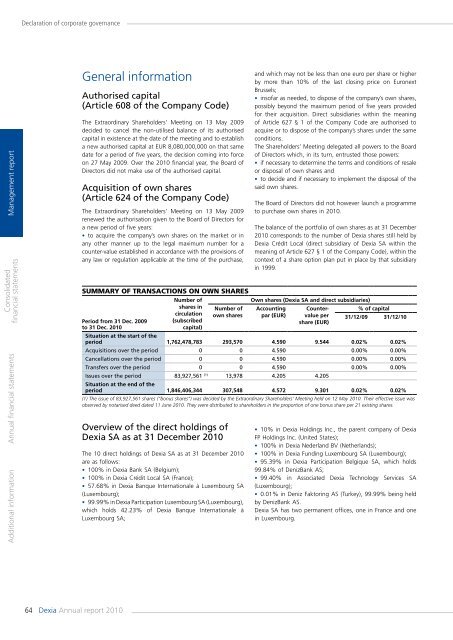

Declaration of corporate governanceManagement <strong>report</strong>Consolidatedfinancial statementsAdditional information <strong>Annual</strong> financial statementsGeneral informationAuthorised capital(Article 608 of the Company Code)The Extraordinary Shareholders’ Meeting on 13 May 2009decided to cancel the non-utilised balance of its authorisedcapital in existence at the date of the meeting and to establisha new authorised capital at EUR 8,080,000,000 on that samedate for a period of five years, the decision <strong>com</strong>ing into forceon 27 May 2009. Over the <strong>2010</strong> financial year, the Board ofDirectors did not make use of the authorised capital.Acquisition of own shares(Article 624 of the Company Code)The Extraordinary Shareholders’ Meeting on 13 May 2009renewed the authorisation given to the Board of Directors fora new period of five years:• to acquire the <strong>com</strong>pany’s own shares on the market or inany other manner up to the legal maximum number for acounter-value established in accordance with the provisions ofany law or regulation applicable at the time of the purchase,and which may not be less than one euro per share or higherby more than 10% of the last closing price on EuronextBrussels;• insofar as needed, to dispose of the <strong>com</strong>pany’s own shares,possibly beyond the maximum period of five years providedfor their acquisition. Direct subsidiaries within the meaningof Article 627 § 1 of the Company Code are authorised toacquire or to dispose of the <strong>com</strong>pany’s shares under the sameconditions.The Shareholders’ Meeting delegated all powers to the Boardof Directors which, in its turn, entrusted those powers:• if necessary to determine the terms and conditions of resaleor disposal of own shares and• to decide and if necessary to implement the disposal of thesaid own shares.The Board of Directors did not however launch a programmeto purchase own shares in <strong>2010</strong>.The balance of the portfolio of own shares as at 31 December<strong>2010</strong> corresponds to the number of <strong>Dexia</strong> shares still held by<strong>Dexia</strong> Crédit Local (direct subsidiary of <strong>Dexia</strong> SA within themeaning of Article 627 § 1 of the Company Code), within thecontext of a share option plan put in place by that subsidiaryin 1999.SUMMARY OF TRANSACTIONS ON OWN SHARESNumber ofOwn shares (<strong>Dexia</strong> SA and direct subsidiaries)shares in Number of Accounting Counter-% of capitalcirculation own shares par (EUR) value perPeriod from 31 Dec. 2009 (subscribedshare (EUR)31/12/09 31/12/10to 31 Dec. <strong>2010</strong>capital)Situation at the start of theperiod 1,762,478,783 293,570 4.590 9.544 0.02% 0.02%Acquisitions over the period 0 0 4.590 0.00% 0.00%Cancellations over the period 0 0 4.590 0.00% 0.00%Transfers over the period 0 0 4.590 0.00% 0.00%Issues over the period 83,927,561 (1) 13,978 4.205 4.205Situation at the end of theperiod 1,846,406,344 307,548 4.572 9.301 0.02% 0.02%(1) The issue of 83,927,561 shares (“bonus shares”) was decided by the Extraordinary Shareholders’ Meeting held on 12 May <strong>2010</strong>. Their effective issue wasobserved by notarised deed dated 11 June <strong>2010</strong>. They were distributed to shareholders in the proportion of one bonus share per 21 existing shares.Overview of the direct holdings of<strong>Dexia</strong> SA as at 31 December <strong>2010</strong>The 10 direct holdings of <strong>Dexia</strong> SA as at 31 December <strong>2010</strong>are as follows:• 100% in <strong>Dexia</strong> Bank SA (Belgium);• 100% in <strong>Dexia</strong> Crédit Local SA (France);• 57.68% in <strong>Dexia</strong> Banque Internationale à Luxembourg SA(Luxembourg);• 99.99% in <strong>Dexia</strong> Participation Luxembourg SA (Luxembourg),which holds 42.23% of <strong>Dexia</strong> Banque Internationale àLuxembourg SA;• 10% in <strong>Dexia</strong> Holdings Inc., the parent <strong>com</strong>pany of <strong>Dexia</strong>FP Holdings Inc. (United States);• 100% in <strong>Dexia</strong> Nederland BV (Netherlands);• 100% in <strong>Dexia</strong> Funding Luxembourg SA (Luxembourg);• 95.39% in <strong>Dexia</strong> Participation Belgique SA, which holds99.84% of DenizBank AS;• 99.40% in Associated <strong>Dexia</strong> Technology Services SA(Luxembourg);• 0.01% in Deniz Faktoring AS (Turkey), 99.99% being heldby DenizBank AS.<strong>Dexia</strong> SA has two permanent offices, one in France and onein Luxembourg.64 <strong>Dexia</strong> <strong>Annual</strong> <strong>report</strong> <strong>2010</strong>